Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pl Please answer all parts Ex 9-31 i 2 McNulty, Inc., produces desks and chairs. A new CFO has just been hired and announces a

Pl

Pl

Please answer all parts

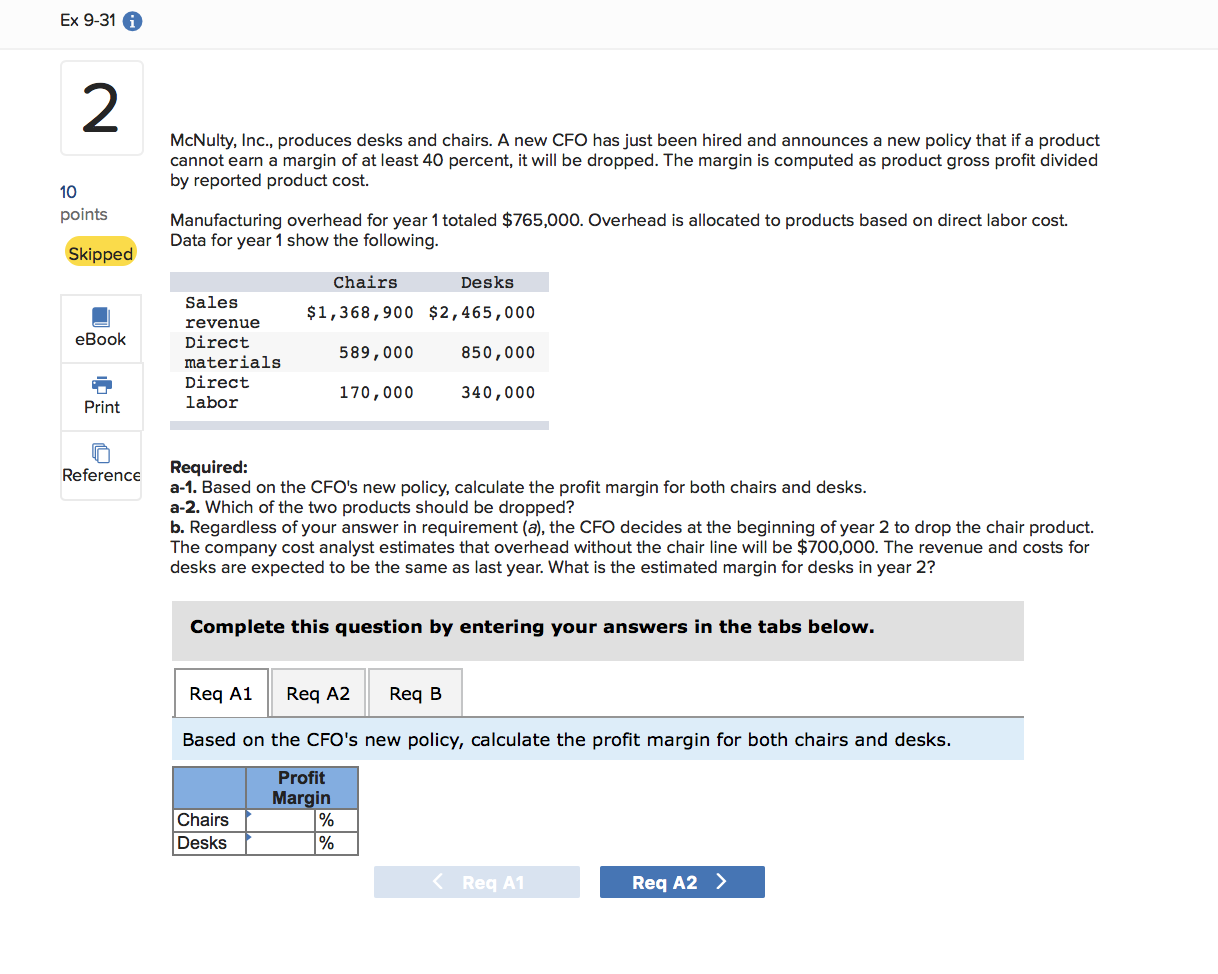

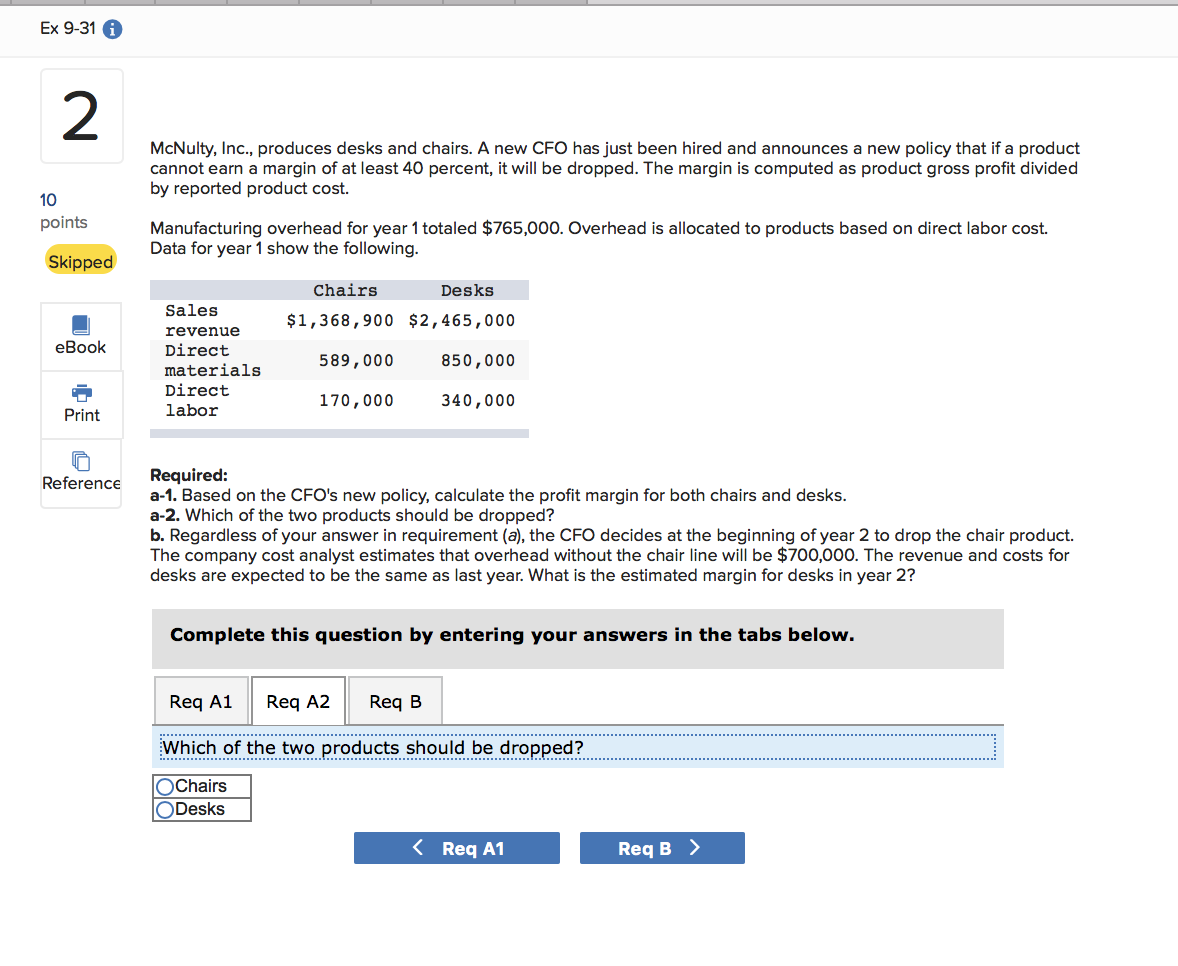

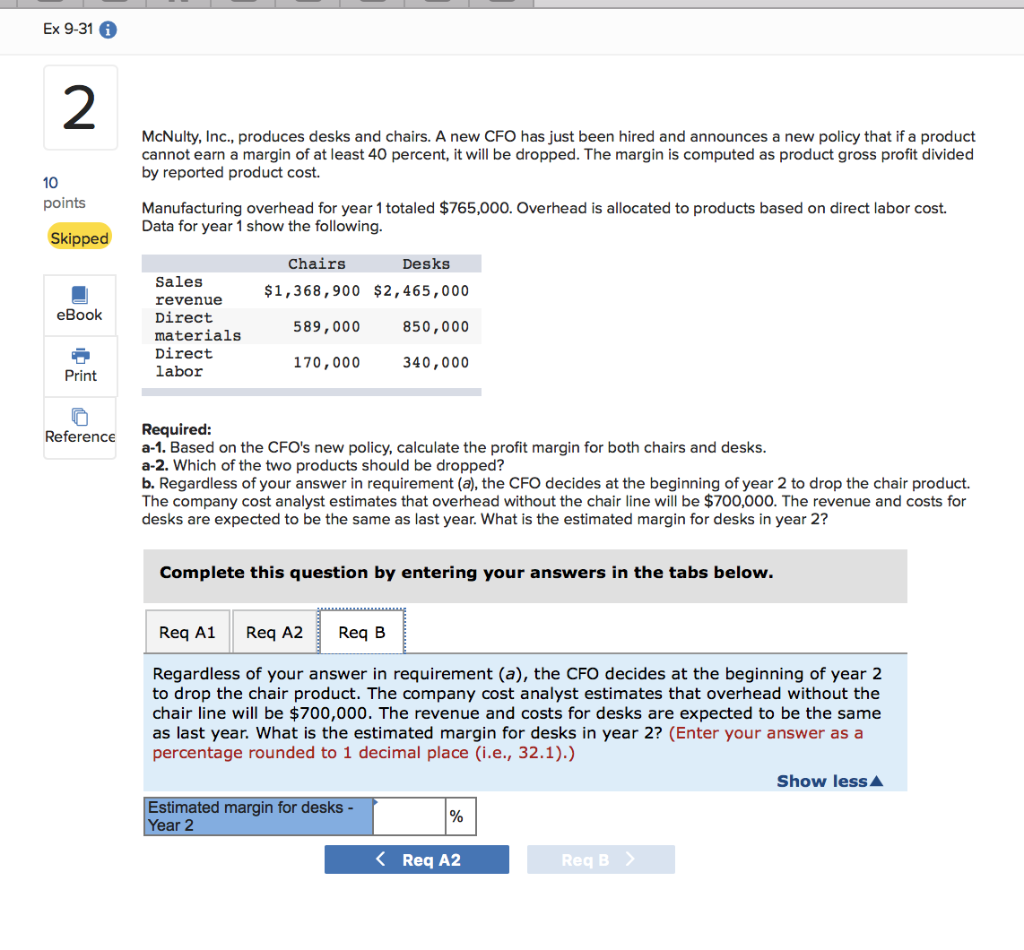

Ex 9-31 i 2 McNulty, Inc., produces desks and chairs. A new CFO has just been hired and announces a new policy that if a product cannot earn a margin of at least 40 percent, it will be dropped. The margin is computed as product gross profit divided by reported product cost. 10 points Manufacturing overhead for year 1 totaled $765,000. Overhead is allocated to products based on direct labor cost. Data for year 1 show the following. Skipped Chairs Desks $1,368,900 $2,465,000 eBook Sales revenue Direct materials Direct labor 589,000 850,000 170,000 340,000 Print Reference Reference Required: a-1. Based on the CFO's new policy, calculate the profit margin for both chairs and desks. a-2. Which of the two products should be dropped? b. Regardless of your answer in requirement (a), the CFO decides at the beginning of year 2 to drop the chair product. The company cost analyst estimates that overhead without the chair line will be $700,000. The revenue and costs for desks are expected to be the same as last year. What is the estimated margin for desks in year 2? Complete this question by entering your answers in the tabs below. Req A1 Req A2 Req