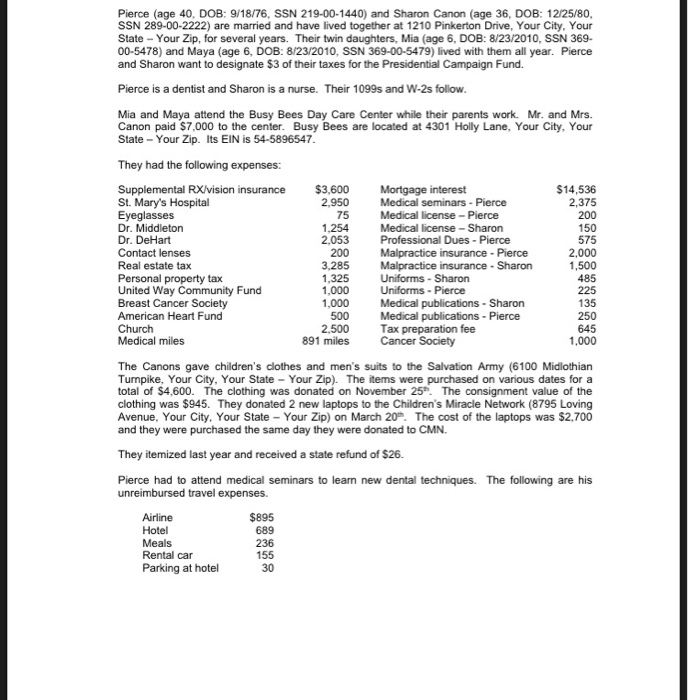

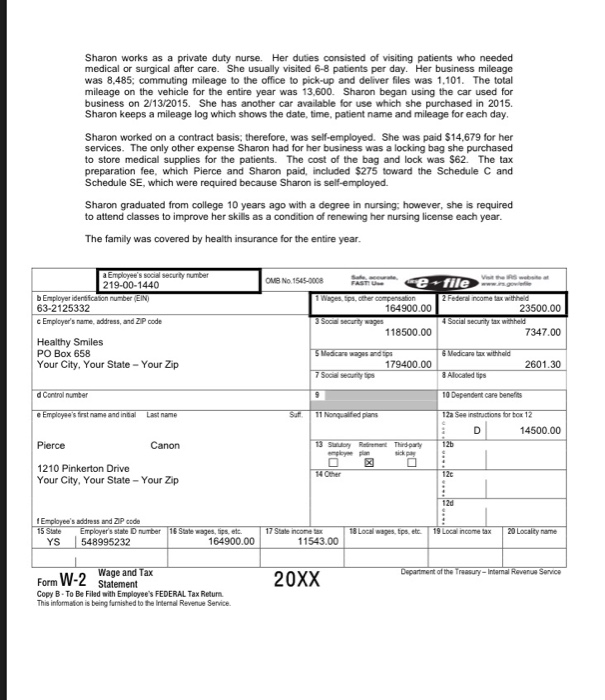

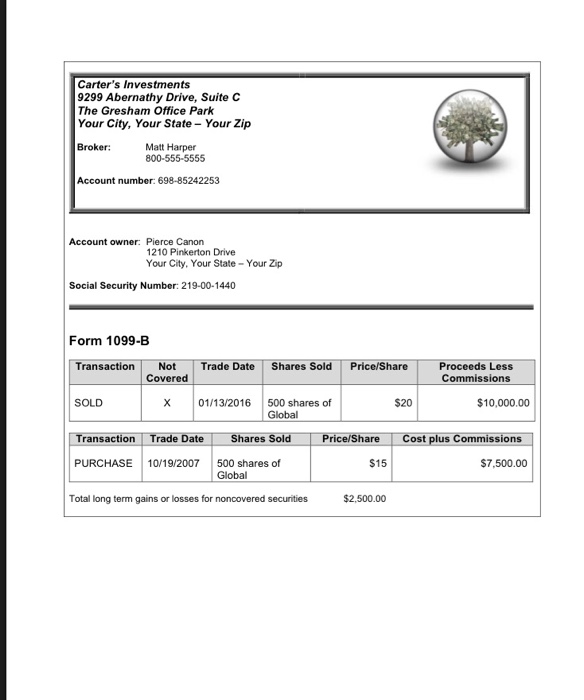

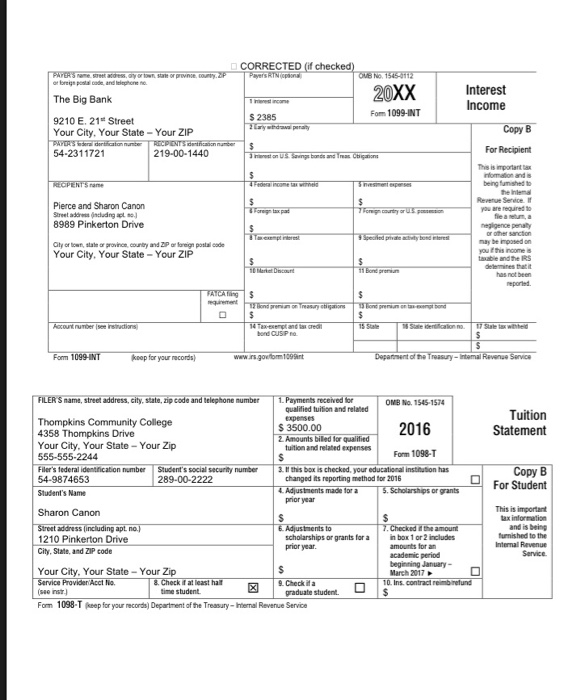

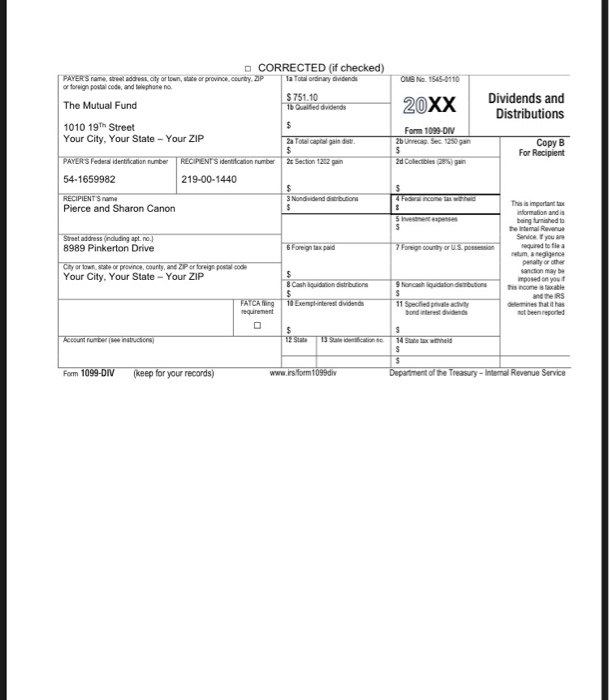

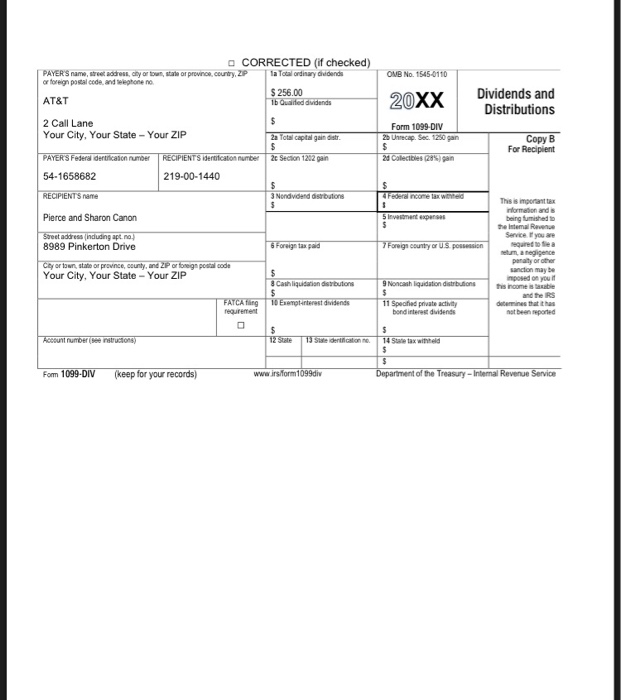

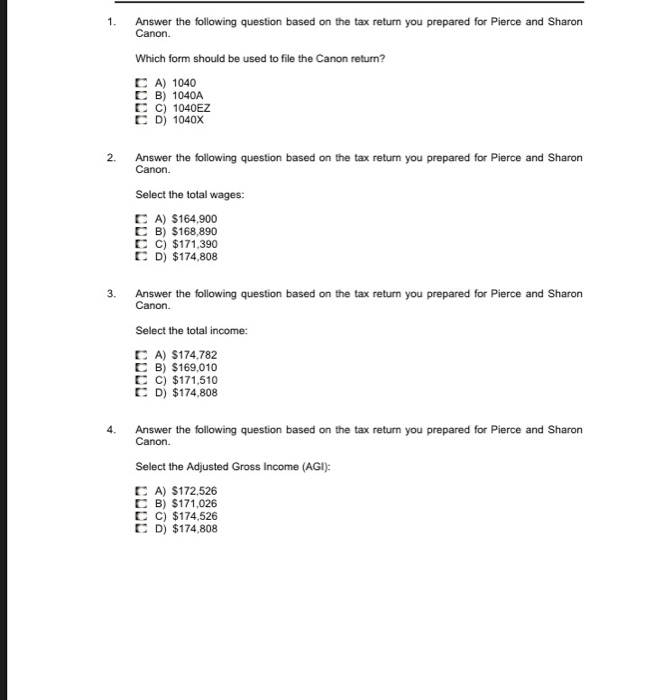

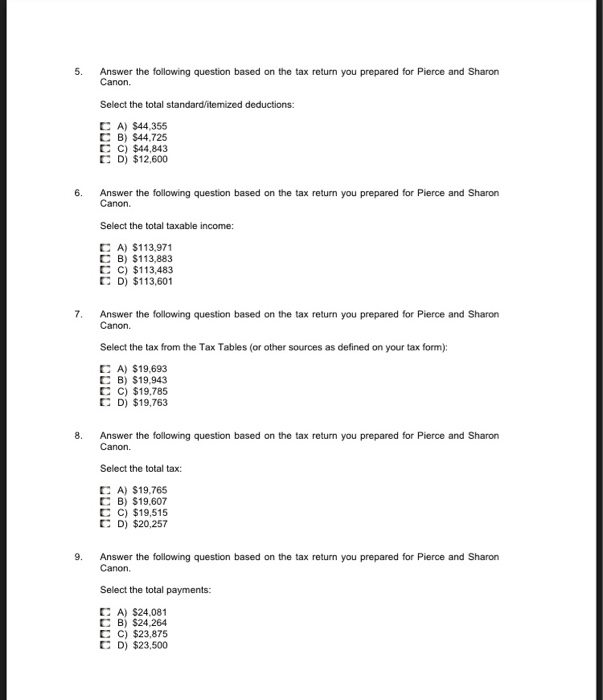

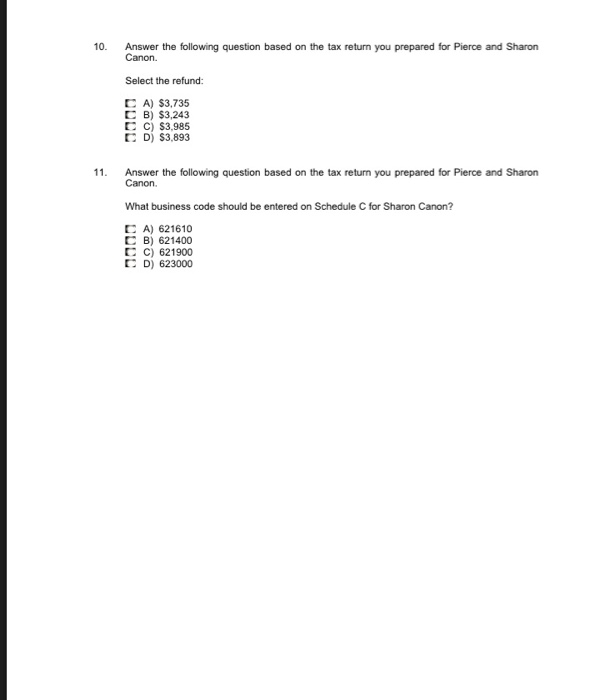

Pierce (age 40, DOB: 9/18/76, SSN 219-00-1440) and Sharon Canon (age 36, DOB: 12125/80, SSN 289-00-2222) are married and have lived together at 1210 Pinkerton Drive, Your City, Your State- Your Zip, for several years. Their twin daughters, Mia (age 6, DOB: 8/23/2010, SSN 369- 00-5478) and Maya (age 6, DOB: 8/23/2010, SSN 369-00-5479) lived with them all year. Pierce and Sharon want to designate $3 of their taxes for the Presidential Campaign Fund. Pierce is a dentist