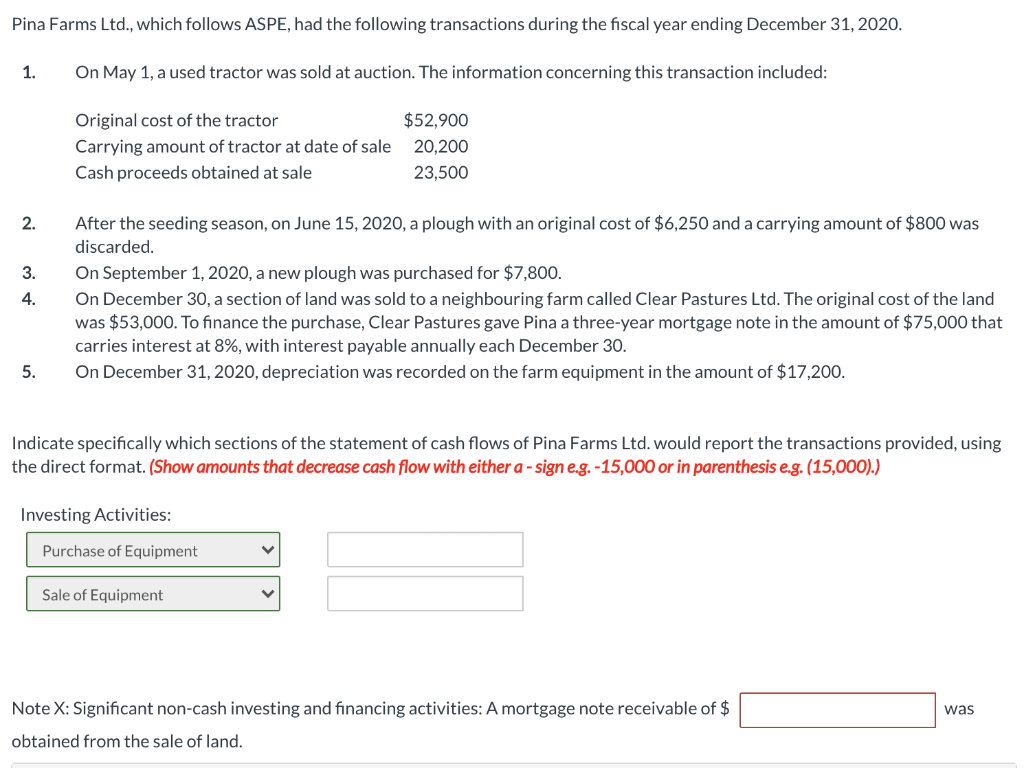

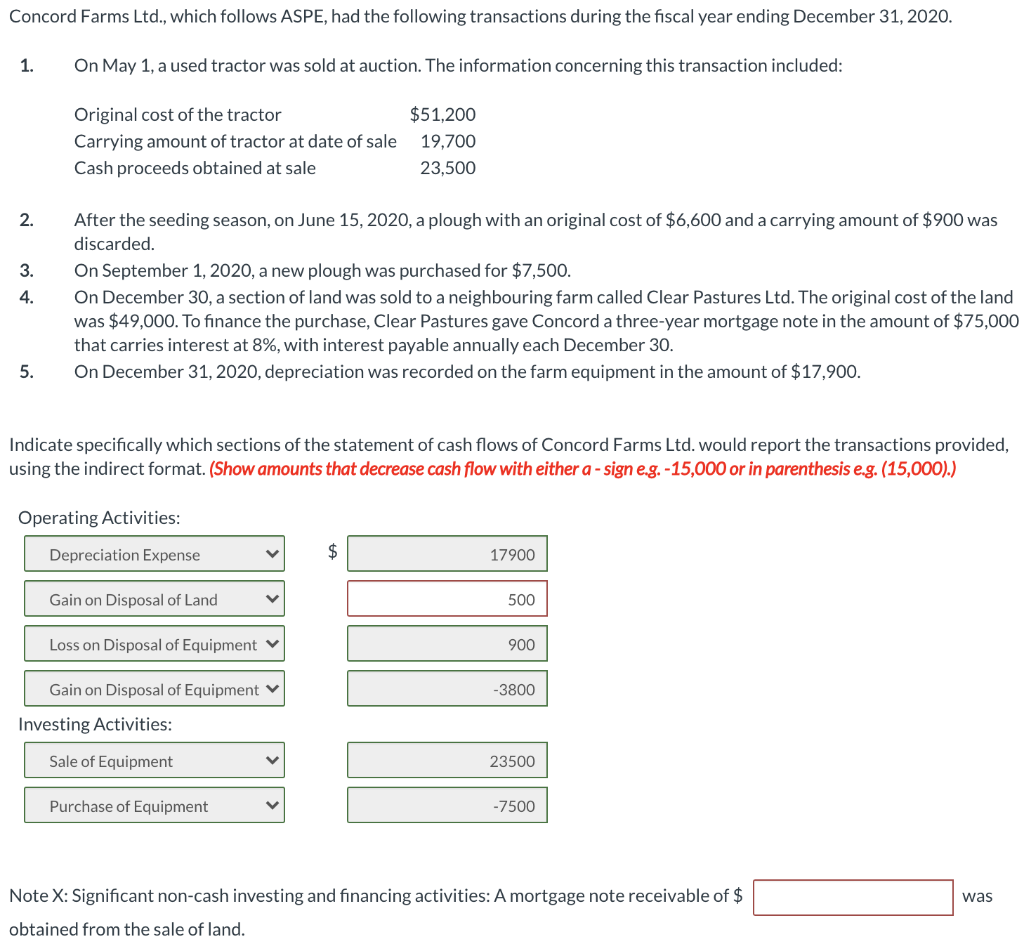

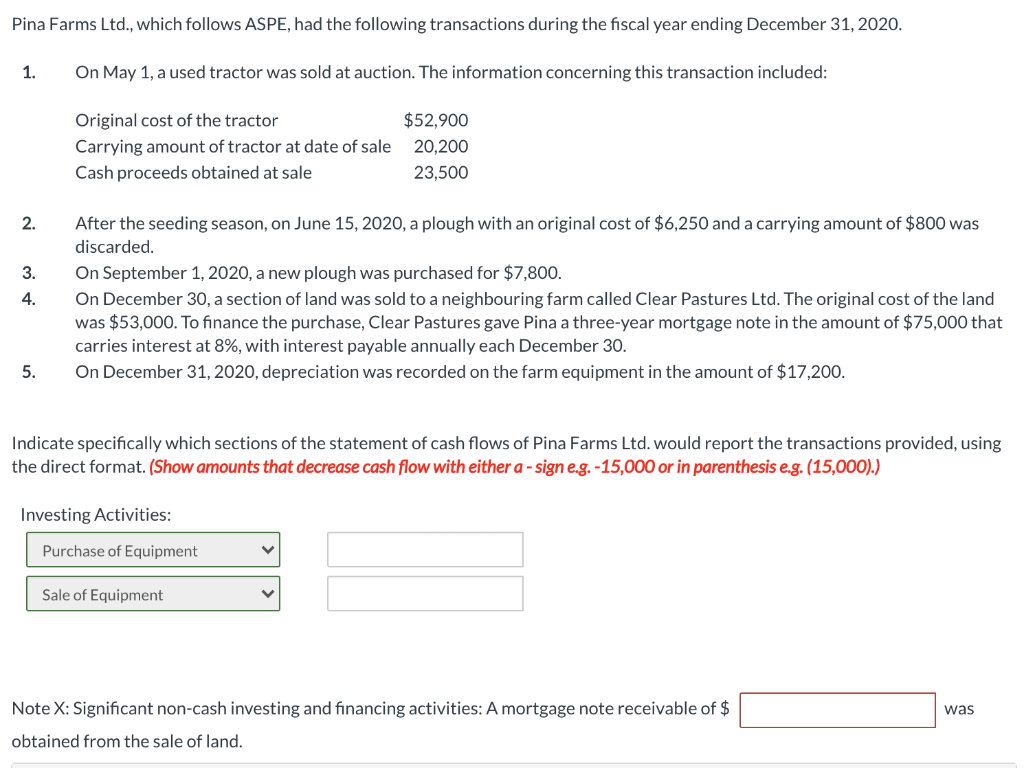

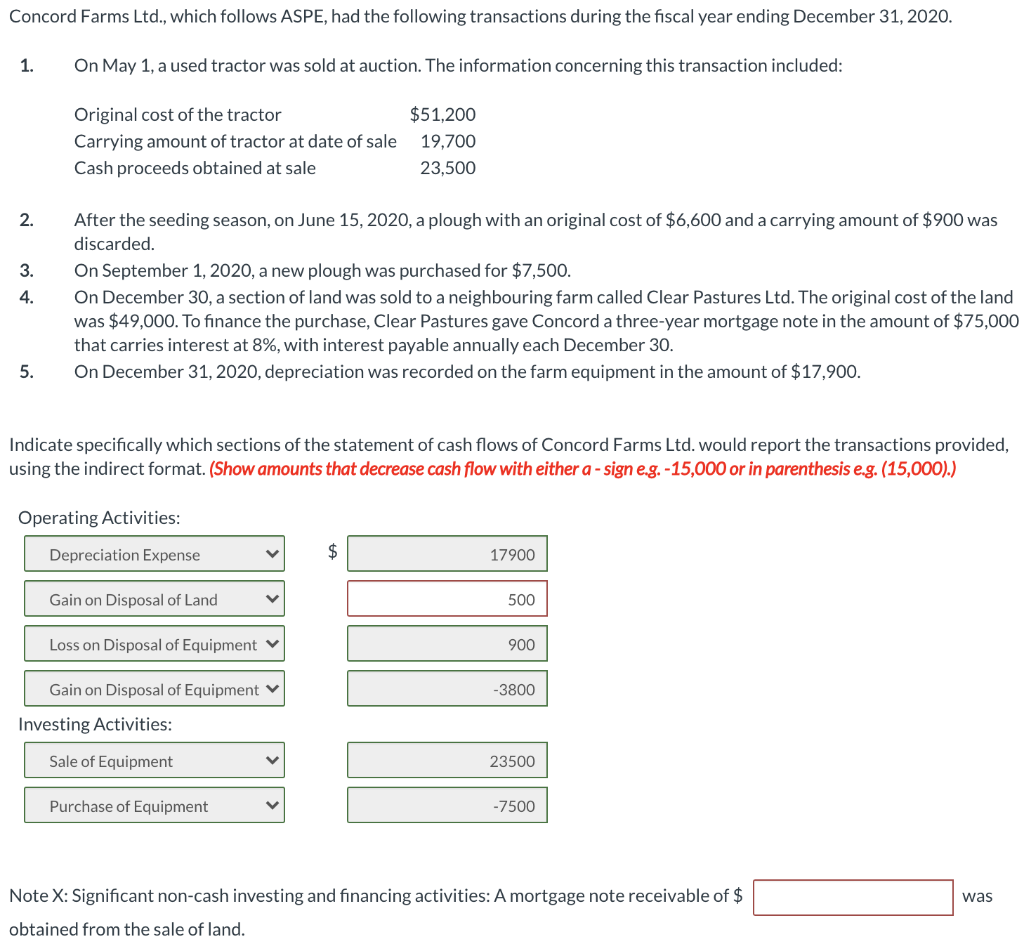

Pina Farms Ltd., which follows ASPE, had the following transactions during the fiscal year ending December 31, 2020. 1. On May 1, a used tractor was sold at auction. The information concerning this transaction included: Original cost of the tractor Carrying amount of tractor at date of sale Cash proceeds obtained at sale $52,900 20,200 23,500 2. 3. 4. After the seeding season, on June 15, 2020, a plough with an original cost of $6,250 and a carrying amount of $800 was discarded. On September 1, 2020, a new plough was purchased for $7,800. On December 30, a section of land was sold to a neighbouring farm called Clear Pastures Ltd. The original cost of the land was $53,000. To finance the purchase, Clear Pastures gave Pina a three-year mortgage note in the amount of $75,000 that carries interest at 8%, with interest payable annually each December 30. On December 31, 2020, depreciation was recorded on the farm equipment in the amount of $17,200. 