Answered step by step

Verified Expert Solution

Question

1 Approved Answer

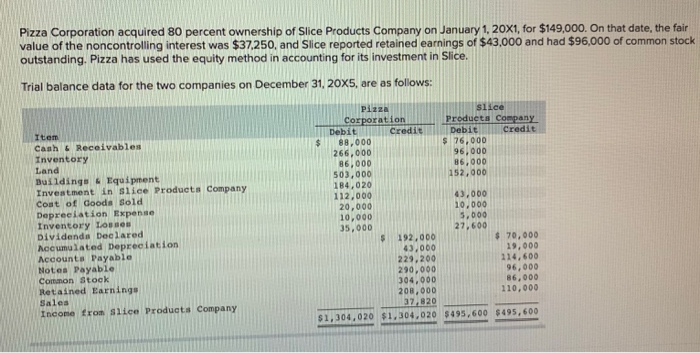

Pizza Corporation acquired 80 percent ownership of Slice Products Company on January 1, 20x1, for $149,000. On that date, the fair value of the noncontrolling

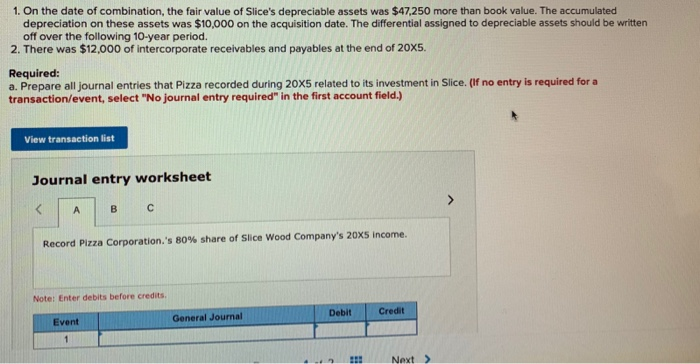

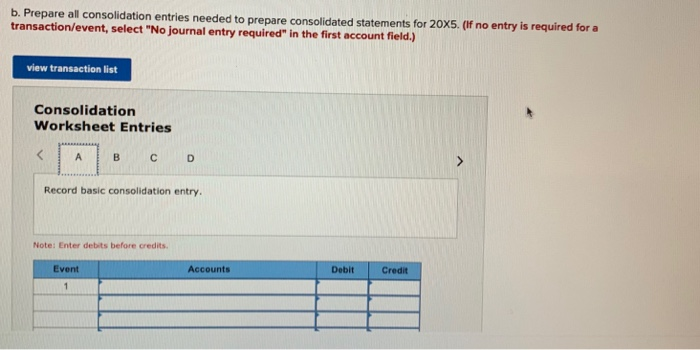

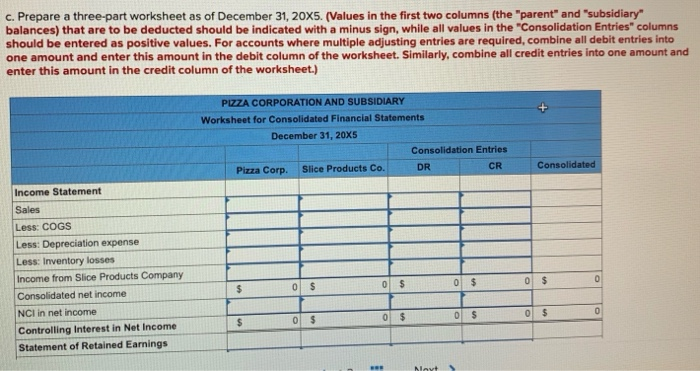

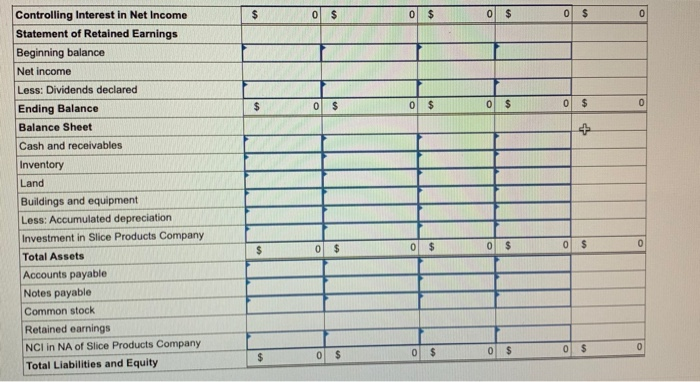

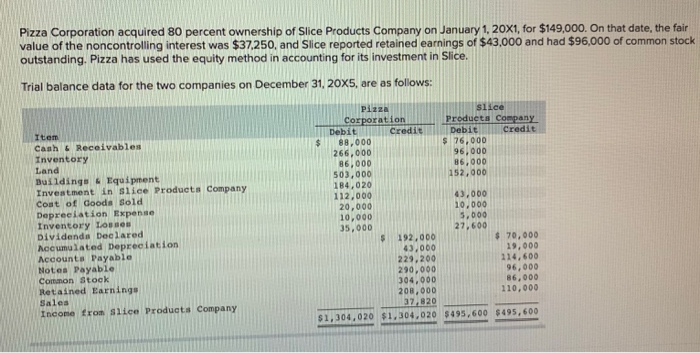

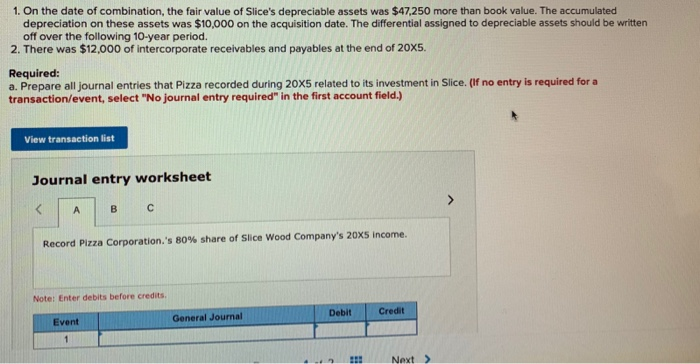

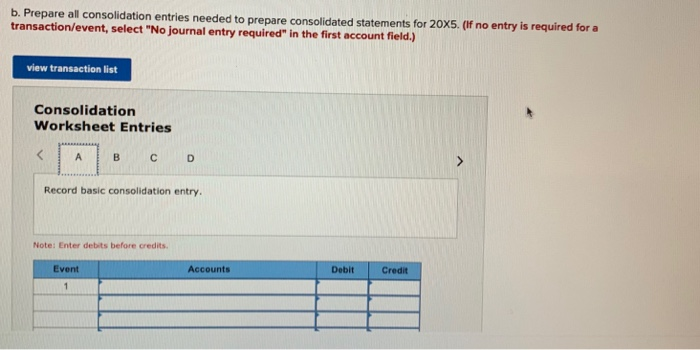

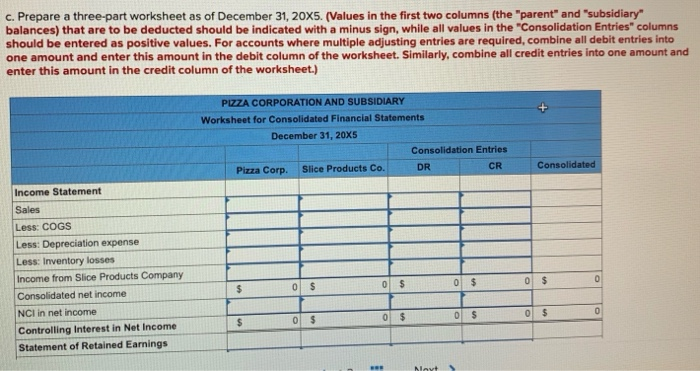

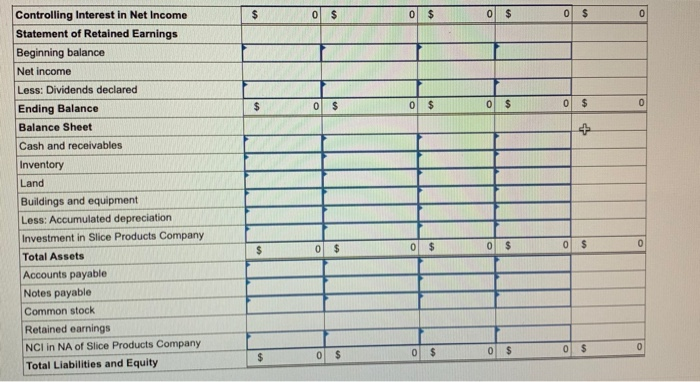

Pizza Corporation acquired 80 percent ownership of Slice Products Company on January 1, 20x1, for $149,000. On that date, the fair value of the noncontrolling interest was $37,250, and Slice reported retained earnings of $43,000 and had $96,000 of common stock outstanding, Pizza has used the equity method in accounting for its investment in Slice. Trial balance data for the two companies on December 31, 20X5, are as follows: Item Cash Receivables Inventory Land Buildings & Equipment Investment in slice Products Company Coat of Goods Sold Depreciation Expense Inventory Los Dividenda Declared Accumulated Depreciation Accounts Payable Notes Payable Common Stock Retained Earning Sales Income from sile Products Company Pizza Slice Corporation Products Company Debit Credit Debit Credit 88,000 $ 76,000 266,000 96,000 86,000 85,000 503,000 152,000 184,020 112.000 43,000 20,000 10,000 10,000 5,000 35,000 27,600 192,000 $ 70.000 43,000 19.000 229,200 114,600 290,000 96.000 304,000 86,000 200,000 110,000 37.220 $1,304,020 $1,304,020 5495,600 $495,600 1. On the date of combination, the fair value of Slice's depreciable assets was $47.250 more than book value. The accumulated depreciation on these assets was $10,000 on the acquisition date. The differential assigned to depreciable assets should be written off over the following 10-year period. 2. There was $12,000 of intercorporate receivables and payables at the end of 20X5. Required: a. Prepare all journal entries that Pizza recorded during 20x5 related to its investment in Slice. (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet C Record Pizza Corporation's 80% share of Slice Wood Company's 20x5 income. Note: Enter debits before credits Debit General Journal Event Credit Next > b. Prepare al consolidation entries needed to prepare consolidated statements for 20X5. