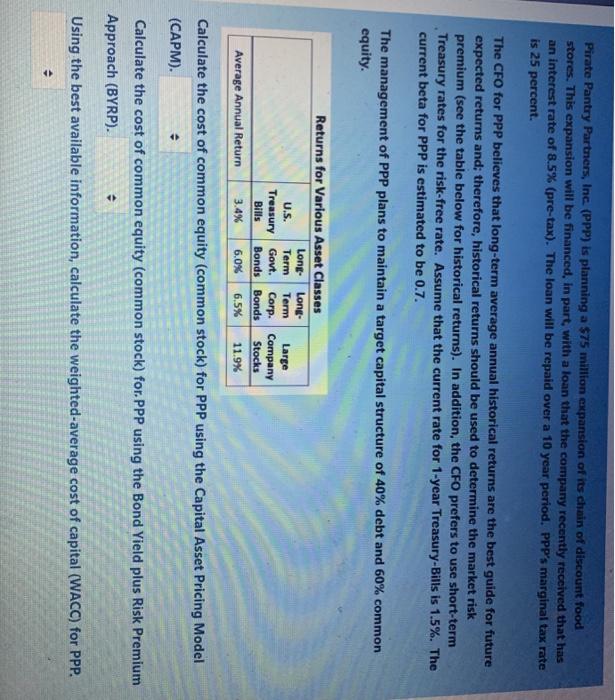

Pirate Pantry Partners, Inc. (PPP) is planning a $75 million expansion of its chain of discount food stores. This expansion will be financed, in part, with a loan that the company recently received that has an interest rate of 8.5% (pre-tax). The loan will be repaid over a 10 year period. PPP's marginal tax rate is 25 percent. The CFO for PPP believes that long-term average annual historical returns are the best guide for future expected returns and; therefore, historical returns should be used to determine the market risk premium (see the table below for historical returns). In addition, the CFO prefers to use short-term Treasury rates for the risk-free rate. Assume that the current rate for 1-year Treasury-Bills is 1.5%. The current beta for PPP is estimated to be 0.7. The management of PPP plans to maintain a target capital structure of 40% debt and 60% common equity. Returns for Various Asset Classes Long Long- U.S. Term Term Large Treasury Govt. Corp. Company Bills Bonds Bonds Stocks Average Annual Return 3.4% 6.0% 6.5% 11.9% Calculate the cost of common equity (common stock) for PPP using the Capital Asset Pricing Model (CAPM). Calculate the cost of common equity (common stock) for.PPP using the Bond Yield plus Risk Premium Approach (BYRP). Using the best available information, calculate the weighted-average cost of capital (WACC) for PPP. Pirate Pantry Partners, Inc. (PPP) is planning a $75 million expansion of its chain of discount food stores. This expansion will be financed, in part, with a loan that the company recently received that has an interest rate of 8.5% (pre-tax). The loan will be repaid over a 10 year period. PPP's marginal tax rate is 25 percent. The CFO for PPP believes that long-term average annual historical returns are the best guide for future expected returns and; therefore, historical returns should be used to determine the market risk premium (see the table below for historical returns). In addition, the CFO prefers to use short-term Treasury rates for the risk-free rate. Assume that the current rate for 1-year Treasury-Bills is 1.5%. The current beta for PPP is estimated to be 0.7. The management of PPP plans to maintain a target capital structure of 40% debt and 60% common equity. Returns for Various Asset Classes Long Long- U.S. Term Term Large Treasury Govt. Corp. Company Bills Bonds Bonds Stocks Average Annual Return 3.4% 6.0% 6.5% 11.9% Calculate the cost of common equity (common stock) for PPP using the Capital Asset Pricing Model (CAPM). Calculate the cost of common equity (common stock) for.PPP using the Bond Yield plus Risk Premium Approach (BYRP). Using the best available information, calculate the weighted-average cost of capital (WACC) for PPP