B Based on the CFO's new policy, calculate the profit margin for both chairs and desks. Profit Margin % % Chairs Desks Ex 9-31 2 McNulty, Inc., produces desks and chairs. A new CFO has just been hired and announces a new policy that if a product cannot earn a margin of at least 40 percent, it will be dropped. The margin is computed as product gross profit divided by reported product cost. 10 points Manufacturing overhead for year 1 totaled $765,000. Overhead is allocated to products based on direct labor cost. Data for year 1 show the following. Skipped Chairs Desks $1,368,900 $2,465,000 eBook Sales revenue Direct materials Direct labor 589,000 850,000 170,000 340,000 Print Reference Required: a-1. Based on the CFO's new policy, calculate the profit margin for both chairs and desks. a-2. Which of the two products should be dropped? b. Regardless of your answer in requirement (a), the CFO decides at the beginning of year 2 to drop the chair product. The company cost analyst estimates that overhead without the chair line will be $700,000. The revenue and costs for desks are expected to be the same as last year. What is the estimated margin for desks in year 2? Complete this question by entering your answers in the tabs below. Reg A1 Req A2 Req B Which of the two products should be dropped? O Chairs Desks Ex 9-31 A 2 McNulty, Inc., produces desks and chairs. A new CFO has just been hired and announces a new policy that if a product cannot earn a margin of at least 40 percent, it will be dropped. The margin is computed as product gross profit divided by reported product cost. 10 points Manufacturing overhead for year 1 totaled $765,000. Overhead is allocated to products based on direct labor cost. Data for year 1 show the following. Skipped Chairs Desks $1,368,900 $2,465,000 eBook Sales revenue Direct materials Direct labor 589,000 850,000 170,000 340,000 Print Reference Required: a-1. Based on the CFO's new policy, calculate the profit margin for both chairs and desks. a-2. Which of the two products should be dropped? b. Regardless of your answer in requirement (a), the CFO decides at the beginning of year 2 to drop the chair product. The company cost analyst estimates that overhead without the chair line will be $700,000. The revenue and costs for desks are expected to be the same as last year. What is the estimated margin for desks in year 2? Complete this question by entering your answers in the tabs below. Req A1 Req A2 Red B Regardless of your answer in requirement (a), the CFO decides at the beginning of year 2 to drop the chair product. The company cost analyst estimates that overhead without the chair line will be $700,000. The revenue and costs for desks are expected to be the same as last year. What is the estimated margin for desks in year 2? (Enter your answer as a percentage rounded to 1 decimal place (i.e., 32.1).) Show less Estimated margin for desks - % Year 2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started