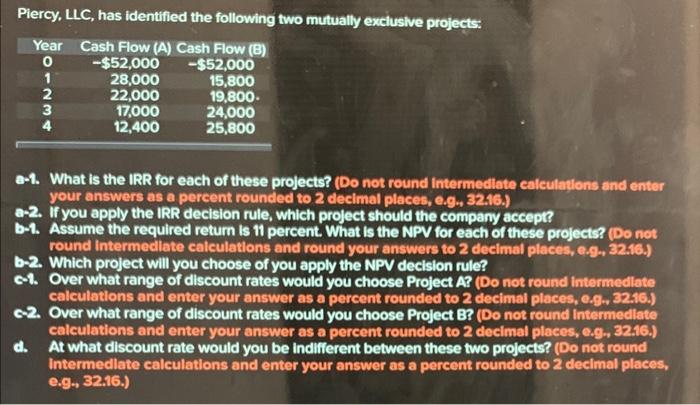

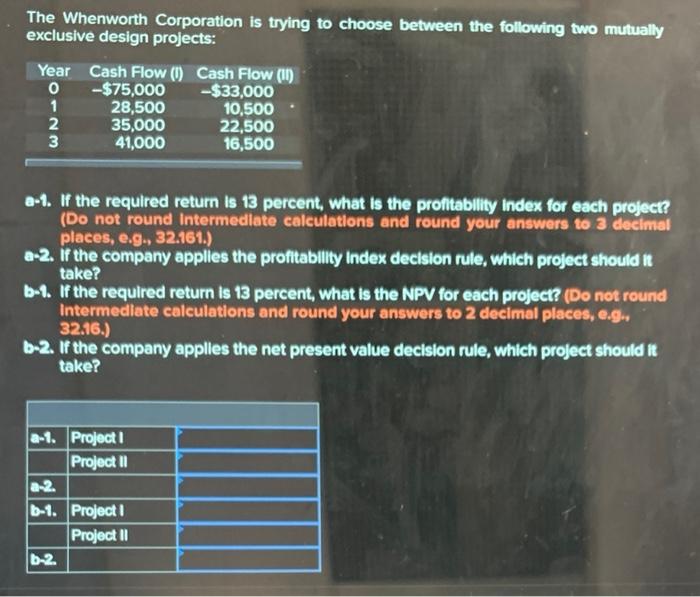

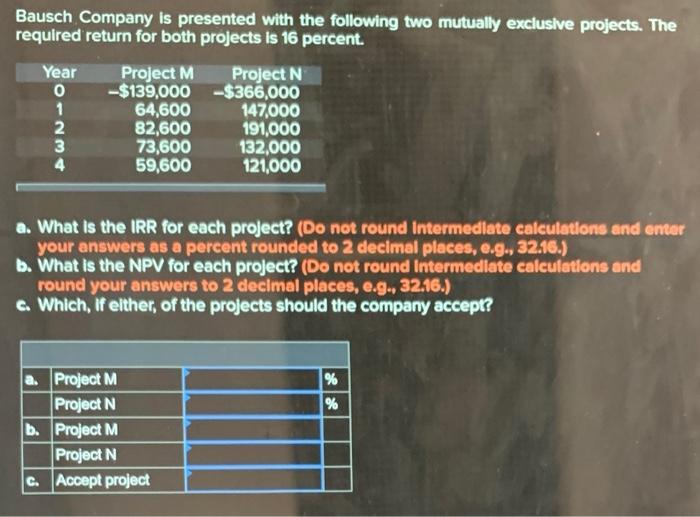

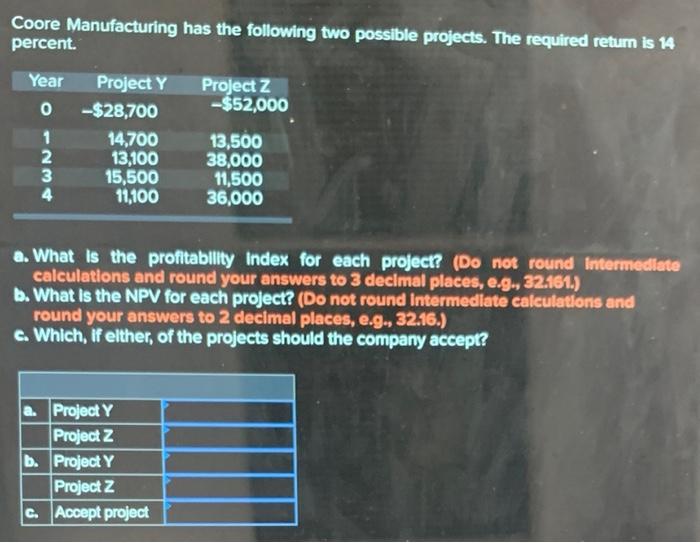

Piercy, LLC, has identified the following two mutually exclusive projects: \begin{tabular}{ccc} Year & Cash Flow (A) Cash Flow (B) \\ 0 & $52,000 & $52,000 \\ 1 & 28,000 & 15,800 \\ 2 & 22,000 & 19,800 \\ 3 & 17,000 & 24,000 \\ 4 & 12,400 & 25,800 \\ \hline \end{tabular} a-1. What is the IRR for each of these projects? (Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a-2. If you apply the IRR decision rule, which project should the company accept? b-1. Assume the required return is 11 percent. What is the NPV for each of these projects? (Do not round intermediate calculations and round your answers to 2 decimal places, e.g. 32.16.) b-2. Which project will you choose of you apply the NPV decision rule? c-1. Over what range of discount rates would you choose Project A? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) C2. Over what range of discount rates would you choose Project B? (Do not round intermedlate calculations and enter your answer as a percent rounded to 2 decimal places, e.9. 32.16.) d. At what discount rate would you be indifferent between these two projects? (Do not round Intermedlate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) The Whenworth Corporation is trying to choose between the following two mutually exclusive design projects: \begin{tabular}{ccc} Year & Cash Flow (0) & Cash Flow (ii) \\ 0 & $75,000 & $33,000 \\ 1 & 28,500 & 10,500 \\ 2 & 35,000 & 22,500 \\ 3 & 41,000 & 16,500 \\ \hline \end{tabular} a-1. If the required return is 13 percent, what is the profitability index for each project? (Do not round Intermediate calculations and round your answers to 3 decimat places, e.g., 32.161.) a-2. If the company applies the profitability index decision rule, which project should it take? b-1. If the required return is 13 percent, what is the NPV for each project? (Do not round Intermedlate calculations and round your answers to 2 decimal places, e.g., 32.16.) b-2. If the company applies the net present value decision rule, which project should it take? Bausch Company is presented with the following two mutually exclusive projects. The required return for both projects is 16 percent. a. What is the IRR for each project? (Do not round Intermedlate calculatlons and cnter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. What is the NPV for each project? (Do not round intermediate ealeulations and round your answers to 2 decimal places, e.g., 32.16.) G. Which, if elther, of the projects should the company accept? Coore Manufacturing has the following two possible projects. The required retum is 14 percent. a. What is the profitability index for each project? (Do not round internediate calculations and round your answers to 3 declmal places, e.g. 32.151.) b. What is the NPV for each project? (Do not round intermedlate ealculations and round your answers to 2 decimal places, e.g., 32.16.) c. Which, If elther, of the projects should the company accept