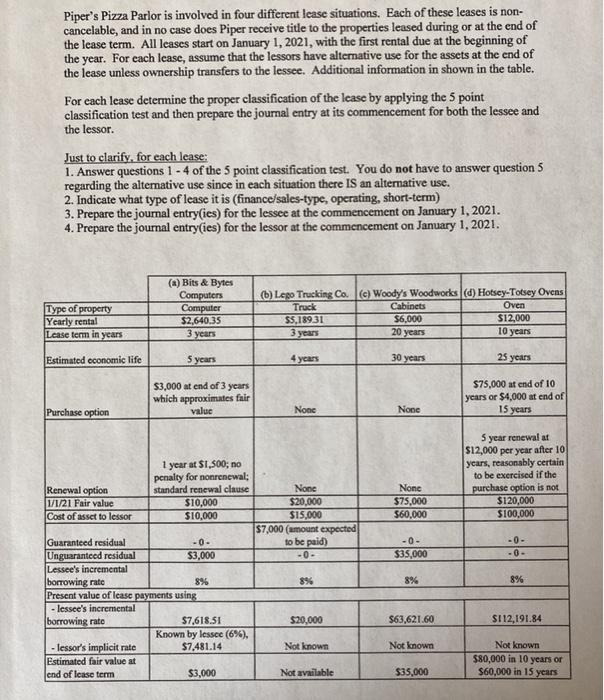

Piper's Pizza Parlor is involved in four different lcase situations. Each of these leases is non- cancelable, and in no case does Piper receive title to the properties leased during or at the end of the Icase term. All leases start on January 1, 2021, with the first rental due at the beginning of the year. For each lease, assume that the lessors have alternative use for the assets at the end of the lease unless ownership transfers to the lessee. Additional information in shown in the table. For each lease determine the proper classification of the lease by applying the 5 point classification test and then prepare the journal entry at its commencement for both the lessee and the lessor. Just to clarify, for each lease: 1. Answer questions 1 - 4 of the 5 point classification test. You do not have to answer question 5 regarding the alternative use since in each situation there is an alternative use. 2. Indicate what type of lease it is (finance/sales-type, operating, short-term) 3. Prepare the journal entry(ies) for the lessee at the commencement on January 1, 2021. 4. Prepare the journal entry(ies) for the lessor at the commencement on January 1, 2021. Type of property Yearly rental Lease term in years (a) Bits & Bytes Computers Computer $2,640.35 3 years (6) Lego Trucking Co. (c) Woody's Woodworks (d) Hotsey-Totsey Ovens Truck Cabinets Oven 55.189.31 $6,000 $12,000 3 years 20 years 10 years Estimated economic life 5 years 4 years 30 years 25 years $3,000 at end of 3 years which approximates fair value $75,000 at end of 10 years or $4,000 at end of Purchase option None None 15 years 5 year ren $12,000 per year after 10 years, reasonably certain to be exercised if the purchase option is not $120,000 $100.000 Nonc $75,000 $60,000 -0- -0- -0- $35,000 1 year at $1,500, no penalty for nonrenewal: Renewal option standard renewal clause None 11/21 Fair value $10,000 $20,000 Cost of asset to lessor $10,000 $15,000 $7.000 (amount expected Guaranteed residual -0- to be paid) Unguaranteed residual $3,000 -0- Lessee's incremental borrowing rate 8% 89 Present value of lease payments using - lessee's incremental borrowing rato $7.618.51 $20,000 Known by lessee (6%), - Iessor's implicit rate $7,481.14 Not known Estimated fair value at end of Icase term $3,000 Not available 8% $63.621.60 $112,191.84 Not known Not known $80,000 in 10 years or $60,000 in 15 years $35,000 Piper's Pizza Parlor is involved in four different lcase situations. Each of these leases is non- cancelable, and in no case does Piper receive title to the properties leased during or at the end of the Icase term. All leases start on January 1, 2021, with the first rental due at the beginning of the year. For each lease, assume that the lessors have alternative use for the assets at the end of the lease unless ownership transfers to the lessee. Additional information in shown in the table. For each lease determine the proper classification of the lease by applying the 5 point classification test and then prepare the journal entry at its commencement for both the lessee and the lessor. Just to clarify, for each lease: 1. Answer questions 1 - 4 of the 5 point classification test. You do not have to answer question 5 regarding the alternative use since in each situation there is an alternative use. 2. Indicate what type of lease it is (finance/sales-type, operating, short-term) 3. Prepare the journal entry(ies) for the lessee at the commencement on January 1, 2021. 4. Prepare the journal entry(ies) for the lessor at the commencement on January 1, 2021. Type of property Yearly rental Lease term in years (a) Bits & Bytes Computers Computer $2,640.35 3 years (6) Lego Trucking Co. (c) Woody's Woodworks (d) Hotsey-Totsey Ovens Truck Cabinets Oven 55.189.31 $6,000 $12,000 3 years 20 years 10 years Estimated economic life 5 years 4 years 30 years 25 years $3,000 at end of 3 years which approximates fair value $75,000 at end of 10 years or $4,000 at end of Purchase option None None 15 years 5 year ren $12,000 per year after 10 years, reasonably certain to be exercised if the purchase option is not $120,000 $100.000 Nonc $75,000 $60,000 -0- -0- -0- $35,000 1 year at $1,500, no penalty for nonrenewal: Renewal option standard renewal clause None 11/21 Fair value $10,000 $20,000 Cost of asset to lessor $10,000 $15,000 $7.000 (amount expected Guaranteed residual -0- to be paid) Unguaranteed residual $3,000 -0- Lessee's incremental borrowing rate 8% 89 Present value of lease payments using - lessee's incremental borrowing rato $7.618.51 $20,000 Known by lessee (6%), - Iessor's implicit rate $7,481.14 Not known Estimated fair value at end of Icase term $3,000 Not available 8% $63.621.60 $112,191.84 Not known Not known $80,000 in 10 years or $60,000 in 15 years $35,000