Question

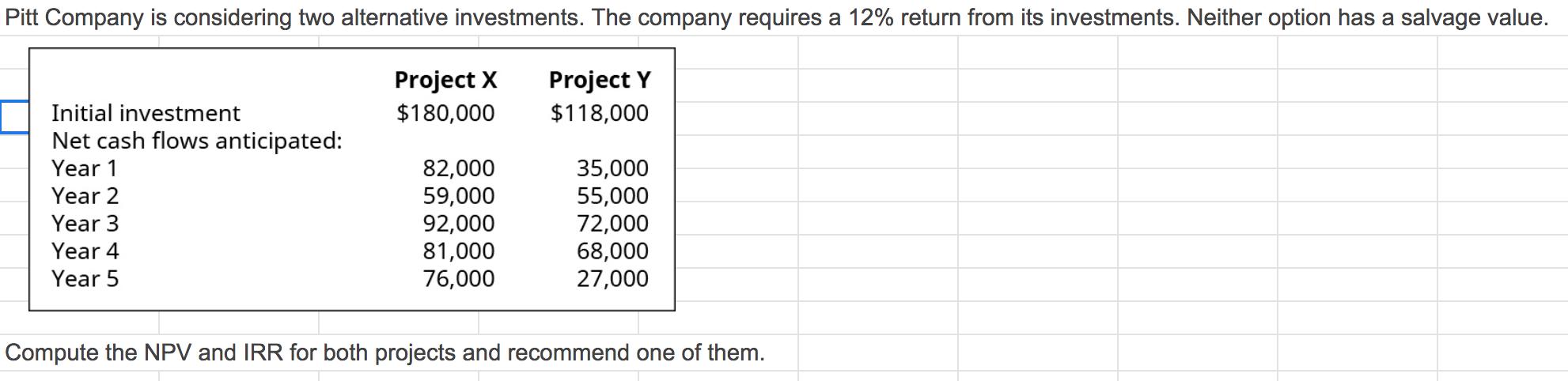

Pitt Company is considering two alternative investments. The company requires a 12% return from its investments. Neither option has a salvage value. Project X

Pitt Company is considering two alternative investments. The company requires a 12% return from its investments. Neither option has a salvage value. Project X Project Y $118,000 Initial investment $180,000 Net cash flows anticipated: Year 1 82,000 35,000 Year 2 59,000 55,000 Year 3 92,000 72,000 Year 4 81,000 68,000 Year 5 76,000 27,000 Compute the NPV and IRR for both projects and recommend one of them.

Step by Step Solution

3.54 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Project X Project Y Discounting Discounting Factor Cash Discounted Cash Factor flow 12 Value flow 12 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Theory and Corporate Policy

Authors: Thomas E. Copeland, J. Fred Weston, Kuldeep Shastri

4th edition

321127218, 978-0321179548, 321179544, 978-0321127211

Students also viewed these Economics questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App