Answered step by step

Verified Expert Solution

Question

1 Approved Answer

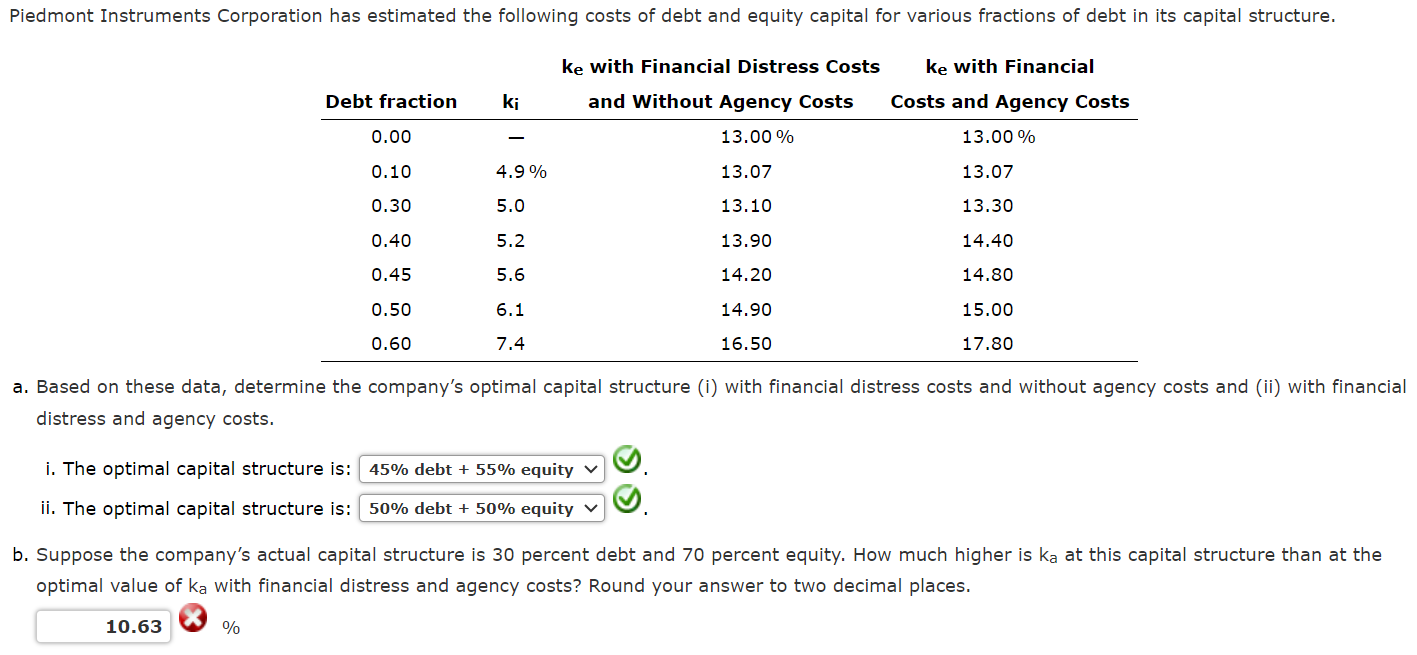

Piedmont Instruments Corporation has estimated the following costs of debt and equity capital for various fractions of debt in its capital structure. a . Based

Piedmont Instruments Corporation has estimated the following costs of debt and equity capital for various fractions of debt in its capital structure.

a Based on these data, determine the company's optimal capital structure i with financial distress costs and without agency costs and ii with financial

distress and agency costs.

i The optimal capital structure is: debt equity

ii The optimal capital structure is: debt equity

b Suppose the company's actual capital structure is percent debt and percent equity. How much higher is at this capital structure than at the

optimal value of with financial distress and agency costs? Round your answer to two decimal places.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started