Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PiX Ltd is considering changing its credit policy for receivables. At present, the company provides a credit period of 30 days and the management

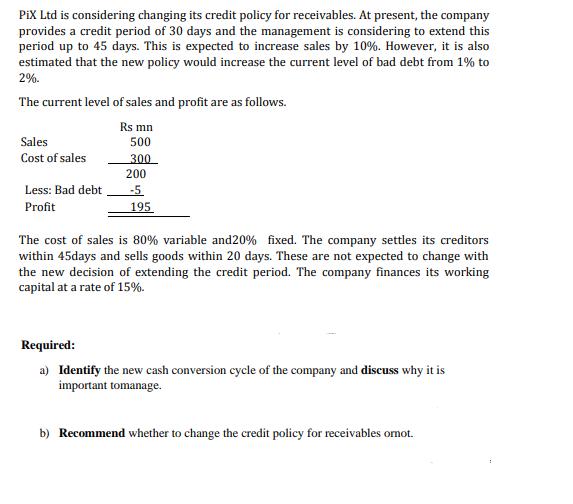

PiX Ltd is considering changing its credit policy for receivables. At present, the company provides a credit period of 30 days and the management is considering to extend this period up to 45 days. This is expected to increase sales by 10%. However, it is also estimated that the new policy would increase the current level of bad debt from 1% to 2%. The current level of sales and profit are as follows. Rs mn 500 Sales Cost of sales Less: Bad debt Profit 300 200 -5 195 The cost of sales is 80% variable and 20% fixed. The company settles its creditors within 45days and sells goods within 20 days. These are not expected to change with the new decision of extending the credit period. The company finances its working capital at a rate of 15%. Required: a) Identify the new cash conversion cycle of the company and discuss why it is important tomanage. b) Recommend whether to change the credit policy for receivables omot.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started