Answered step by step

Verified Expert Solution

Question

1 Approved Answer

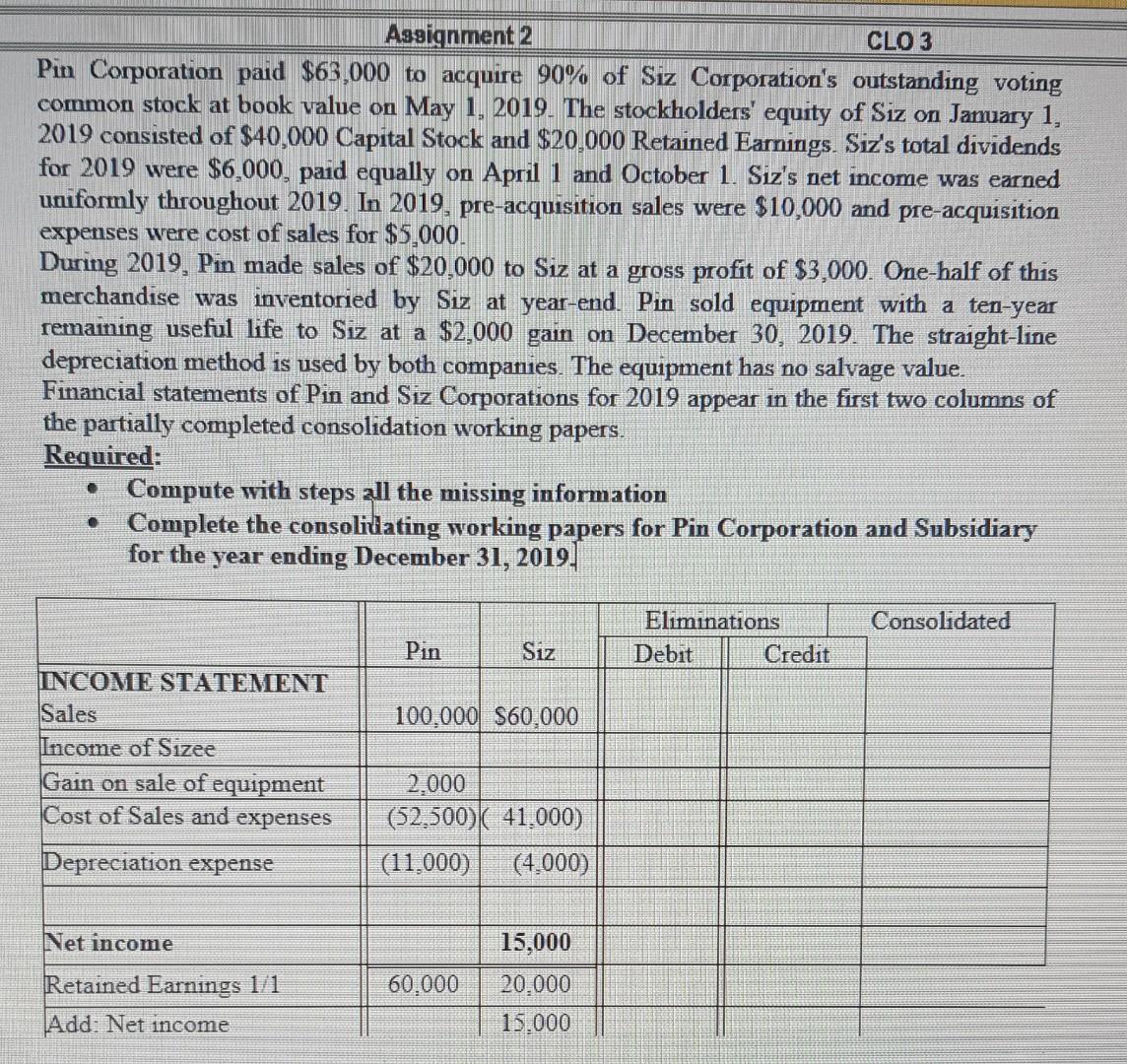

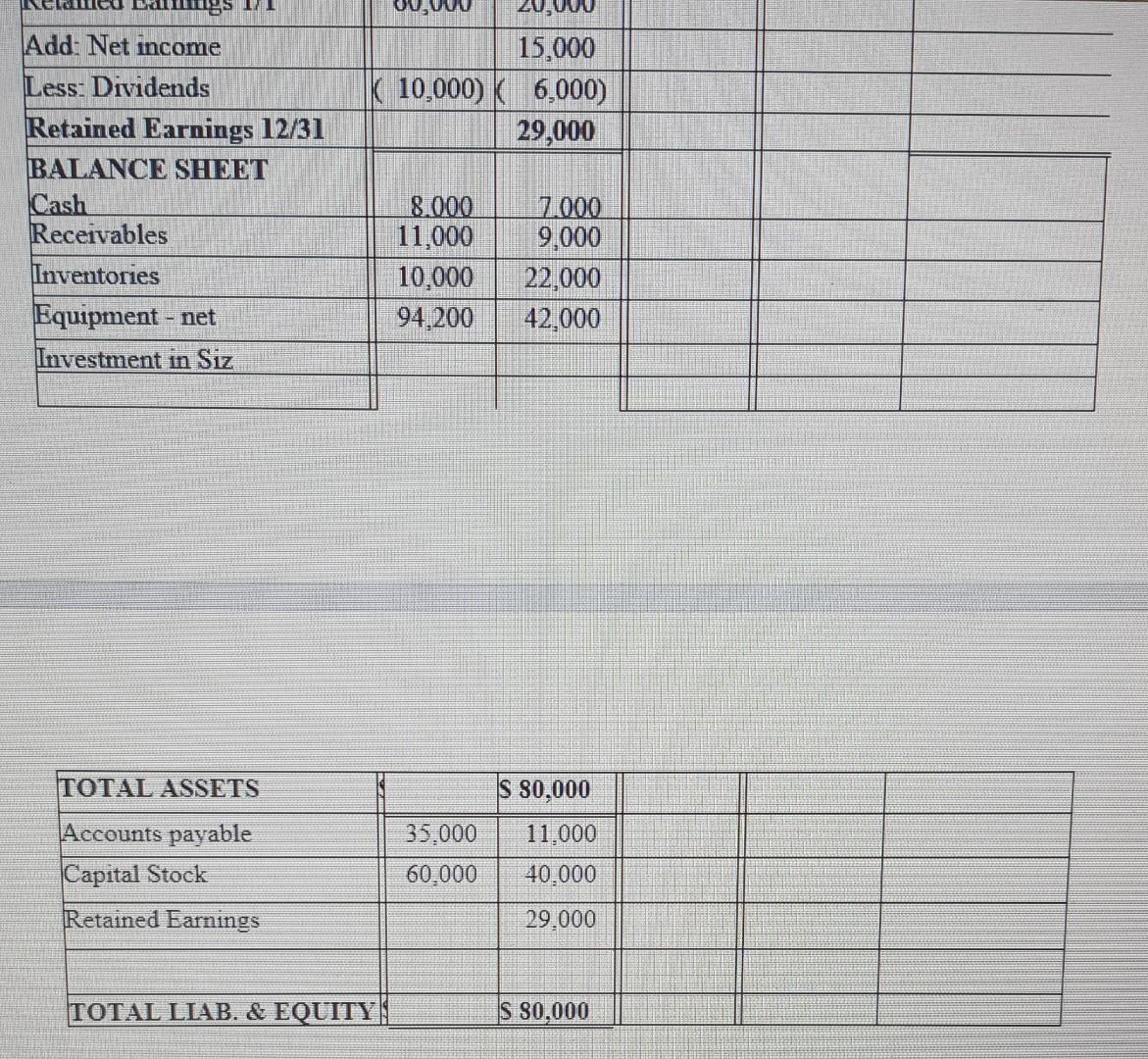

Pin Corporation paid $63,000 to acquire 90% of Siz Corporation's outstanding voting common stock at book value on May 1,2019. The stockholders' equity of Siz

Pin Corporation paid $63,000 to acquire 90% of Siz Corporation's outstanding voting common stock at book value on May 1,2019. The stockholders' equity of Siz on Jamuary 1 , 2019 consisted of \$40,000 Capital Stock and \$20,000 Retained Eamings. Siz's total dividends for 2019 were $6,000, paid equally on April 1 and October 1 . Siz's net income was earned uniformly throughout 2019. In 2019, pre-acquisition sales were $10,000 and pre-acquisition expenses were cost of sales for $5,000. During 2019, Pin made sales of $20,000 to Siz at a gross profit of $3,000. One-half of this merchandise was inventoried by Siz at year-end. Pin sold equipment with a ten-year remaining useful life to Siz at a $2,000 gain on December 30,2019 . The straight-line depreciation method is used by both companies. The equipment has no salvage value. Financial statements of P in and Siz Corporations for 2019 appear in the first two columns of the partially completed consolidation working papers. Required: - Compute with steps all the missing information - Complete the consolidating working papers for Pin Corporation and Subsidiary for the year ending December 31, 2019. Pin Corporation paid $63,000 to acquire 90% of Siz Corporation's outstanding voting common stock at book value on May 1,2019. The stockholders' equity of Siz on Jamuary 1 , 2019 consisted of \$40,000 Capital Stock and \$20,000 Retained Eamings. Siz's total dividends for 2019 were $6,000, paid equally on April 1 and October 1 . Siz's net income was earned uniformly throughout 2019. In 2019, pre-acquisition sales were $10,000 and pre-acquisition expenses were cost of sales for $5,000. During 2019, Pin made sales of $20,000 to Siz at a gross profit of $3,000. One-half of this merchandise was inventoried by Siz at year-end. Pin sold equipment with a ten-year remaining useful life to Siz at a $2,000 gain on December 30,2019 . The straight-line depreciation method is used by both companies. The equipment has no salvage value. Financial statements of P in and Siz Corporations for 2019 appear in the first two columns of the partially completed consolidation working papers. Required: - Compute with steps all the missing information - Complete the consolidating working papers for Pin Corporation and Subsidiary for the year ending December 31, 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started