and Sharon is a nurse. Their 1099s and W-2s follow Mia and Maya attend the Busy Bees Day Care Center while their parents work. Mr. and Mrs. Canon paid $7,000 to the center. Busy Bees are located at 4301 Holly Lane, Your City, Your State Your Zip. Its EIN is 54-5896547 They had the following expenses: Supplemental RX/vision insurance St. Mary's Hospital Eyeglasses Dr. Middleton Dr. DeHart Contact lenses Real estate tax Personal property tax United Way Community Fund Breast Cancer Society American Heart Fund $3,600 Mortgage interest Medical seminars Pierce Medical license Pierce Medical license Sharon Professional Dues Pierce Malpractice insurance Pierce $14,536 2,375 200 150 575 2,950 1,254 2,053 1,500 485 3,285 Malpractice insurance Sharon 1,325 Uniforms-Sharon 1,000 1,000 Medical publications Uniforms Pierce 135 250 645 1,000 - Sharon Medical publications- Pierce Tax preparation fee Cancer Society 2,500 Medical miles 891 miles The Canons gave children's clothes and men's suits to the Salvation Army (6100 Midlothian Turnpike, Your City, Your State Your Zip) The items were purchased on various dates for a total of $4,600. The clothing was donated on November 25h The consignment value of the clothing was $945. They donated 2 new laptops to the Children's Miracle Network (8795 Loving Avenue, Your City, Your State Your Zip) on March 20. The cost of the laptops was $2,700 and they were purchased the same day they were donated to CMN. They itemized last year and received a state refund of $26. Pierce had to attend medical seminars to learn new dental techniques. The following are his unreimbursed travel expenses. Airline Hotel Meals Rental car Parking at hotel $895 689 236 155 30