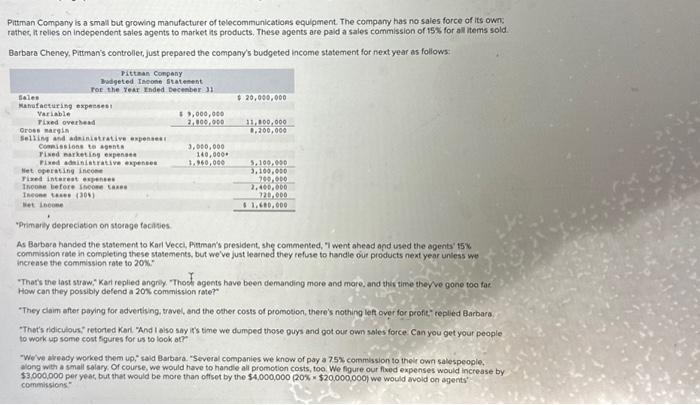

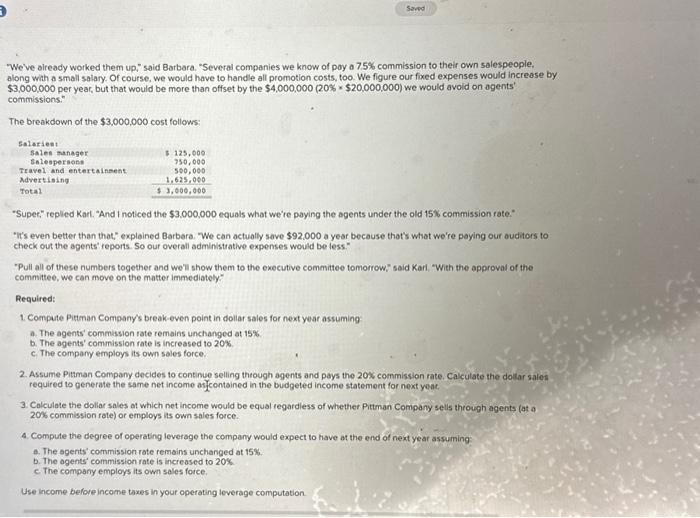

Pitman Company is a small but growing manufacturer of tolecommunications equipment. The company has no sales force of its own; rathes, it relies on independent sales agents to market its products. These agents are paid a sales commission of iss, for all items sold Barbara Cheney, Patman's controllec, just prepared the company's budgeted income statement for nextyear as follows: Primarly depreciaton on storage facistes As Barbara handed the statement to Karl Vecel, Puman's president, she commented, "I went ahead apd used the agents' t5x commission rate in completing these statements, but we've just learned they refise to handle out pioducts next year uniess we increase the commission rate to 20s : "Tharts the last straw," Kart replied angryy. Thoof agents have been demanding more and more, and this time they ve gone too fat How can they possibly defend a 20x commission rate? "They claim after paying for advertisng travel, and the other costs of promotion, there's nothing left over for peofie" tepled Barbara "Thet's ridiculous;" retoned Kart "And I also say ir's time we dumped those guys and got our own sales force. Can you get your people to work up some cost figures for us to look at? "We've already worked them up," sald Barbara. "Several companies we know of pay a 75x commission to their own salespeople. along with a smail solary. Of course, we would have to handie all promotion costs, too. We figure our flued expenses would increase by $3,000,000 per yeat, but thet would be more than offset by the $4,000,000 (20\% $20,000,000) we would arvold on agents' commissions. Pitman Company is a small but growing manufacturer of tolecommunications equipment. The company has no sales force of its own; rathes, it relies on independent sales agents to market its products. These agents are paid a sales commission of iss, for all items sold Barbara Cheney, Patman's controllec, just prepared the company's budgeted income statement for nextyear as follows: Primarly depreciaton on storage facistes As Barbara handed the statement to Karl Vecel, Puman's president, she commented, "I went ahead apd used the agents' t5x commission rate in completing these statements, but we've just learned they refise to handle out pioducts next year uniess we increase the commission rate to 20s : "Tharts the last straw," Kart replied angryy. Thoof agents have been demanding more and more, and this time they ve gone too fat How can they possibly defend a 20x commission rate? "They claim after paying for advertisng travel, and the other costs of promotion, there's nothing left over for peofie" tepled Barbara "Thet's ridiculous;" retoned Kart "And I also say ir's time we dumped those guys and got our own sales force. Can you get your people to work up some cost figures for us to look at? "We've already worked them up," sald Barbara. "Several companies we know of pay a 75x commission to their own salespeople. along with a smail solary. Of course, we would have to handie all promotion costs, too. We figure our flued expenses would increase by $3,000,000 per yeat, but thet would be more than offset by the $4,000,000 (20\% $20,000,000) we would arvold on agents' commissions