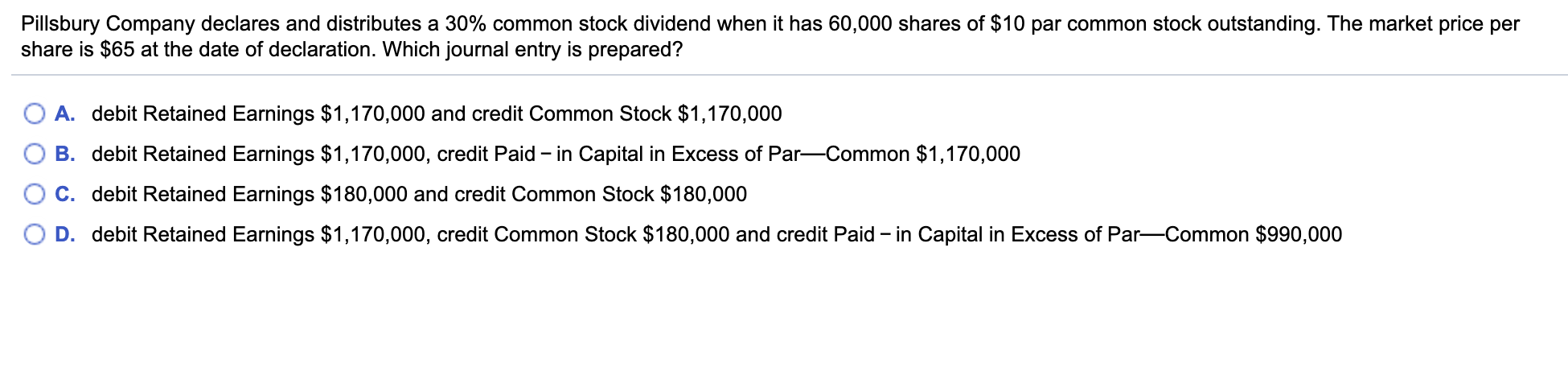

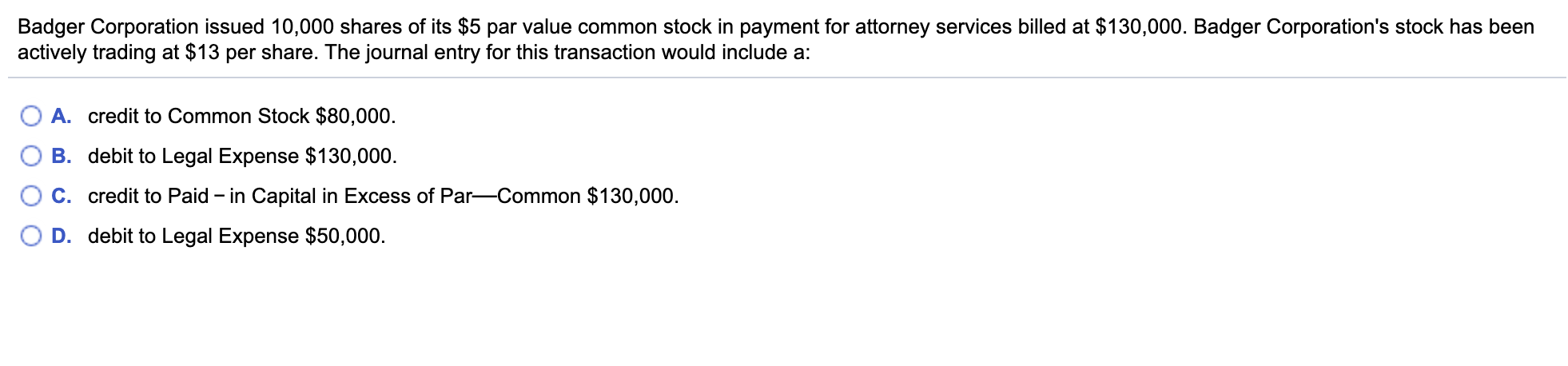

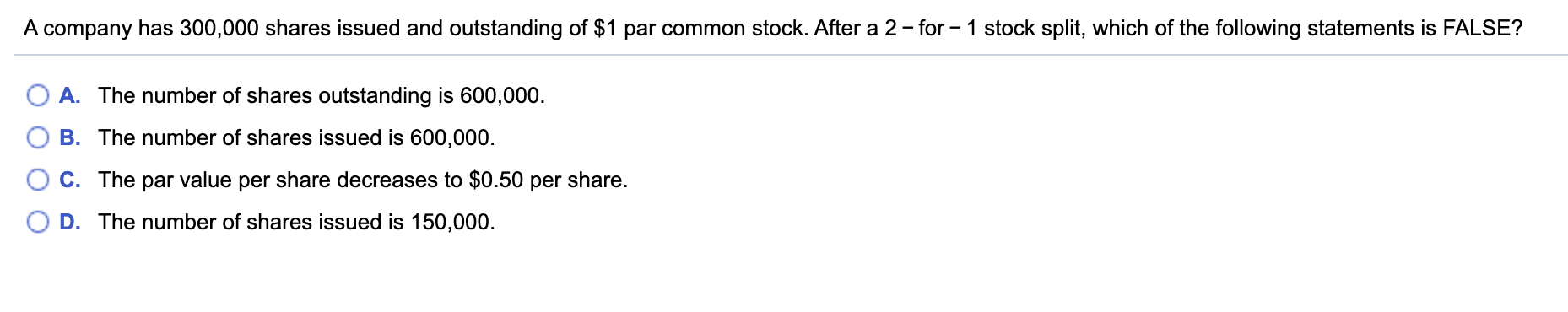

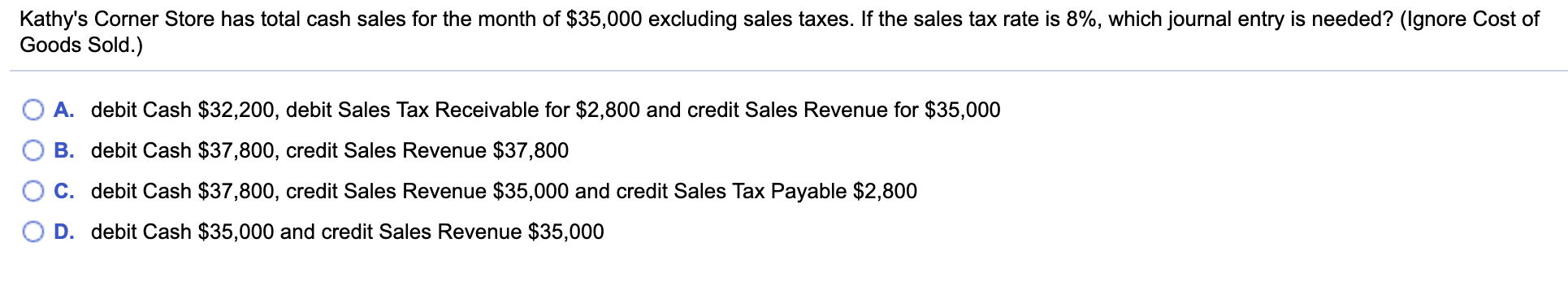

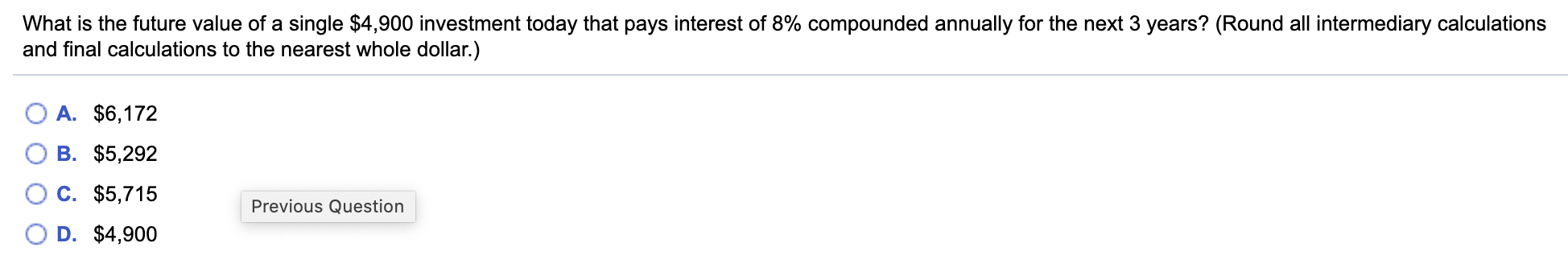

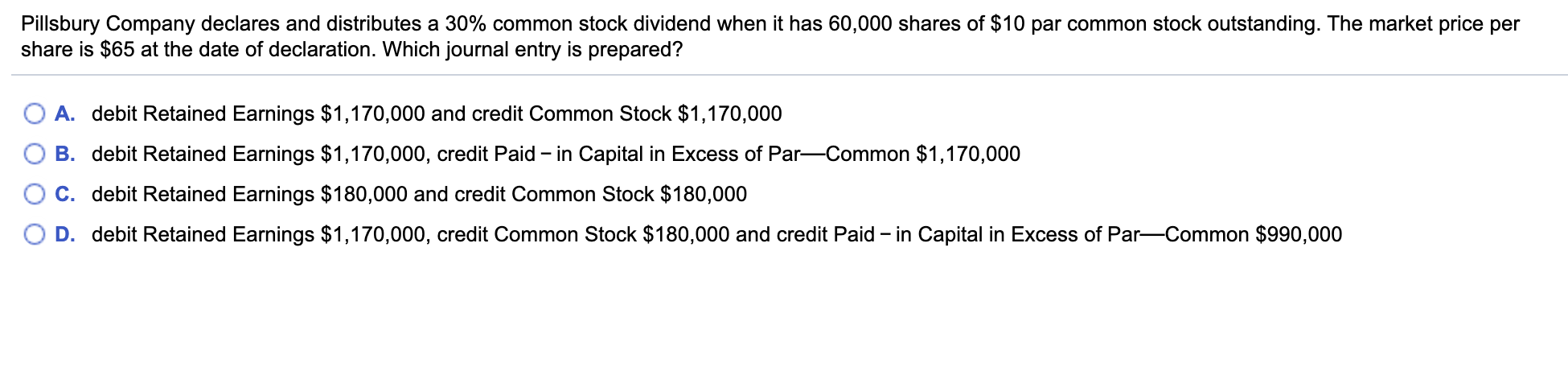

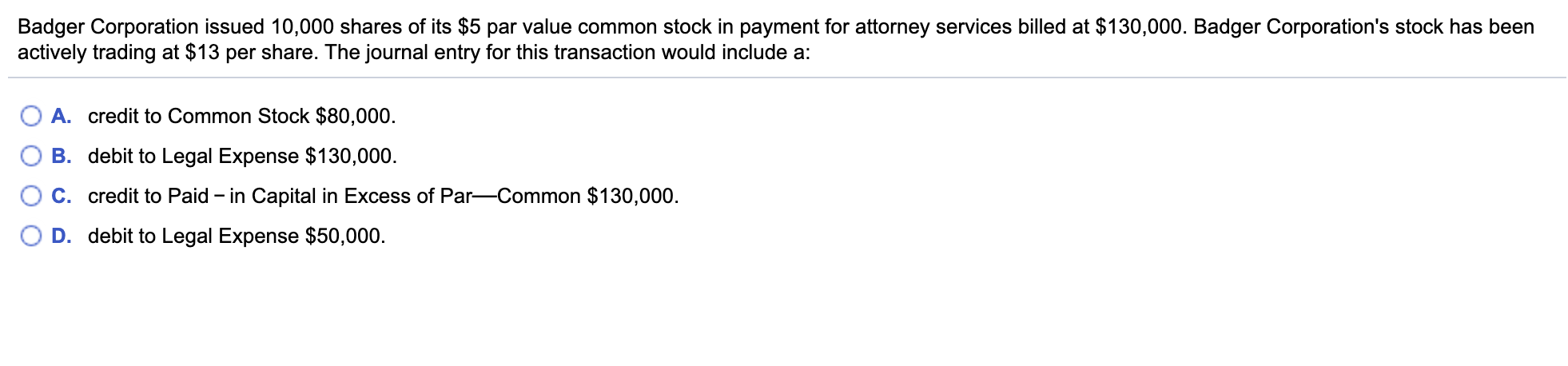

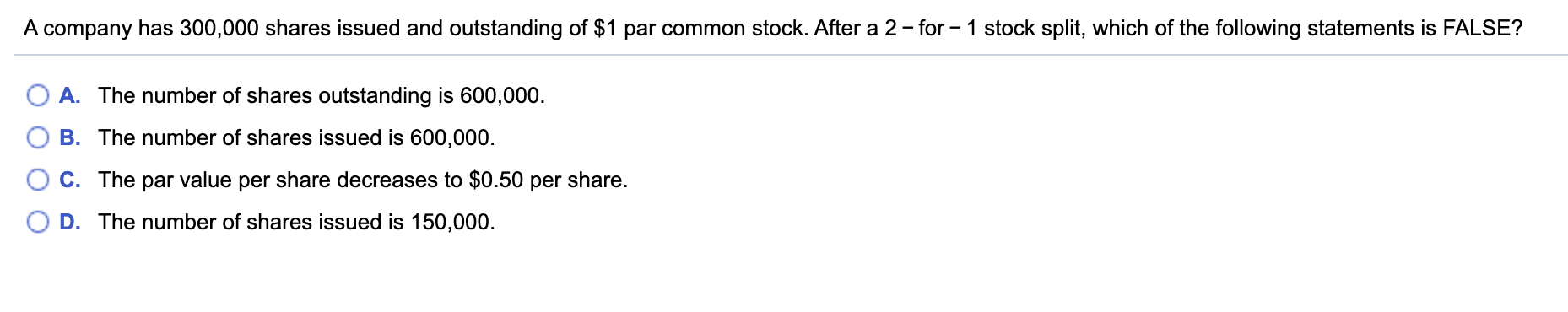

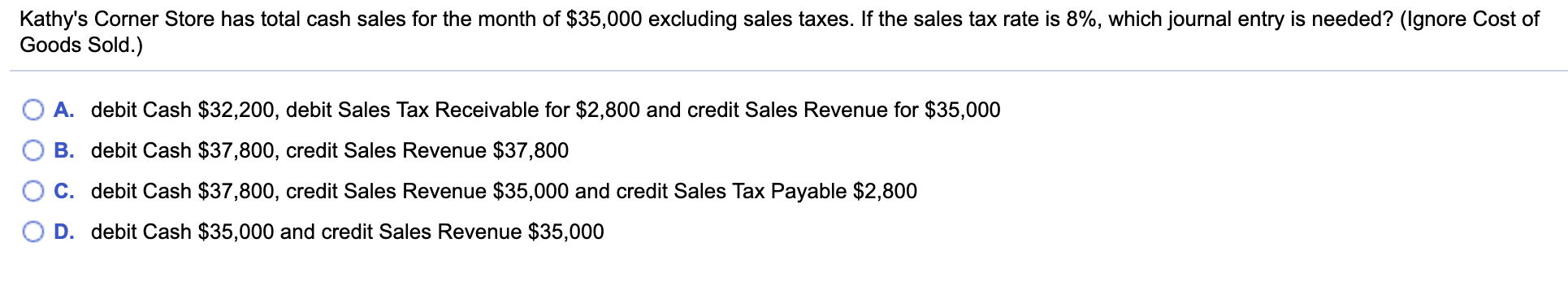

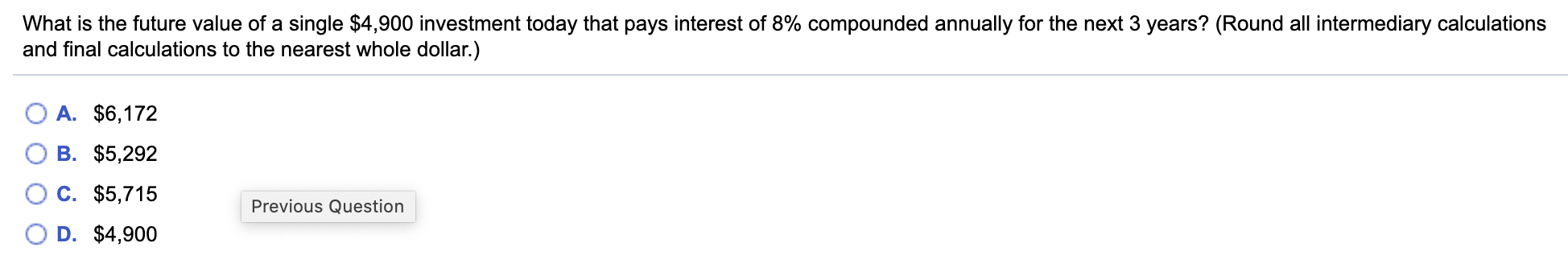

Pillsbury Company declares and distributes a 30% common stock dividend when it has 60,000 