Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pizza Pizza is planning to open a new outlet in the math building, since we all know mathies love pizza. The details of the

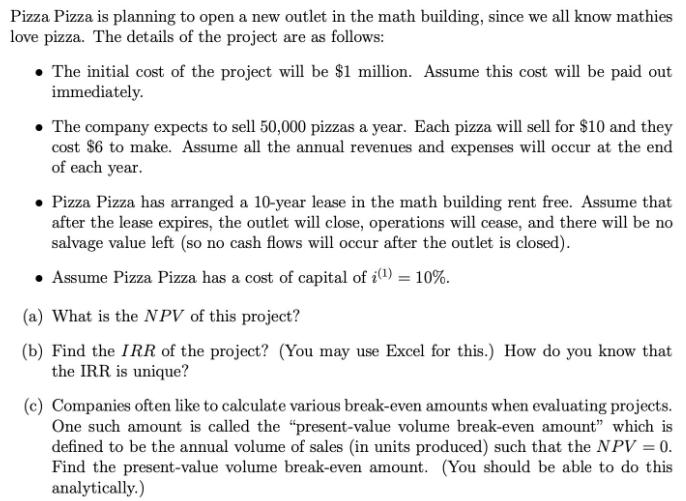

Pizza Pizza is planning to open a new outlet in the math building, since we all know mathies love pizza. The details of the project are as follows: The initial cost of the project will be $1 million. Assume this cost will be paid out immediately. The company expects to sell 50,000 pizzas a year. Each pizza will sell for $10 and they cost $6 to make. Assume all the annual revenues and expenses will occur at the end of each year. Pizza Pizza has arranged a 10-year lease in the math building rent free. Assume that after the lease expires, the outlet will close, operations will cease, and there will be no salvage value left (so no cash flows will occur after the outlet is closed). Assume Pizza Pizza has a cost of capital of () = 10%. (a) What is the NPV of this project? (b) Find the IRR of the project? (You may use Excel for this.) How do you know that the IRR is unique? (c) Companies often like to calculate various break-even amounts when evaluating projects. One such amount is called the "present-value volume break-even amount" which is defined to be the annual volume of sales (in units produced) such that the NPV = 0. Find the present-value volume break-even amount. (You should be able to do this analytically.)

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the NPV of the project we need to find the present value PV of the cash inflows and out...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started