Pl complete the 1040 with break down

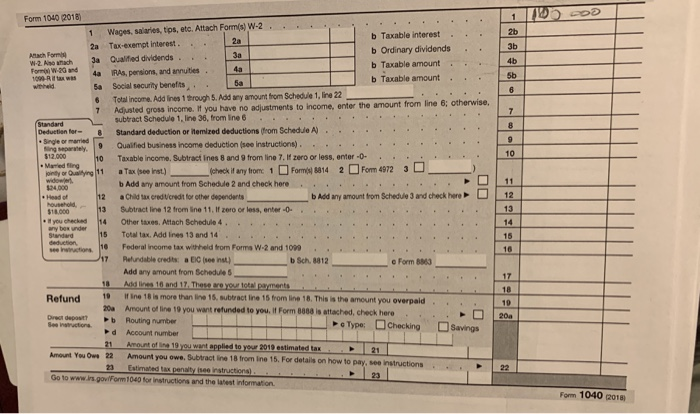

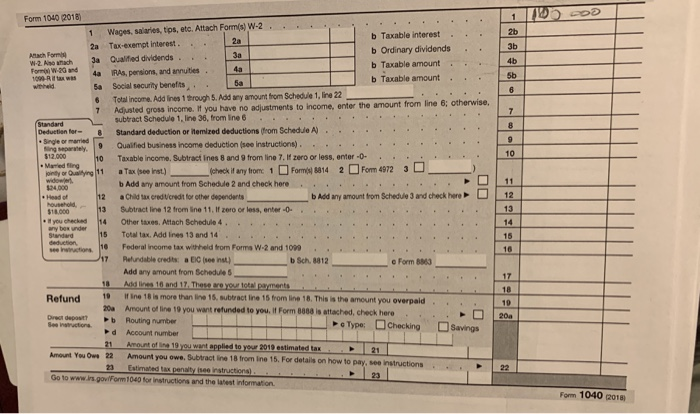

55. Demarco and Janine Jackson have been married for 20 years and have four children who qualify as their dependents (Damarcus, Janine, Michael, and Candice). The couple received salary income of $100,000, qualified business income of $10,000 from an investment in a partnership, and they sold their home this year. They initially purchased the home three years ago for $200,000 and they sold it for $250,000. The gain on the sale qualified for the exclusion from the sale of a principal residence. The Jacksons incurred $16,500 of itemized deductions, and they had $3,550 withheld from their paychecks for federal taxes. They are also allowed to claim a child tax credit for each of their children. However, because Candice is 18 years of age, the Jacksons may claim a child tax credit for other qualifying dependents for Candice. a. What is the Jacksons' taxable income, and what is their tax liability or (refund)? b. Complete the first two pages of the Jacksons' Form 1040 (use the most recent form available). c. What would their taxable income be if their itemized deductions totaled $28,000 instead of $16,500? d. What would their taxable income be if they had SO temized deductions and $6,000 offor AGI deductions? e. Assume the original facts but now suppose the Jacksons also incurred a loss of $5.000 on the sale of some of their investment assets. What effect does the $5,000 loss have on their taxable income? f. Assume the original facts but now suppose the Jacksons own investments that appreciated by $10.000 during the year. The Jacksons believe the investments will continue to appreciate, so they did not sell the investments during this year. What is the Jacksons' taxable income? Form 1040 2018) 1 Wages, salaries, tips, etc. Attach Form(s) W-2. 2a Tax-exempt interest b Taxable interest b Ordinary dividends b Taxable amount b Taxable amount. 2b 3b 4b 5b 2a Allach Forms W-2. Aso amach a Qualfied dividends 3a 4a As, prions, and arutes. 4a 5a Social security benefts. 1000 Rita was 6 Total income. Add ines 1 trough 5.Add any amount from Schedule 1, line 22 income. It you have no adjustments to income, enter the amount from line 6; otherwise, subtract Schedule 1, line 36, from ine 6 rct Scec ie, ustments to income, enter the amount from line 6: otherwise. Deduetion fer-8 Standard deduetion or itemized deductions (from SchedJe A) Single or married 9 Qualified business income deduction (see instructions). 10 Taxable income. Subtract Ines 8 and 9 from line 7. i' zero or less, enter-O. 10 $12.000 Married ling i . (ehack It any from 1Fome 8814 2 Fom 4972 3 b Add any amount from Schedule 2 and check here Child tax cred U/credit for other dependertsb 2 13 14 15 2 b Aod any amount from Schedule 3 and check here0 * Head of 18.00013 Subtract line 12 from line 11, If zero or less, enter -0 Other taxes. Attach Schedule 4 "yocheck 14 Svd1 Total tax. Add ines 13 and 14 see nsinuctionFederal income tax wthheld from Forms W-2 and 10n. 17 ReArdable credit, aec(see nst b Sen 8812 e Form 8863 Add any amount from Schedule 5 17 Add lines 16 and 17 These are your total payments Refund 10 Ine 18 s more than line 16, subtract line 15 from line 18. This is the amount you overpaid ee naructoraAccount number Amount You ows 22 Amount you owe. Subtract line 18 from ine 15. For details on how to pay, see instructions Go to www.irs govlForm 1040 for Instructions and the latest information 20a Amount of line 19 you want refunded to you. It Form 8888 is attached, check here oType: Checking Savings 21 Ann o, 1., 19 ou want applied to mr 2019 estimated tax 21 