Answered step by step

Verified Expert Solution

Question

1 Approved Answer

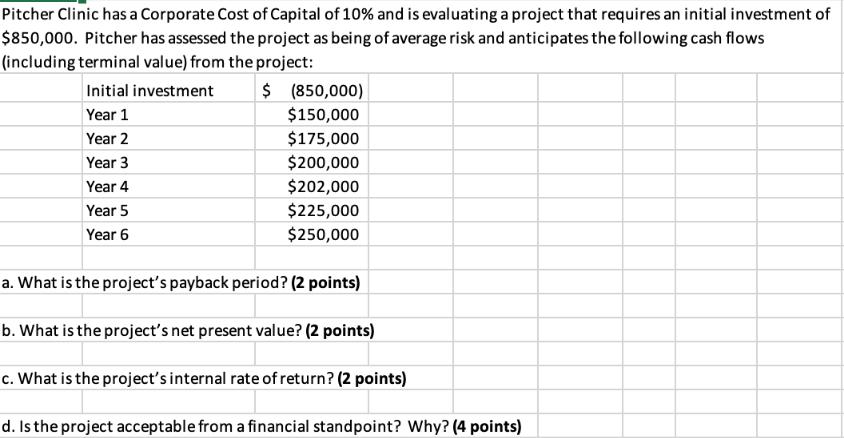

Pitcher Clinic has a Corporate Cost of Capital of 10% and is evaluating a project that requires an initial investment of $850,000. Pitcher has

Pitcher Clinic has a Corporate Cost of Capital of 10% and is evaluating a project that requires an initial investment of $850,000. Pitcher has assessed the project as being of average risk and anticipates the following cash flows (including terminal value) from the project: Initial investment Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 $ (850,000) $150,000 $175,000 $200,000 $202,000 $225,000 $250,000 a. What is the project's payback period? (2 points) b. What is the project's net present value? (2 points) c. What is the project's internal rate of return? (2 points) d. Is the project acceptable from a financial standpoint? Why? (4 points)

Step by Step Solution

★★★★★

3.45 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the projects payback period we need to determine the number of years it takes for the cumulative cash inflows to equal or exceed the initial investment a Calculating the payback period Ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started