shares of $10 par common stock outstanding. The market price per share is $65 at the date of declaration. Which journal entry is prepared? O A. debit Retained Earnings $1,170,000 and credit Common Stock $1,170,000 O B. debit Retained Earnings $1,170,000, credit Paid - in Capital in Excess of ParCommon $1,170,000 O C. debit Retained Earnings $180,000 and credit Common Stock $180,000 O D. debit Retained Earnings $1,170,000, credit Common Stock $180,000 and credit Paid - in Capital in Excess of Par-Common $990,000 Badger Corporation issued 10,000 shares of its $5 par value common stock in payment for attorney services billed at $130,000. Badger Corporation's stock has been actively trading at $13 per share. The journal entry for this transaction would include a: O A. credit to Common Stock $80,000. O B. debit to Legal Expense $130,000. OC. credit to Paid - in Capital in Excess of ParCommon $130,000. OD. debit to Legal Expense $50,000 A company has 300,000 shares issued and outstanding of $1 par common stock. After a 2-for- 1 stock split, which of the following statements is FALSE? O A. The number of shares outstanding is 600,000. OB. The number of shares issued is 600,000. OC. The par value per share decreases to $0.50 per share. OD. The number of shares issued is 150,000. Kathy's Corner Store has total cash sales for the month of $35,000 excluding sales taxes. If the sales tax rate is 8%, which journal entry is needed? (Ignore Cost of Goods Sold.) O A. debit Cash $32,200, debit Sales Tax Receivable for $2,800 and credit Sales Revenue for $35,000 O B. debit Cash $37,800, credit Sales Revenue $37,800 O C. debit Cash $37,800, credit Sales Revenue $35,000 and credit Sales Tax Payable $2,800 OD. debit Cash $35,000 and credit Sales Revenue $35,000 What is the future value of a single $4,900 investment today that pays interest of 8% compounded annually for the next 3 years? (Round all intermediary calculations and final calculations to the nearest whole dollar.) O A. $6,172 O B. $5,292 OC. $5,715 OD. $4,900 Previous