23 Estimated tas penaity ises instructions) 23 Form 1040 2o1s) 55. Demarco and Janine Jackson have been married for 20 years and have four children who qualify as their dependents (Damarcus, Janine, Michael, and Candice). The couple received salary income of $100,000, qualified business income of $10,000 from an investment in a partnership, and they sold their home this year. They initially purchased the home three years ago for $200,000 and they sold it for $250,000. The gain on the sale qualified for the exclusion from the sale of a principal residence. The Jacksons incurred $16,500 of itemized deductions, and they had $3,550 withheld from their paychecks for federal taxes. They are also allowed to claim a child tax credit for each of their children. However, because Candice is 18 years of age, the Jacksons may claim a child tax credit for other qualifying dependents for Candice. a. What is the Jacksons' taxable income, and what is their tax liability or (refund)? b. Complete the first two pages of the Jacksons' Form 1040 (use the most recent form available). c. What would their taxable income be if their itemized deductions totaled $28,000 instead of $16,500? d. What would their taxable income be if they had SO temized deductions and $6,000 offor AGI deductions? e. Assume the original facts but now suppose the Jacksons also incurred a loss of $5.000 on the sale of some of their investment assets. What effect does the $5,000 loss have on their taxable income? f. Assume the original facts but now suppose the Jacksons own investments that appreciated by $10.000 during the year. The Jacksons believe the investments will continue to appreciate, so they did not sell the investments during this year. What is the Jacksons' taxable income? Form 1040 2018) 1 Wages, salaries, tips, etc. Attach Form(s) W-2. 2a Tax-exempt interest b Taxable interest b Ordinary dividends b Taxable amount b Taxable amount. 2b 3b 4b 5b 2a Allach Forms W-2. Aso amach a Qualfied dividends 3a 4a As, prions, and arutes. 4a 5a Social security benefts. 1000 Rita was 6 Total income. Add ines 1 trough 5.Add any amount from Schedule 1, line 22 income. It you have no adjustments to income, enter the amount from line 6; otherwise, subtract Schedule 1, line 36, from ine 6 rct Scec ie, ustments to income, enter the amount from line 6: otherwise. Deduetion fer-8 Standard deduetion or itemized deductions (from SchedJe A) Single or married 9 Qualified business income deduction (see instructions). 10 Taxable income. Subtract Ines 8 and 9 from line 7. i' zero or less, enter-O. 10 $12.000 Married ling i . (ehack It any from 1Fome 8814 2 Fom 4972 3 b Add any amount from Schedule 2 and check here Child tax cred U/credit for other dependertsb 2 13 14 15 2 b Aod any amount from Schedule 3 and check here0 * Head of 18.00013 Subtract line 12 from line 11, If zero or less, enter -0 Other taxes. Attach Schedule 4 "yocheck 14 Svd1 Total tax. Add ines 13 and 14 see nsinuctionFederal income tax wthheld from Forms W-2 and 10n. 17 ReArdable credit, aec(see nst b Sen 8812 e Form 8863 Add any amount from Schedule 5 17 Add lines 16 and 17 These are your total payments Refund 10 Ine 18 s more than line 16, subtract line 15 from line 18. This is the amount you overpaid ee naructoraAccount number Amount You ows 22 Amount you owe. Subtract line 18 from ine 15. For details on how to pay, see instructions Go to www.irs govlForm 1040 for Instructions and the latest information 20a Amount of line 19 you want refunded to you. It Form 8888 is attached, check here oType: Checking Savings 21 Ann o, 1., 19 ou want applied to mr 2019 estimated tax 21 23 Estimated tas penaity ises instructions) 23 Form 1040 2o1s)