Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Piston Limited, South Africa, is a specialist manufacturer of electronic scooters. In seeking to expand its operations, it could acquire a French subsidiary company, Zooter

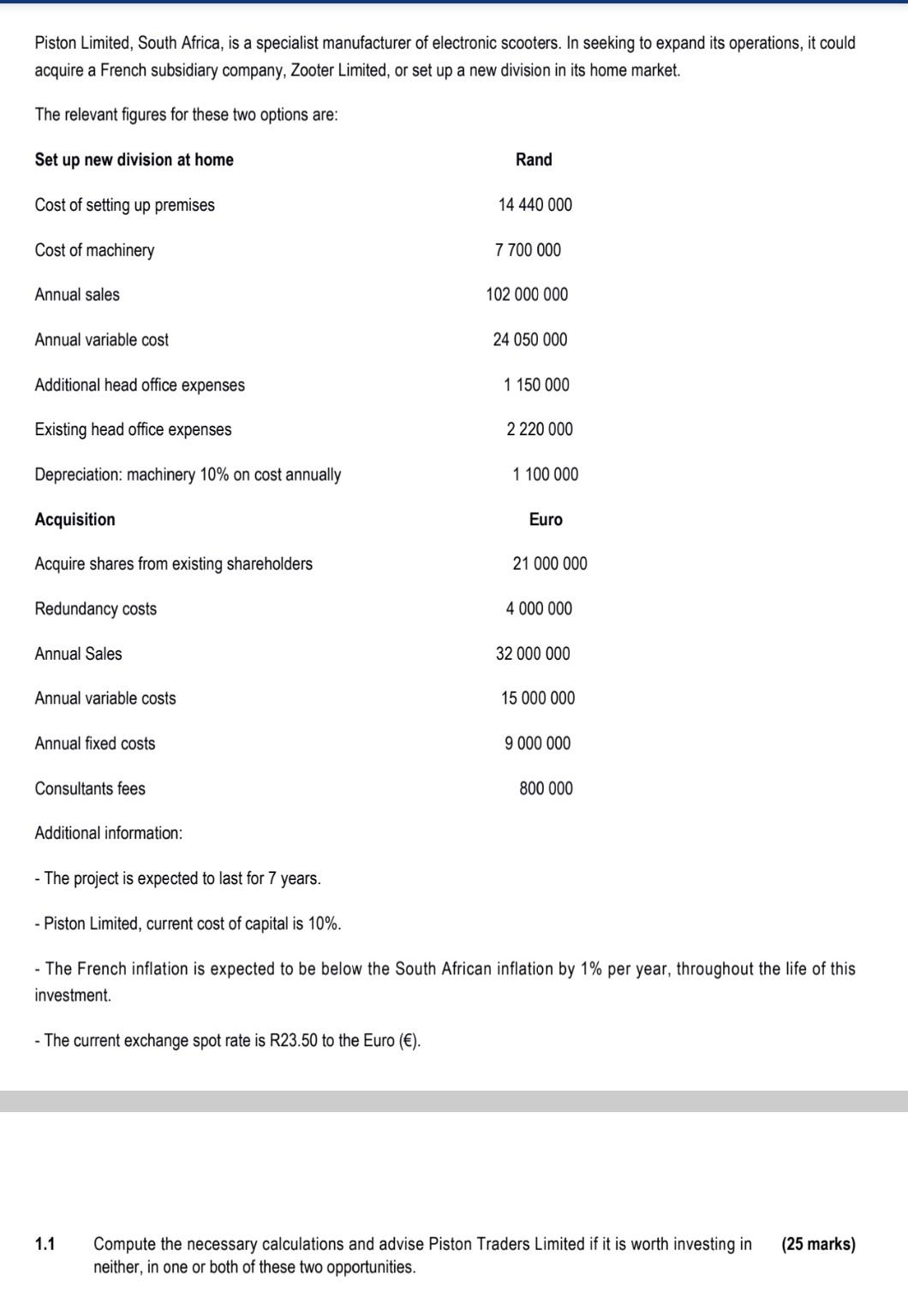

Piston Limited, South Africa, is a specialist manufacturer of electronic scooters. In seeking to expand its operations, it could acquire a French subsidiary company, Zooter Limited, or set up a new division in its home market. The relevant figures for these two options are: Set up new division at home Rand Cost of setting up premises 14 440 000 Cost of machinery 7 700 000 Annual sales 102 000 000 Annual variable cost 24 050 000 Additional head office expenses 1 150 000 Existing head office expenses 2 220 000 Depreciation: machinery 10% on cost annually 1 100 000 Acquisition Euro Acquire shares from existing shareholders 21 000 000 Redundancy costs 4 000 000 Annual Sales 32 000 000 Annual variable costs 15 000 000 Annual fixed costs 9 000 000 Consultants fees 800 000 Additional information: - The project is expected to last for 7 years. - Piston Limited, current cost of capital is 10%. - The French inflation is expected to be below the South African inflation by 1% per year, throughout the life of this investment. - The current exchange spot rate is R23.50 to the Euro (). 1.1 (25 marks) Compute the necessary calculations and advise Piston Traders Limited if it is worth investing in neither, in one or both of these two opportunities. Piston Limited, South Africa, is a specialist manufacturer of electronic scooters. In seeking to expand its operations, it could acquire a French subsidiary company, Zooter Limited, or set up a new division in its home market. The relevant figures for these two options are: Set up new division at home Rand Cost of setting up premises 14 440 000 Cost of machinery 7 700 000 Annual sales 102 000 000 Annual variable cost 24 050 000 Additional head office expenses 1 150 000 Existing head office expenses 2 220 000 Depreciation: machinery 10% on cost annually 1 100 000 Acquisition Euro Acquire shares from existing shareholders 21 000 000 Redundancy costs 4 000 000 Annual Sales 32 000 000 Annual variable costs 15 000 000 Annual fixed costs 9 000 000 Consultants fees 800 000 Additional information: - The project is expected to last for 7 years. - Piston Limited, current cost of capital is 10%. - The French inflation is expected to be below the South African inflation by 1% per year, throughout the life of this investment. - The current exchange spot rate is R23.50 to the Euro (). 1.1 (25 marks) Compute the necessary calculations and advise Piston Traders Limited if it is worth investing in neither, in one or both of these two opportunities

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started