Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Mrs. Rosa (Rosa) turned 65 on 13 January 2023, she had worked as a senior administrator in one of the reputable accounting firms, Tax

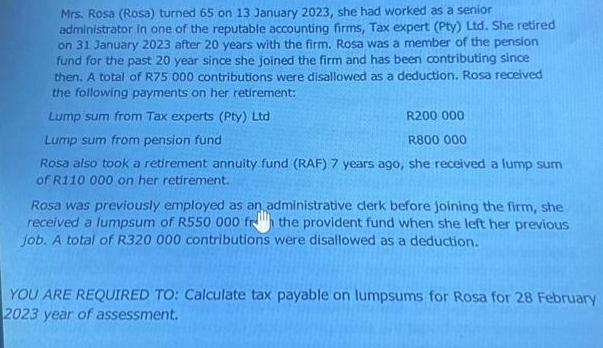

Mrs. Rosa (Rosa) turned 65 on 13 January 2023, she had worked as a senior administrator in one of the reputable accounting firms, Tax expert (Pty) Ltd. She retired on 31 January 2023 after 20 years with the firm. Rosa was a member of the pension fund for the past 20 year since she joined the firm and has been contributing since then. A total of R75 000 contributions were disallowed as a deduction. Rosa received the following payments on her retirement: Lump sum from Tax experts (Pty) Ltd R200 000 Lump sum from pension fund R800 000 Rosa also took a retirement annuity fund (RAF) 7 years ago, she received a lump sum of R110 000 on her retirement.. Rosa was previously employed as an administrative clerk before joining the firm, she received a lumpsum of R550 000 fr the provident fund when she left her previous job. A total of R320 000 contributions were disallowed as a deduction. YOU ARE REQUIRED TO: Calculate tax payable on lumpsums for Rosa for 28 February 2023 year of assessment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started