Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pierre is 24 years old and has always lived in Quebec. Upon graduation from Concordia last year, he landed a fantastic full-time job and

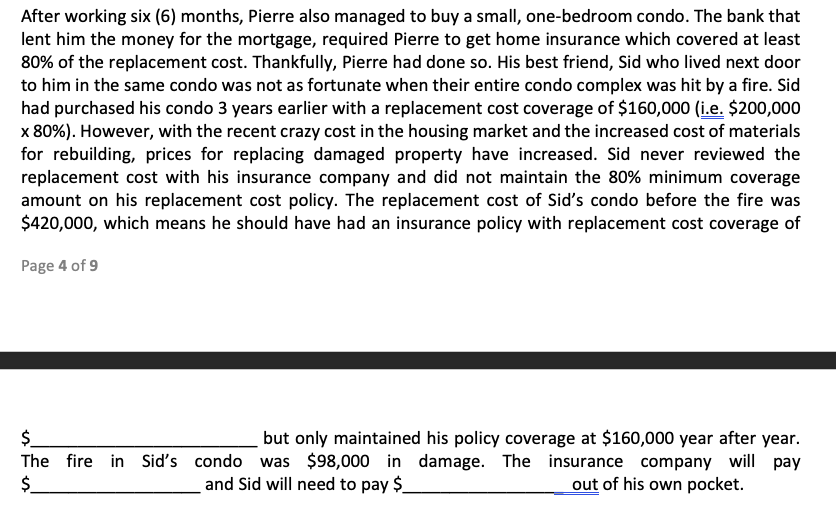

Pierre is 24 years old and has always lived in Quebec. Upon graduation from Concordia last year, he landed a fantastic full-time job and decided to spend his pay cheques on buying a BMW for his first car. He needed a car as his girlfriend lives in New York City and he drives every weekend to visit her. Complete the sentence by inserting the correct word and/or calculation for this mini-case. Highlight and underline your response. and the He decided on having a very high For car insurance, due to Pierre's insurance he pays very high of $2,000 which helped reduce his car insurance costs but knows he would have to pay this before his insurance company would cover the rest of the claim if he got into an accident and was determined for the collision. Pierre knows that in Quebec, the insurance is regardless of who is responsible for the accident. He also knows that every province recognizes that it is critical for drivers to have adequate coverage as you can be held responsible for any amounts above your policy limit; in Quebec, you must have at least $_ in coverage. Since Pierre took FINA 200 during his studies, he wisely knew to increase this coverage to $2 million when driving outside of Quebec (i.e. in some other provinces and in the US), as an injured party has the right to for pain and suffering. In addition, Pierre purchased Medical Insurance for his trips to the US, as he knew that his provincial health insurance coverage for emergency medical costs outside the province only covered up to the rates in effect in Quebec. Since costs outside of Quebec are often much higher, having good coverage is critical. Pierre also has Disability Insurance through his employer where the monthly disability benefit amount would be 70% of his Pre-Disability Income at the time of a claim. He currently earns a gross annual salary of $90,000. If Pierre were to become disabled, he knows that the bills would continue to come in but not a salary. He takes comfort knowing that he could cover his mortgage and bills with the amount of a monthly disability benefit of $ After working six (6) months, Pierre also managed to buy a small, one-bedroom condo. The bank that lent him the money for the mortgage, required Pierre to get home insurance which covered at least 80% of the replacement cost. Thankfully, Pierre had done so. His best friend, Sid who lived next door to him in the same condo was not as fortunate when their entire condo complex was hit by a fire. Sid had purchased his condo 3 years earlier with a replacement cost coverage of $160,000 (i.e. $200,000 x 80%). However, with the recent crazy cost in the housing market and the increased cost of materials for rebuilding, prices for replacing damaged property have increased. Sid never reviewed the replacement cost with his insurance company and did not maintain the 80% minimum coverage amount on his replacement cost policy. The replacement cost of Sid's condo before the fire was $420,000, which means he should have had an insurance policy with replacement cost coverage of Page 4 of 9 $ but only maintained his policy coverage at $160,000 year after year. The fire in Sid's condo was $98,000 in damage. The insurance company will pay and Sid will need to pay $ out of his own pocket. $

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Answer For car insurance due to Pierres young age and the high value of his BMW he decided on having a very high deductible of 2000 which helped reduc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started