Question

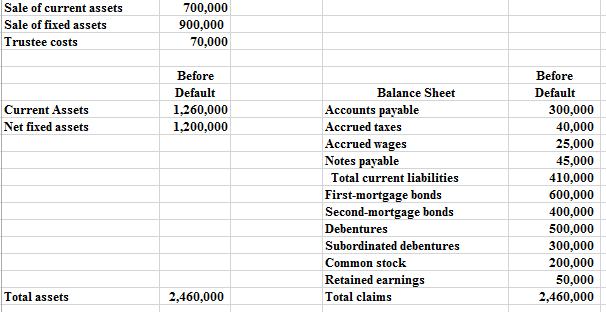

Pierre Imports will be liquidated. Its current balance sheet is shown below. Fixed assets are sold for $900,000 and current assets are sold for $700,000.

Pierre Imports will be liquidated. Its current balance sheet is shown below. Fixed assets are sold for $900,000 and current assets are sold for $700,000. All fixed assets are pledged as collateral for all mortgage bonds. Subordinated debentures are subordinate only to notes payable. Trustee costs are $70,000.

a. How much will SHs receive?

b. How much will mortgage bondholders receive?

c.How much will priority creditors receive?

d. Identify the remaining general creditors. How much will each receive before subordination adjustment?

e. How much will each general creditor receive after subordination adjustment?

Sale of current assets Sale of fixed assets Trustee costs 700,000 900,000 70,000 Before Default 1.260.000 1,200,000 Before Default Balance Sheet Current Assets Net fixed assets 300,000 40,000 25,000 45,000 410,000 600,000 400,000 500,000 300,000 200,000 50,000 2,460,000 Accounts payable Accrued tares Accrued wages Notes payable Total current liabilities First-mortgage bonds Second-mortgage bonds Debentures Subordinated debentures Common stock Retained earnings Total claims Total assets 2,460,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started