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) view transaction list Consolidation Worksheet Entries B C D Record basic consolidation entry. Note: Enter debits before credits Event Accounts Debit Credit c. Prepare a three-part worksheet as of December 31, 20X5. (Values in the first two columns (the "parent" and "subsidiary balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) PIZZA CORPORATION AND SUBSIDIARY Worksheet for Consolidated Financial Statements December 31, 20X5 Consolidation Entries Pizza Corp. Slice Products Co. DR CR Consolidated Income Statement Sales Less: COGS Less: Depreciation expense Less: Inventory losses Income from Slice Products Company Consolidated net income NCI in net income Controlling Interest in Net Income Statement of Retained Earnings S ols Controlling Interest in Net Income Statement of Retained Earnings Beginning balance Net income Less: Dividends declared Ending Balance Balance Sheet Cash and receivables Inventory Land Buildings and equipment Less: Accumulated depreciation Investment in Slice Products Company Total Assets Accounts payable Notes payable Common stock Retained earnings NCI in NA of Slice Products Company Total Liabilities and Equity 0 $ 0 $ 0 $ 0 $ 0 $

Pizza Corporation acquired 80 percent ownership of Slice Products Company on January 1, 20x1, for $149,000. On that date, the fair value of the noncontrolling interest was $37,250, and Slice reported retained earnings of $43,000 and had $96,000 of common stock outstanding, Pizza has used the equity method in accounting for its investment in Slice. Trial balance data for the two companies on December 31, 20X5, are as follows: Item Cash Receivables Inventory Land Buildings & Equipment Investment in slice Products Company Coat of Goods Sold Depreciation Expense Inventory Los Dividenda Declared Accumulated Depreciation Accounts Payable Notes Payable Common Stock Retained Earning Sales Income from sile Products Company Pizza Slice Corporation Products Company Debit Credit Debit Credit 88,000 $ 76,000 266,000 96,000 86,000 85,000 503,000 152,000 184,020 112.000 43,000 20,000 10,000 10,000 5,000 35,000 27,600 192,000 $ 70.000 43,000 19.000 229,200 114,600 290,000 96.000 304,000 86,000 200,000 110,000 37.220 $1,304,020 $1,304,020 5495,600 $495,600 1. On the date of combination, the fair value of Slice's depreciable assets was $47.250 more than book value. The accumulated depreciation on these assets was $10,000 on the acquisition date. The differential assigned to depreciable assets should be written off over the following 10-year period. 2. There was $12,000 of intercorporate receivables and payables at the end of 20X5. Required: a. Prepare all journal entries that Pizza recorded during 20x5 related to its investment in Slice. (if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet C Record Pizza Corporation's 80% share of Slice Wood Company's 20x5 income. Note: Enter debits before credits Debit General Journal Event Credit Next > b. Prepare al consolidation entries needed to prepare consolidated statements for 20X5. (If no entry is required for a transaction/event, select "No journal entry required in the first account field.) view transaction list Consolidation Worksheet Entries B C D Record basic consolidation entry. Note: Enter debits before credits Event Accounts Debit Credit c. Prepare a three-part worksheet as of December 31, 20X5. (Values in the first two columns (the "parent" and "subsidiary balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) PIZZA CORPORATION AND SUBSIDIARY Worksheet for Consolidated Financial Statements December 31, 20X5 Consolidation Entries Pizza Corp. Slice Products Co. DR CR Consolidated Income Statement Sales Less: COGS Less: Depreciation expense Less: Inventory losses Income from Slice Products Company Consolidated net income NCI in net income Controlling Interest in Net Income Statement of Retained Earnings S ols Controlling Interest in Net Income Statement of Retained Earnings Beginning balance Net income Less: Dividends declared Ending Balance Balance Sheet Cash and receivables Inventory Land Buildings and equipment Less: Accumulated depreciation Investment in Slice Products Company Total Assets Accounts payable Notes payable Common stock Retained earnings NCI in NA of Slice Products Company Total Liabilities and Equity 0 $ 0 $ 0 $ 0 $ 0 $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started