5. Indicate specifically which sections of the statement of cash flows of Pina Farms Ltd. would report the transactions provided, using the direct format. (Show amounts that decrease cash flow with either a - sign e.g.-15,000 or in parenthesis e.g. (15,000).) Investing Activities: Purchase of Equipment Sale of Equipment was Note X: Significant non-cash investing and financing activities: A mortgage note receivable of $ obtained from the sale of land. Concord Farms Ltd., which follows ASPE, had the following transactions during the fiscal year ending December 31, 2020. 1. On May 1, a used tractor was sold at auction. The information concerning this transaction included: Original cost of the tractor Carrying amount of tractor at date of sale Cash proceeds obtained at sale $51,200 19,700 23,500 2. 3. 4. After the seeding season, on June 15, 2020, a plough with an original cost of $6,600 and a carrying amount of $900 was discarded. On September 1, 2020, a new plough was purchased for $7,500. On December 30, a section of land was sold to a neighbouring farm called Clear Pastures Ltd. The original cost of the land was $49,000. To finance the purchase, Clear Pastures gave Concord a three-year mortgage note in the amount of $75,000 that carries interest at 8%, with interest payable annually each December 30. On December 31, 2020, depreciation was recorded on the farm equipment in the amount of $17,900. 5. Indicate specifically which sections of the statement of cash flows of Concord Farms Ltd. would report the transactions provided, using the indirect format. (Show amounts that decrease cash flow with either a-sign e.g. -15,000 or in parenthesis e.g. (15,000).) Operating Activities: Depreciation Expense $ 17900 Gain on Disposal of Land 500 Loss on Disposal of Equipment 900 Gain on Disposal of Equipment -3800 Investing Activities: Sale of Equipment 23500 Purchase of Equipment -7500 was Note X: Significant non-cash investing and financing activities: A mortgage note receivable of $ obtained from the sale of land