Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pistol Inc. has acquired all the voting shares of Saber Inc. and has gathered the following data to prepare consolidated financial statements. Pistol paid

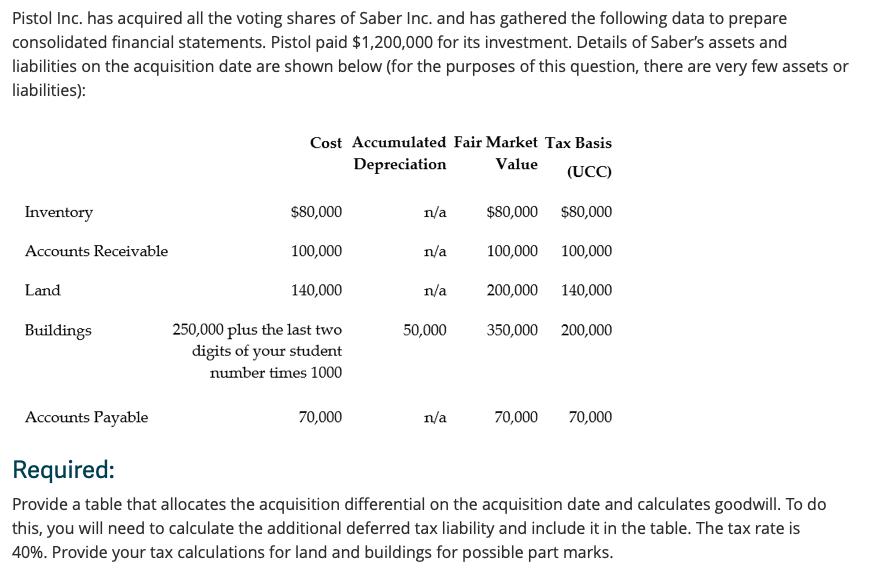

Pistol Inc. has acquired all the voting shares of Saber Inc. and has gathered the following data to prepare consolidated financial statements. Pistol paid $1,200,000 for its investment. Details of Saber's assets and liabilities on the acquisition date are shown below (for the purposes of this question, there are very few assets or liabilities): Inventory Accounts Receivable Land Buildings Accounts Payable Cost Accumulated Fair Market Tax Basis Depreciation Value (UCC) $80,000 $80,000 100,000 100,000 $80,000 100,000 140,000 250,000 plus the last two digits of your student number times 1000 70,000 n/a n/a n/a 50,000 n/a 200,000 140,000 350,000 200,000 70,000 70,000 Required: Provide a table that allocates the acquisition differential on the acquisition date and calculates goodwill. To do this, you will need to calculate the additional deferred tax liability and include it in the table. The tax rate is 40%. Provide your tax calculations for land and buildings for possible part marks.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

At the Date of Acqusition the Assets and Liabilities of Subsidiary companies are taken at Fair Value ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started