Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Piper pie, which pays corporation tax at 30 per cent, has the following capital structure: Ordinary shares: 1,000,000 ordinary shares of nominal value 25p per

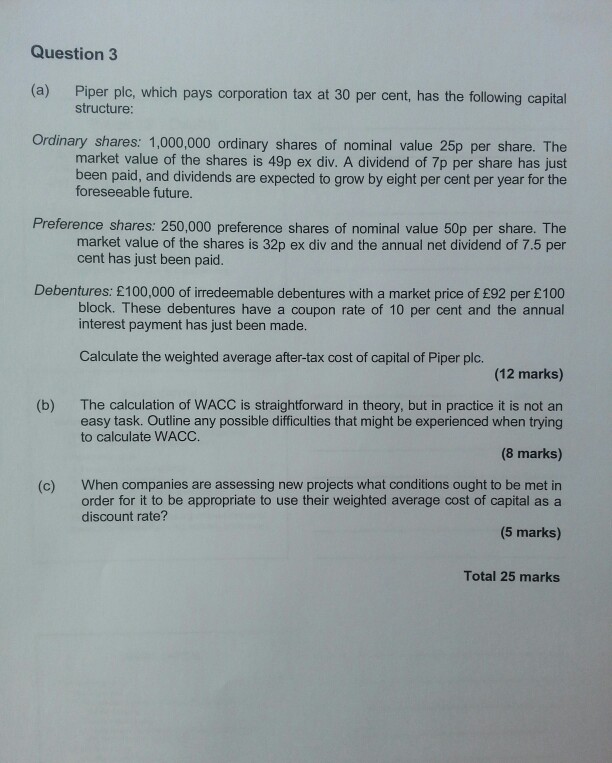

Piper pie, which pays corporation tax at 30 per cent, has the following capital structure: Ordinary shares: 1,000,000 ordinary shares of nominal value 25p per share. The market value of the shares is 49p ex div. A dividend of 7p per share has just been paid, and dividends are expected to grow by eight per cent per year for the foreseeable future. Preference shares: 250,000 preference shares of nominal value 50p per share. The market value of the shares is 32p ex div and the annual net dividend of 7.5 per cent has just been paid. Debentures: Epsilon100,000 of irredeemable debentures with a market price of Epsilon92 per Epsilon100 block. These debentures have a coupon rate of 10 per cent and the annual interest payment has just been made. Calculate the weighted average after-tax cost of capital of Piper pie. The calculation of WACC is straightforward in theory, but in practice it is not an easy task. Outline any possible difficulties that might be experienced when trying to calculate WACC. When companies are assessing new projects what conditions ought to be met in order for it to be appropriate to use their weighted average cost of capital as a discount rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started