A car manufacturer has been experiencing financial difficulties over the past few years. Sales have reduced significantly

Question:

A car manufacturer has been experiencing financial difficulties over the past few years. Sales have reduced significantly as a result of the worldwide economic recession. Costs have increased due to quality issues that led to a recall of some models of its cars.Production volume last year was 50 000 cars and it is expected that this will increase by 4 percent per annum each year for the next five years.The company directors are concerned to improve profitability and are considering two potential investment projects.Project 1 ? implement a new quality control process.The company has paid a consultant process engineer $50 000 to review the company?s quality processes. The consultant recommended that the company implement a new quality control process. The new process will require a machine costing $20 000 000. The machine is expected to have a useful life of five years and no residual value.

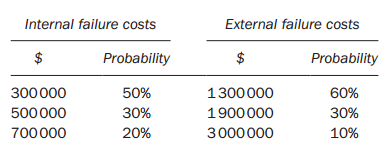

It is estimated that raw material costs will be reduced by $62 per car and that both internal and external failure costs from quality failures will be reduced by 80 percent.Estimated internal and external failure costs per year without the new process, based on last year?s production volume of 50 000 cars, and their associated probabilities are shown below:

Internal and external failure costs are expected to increase each year in line with the number of cars produced.The company?s accountant has calculated that this investment will result in a net present value (NPV) of $13 38 000 and an internal rate of return of 10.5 percent.Project 2 ? in-house component manufacturing.The company could invest in new machinery to enable in-house manufacturing of a component that is currently made by outside suppliers. The new machinery is expected to cost $15 000 000 and have a useful life of five years and no residual value.Additional working capital of $1 000 000 will also be required as a result of producing the component in-house.The price paid to the current supplier is $370 per component. It is estimated that the in-house variable cost of production will be $260 per component. Each car requires one component. Fixed production costs, including machinery depreciation, are estimated to increase by $5 000 000 per annum as a result of manufacturing the component in-house.Depreciation is calculated on a straight line basis.Additional informationThe company is unable to raise enough capital to carry out both projects. The company will therefore have to choose between the two alternatives.Taxation and inflation should be ignored.The company uses a cost of capital of 8 percent per annum.

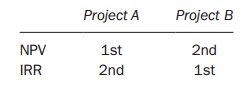

Required:(a) Calculate for Project 1 the relevant cash flows that the accountant should have used for year 1 when appraising the project.All workings should be shown in $000.(b) Calculate for Project 2:(i) The net present value (NPV)(ii) The internal rate of return (IRR).All workings should be shown in $000(c) Advise the company directors which of the two investment projects should be undertaken.(d) A company is considering two alternative investment projects both of which have a positive net present value.The projects have been ranked on the basis of both net present value (NPV) and internal rate of return (IRR). The result of the ranking is shown below:

Discuss potential reasons why the conflict between the NPV and IRR ranking may have arisen.

Net Present ValueWhat is NPV? The net present value is an important tool for capital budgeting decision to assess that an investment in a project is worthwhile or not? The net present value of a project is calculated before taking up the investment decision at... Internal Rate of Return

Internal Rate of Return of IRR is a capital budgeting tool that is used to assess the viability of an investment opportunity. IRR is the true rate of return that a project is capable of generating. It is a metric that tells you about the investment... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of...

Step by Step Answer: