Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pina Inc. is a large multinational corporation with a number of subsidiaries located in countries all over the world. One of Pina's subsidiaries, Grouper

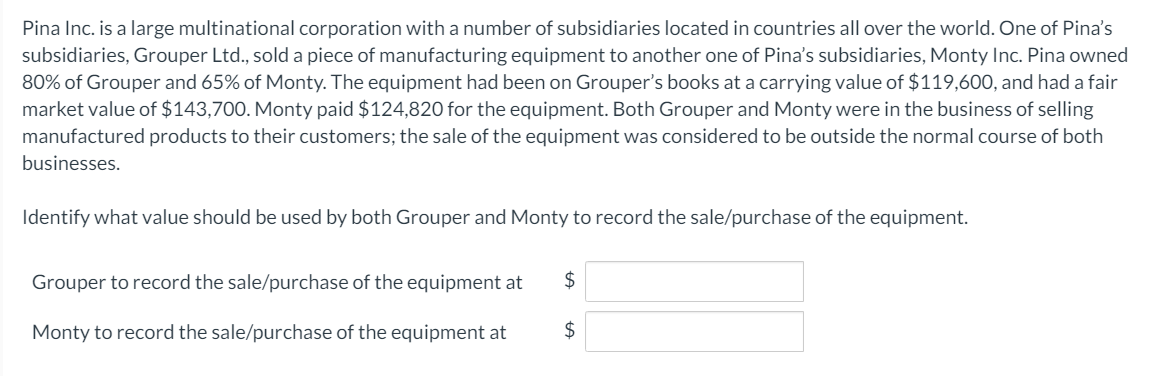

Pina Inc. is a large multinational corporation with a number of subsidiaries located in countries all over the world. One of Pina's subsidiaries, Grouper Ltd., sold a piece of manufacturing equipment to another one of Pina's subsidiaries, Monty Inc. Pina owned 80% of Grouper and 65% of Monty. The equipment had been on Grouper's books at a carrying value of $119,600, and had a fair market value of $143,700. Monty paid $124,820 for the equipment. Both Grouper and Monty were in the business of selling manufactured products to their customers; the sale of the equipment was considered to be outside the normal course of both businesses. Identify what value should be used by both Grouper and Monty to record the sale/purchase of the equipment. Grouper to record the sale/purchase of the equipment at $ Monty to record the sale/purchase of the equipment at $

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Solution Grouper Ltd will record sale at 124820 ie for actual amount received and not at market ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started