Answered step by step

Verified Expert Solution

Question

1 Approved Answer

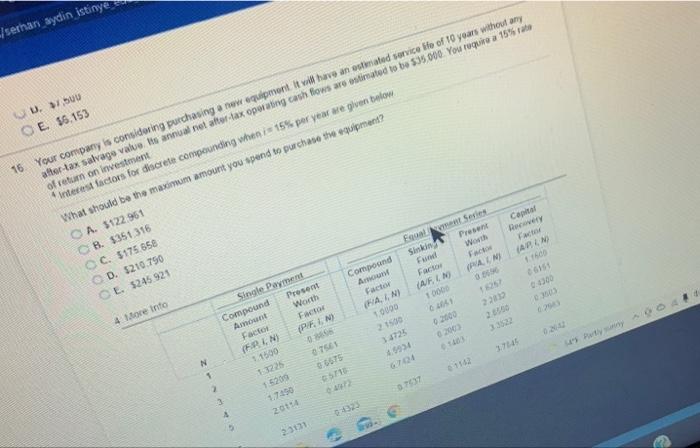

pla answer serhan_aydin istine U/50 E. $6.153 16 Your company is considering purchasing a new equipment. It will have an estrated service to of 10

pla answer

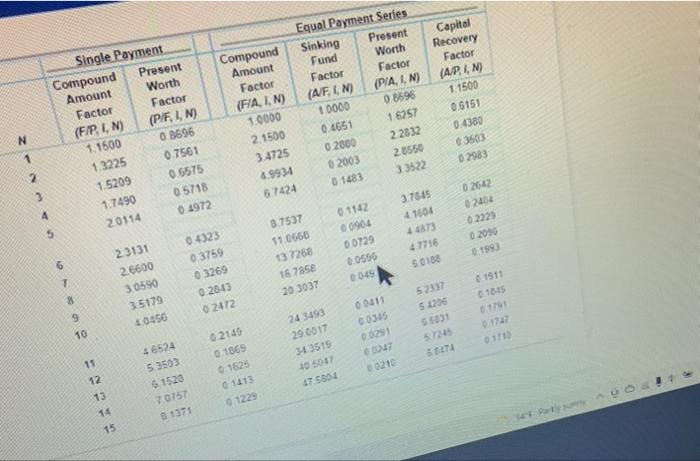

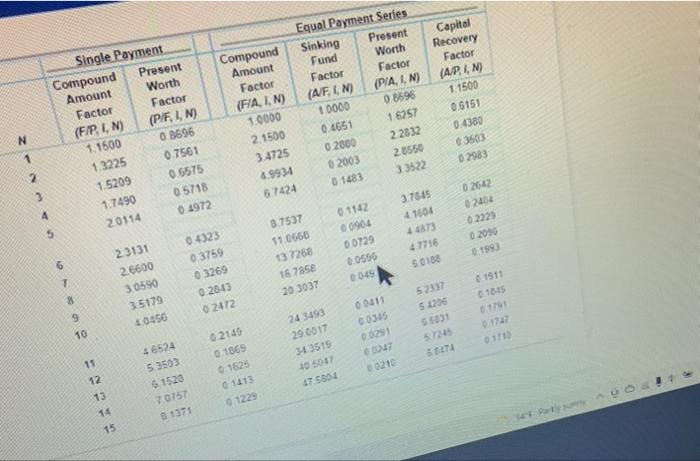

serhan_aydin istine U/50 E. $6.153 16 Your company is considering purchasing a new equipment. It will have an estrated service to of 10 years without any after-tax salvage value. Its annual niet after tax operating cash flows are estimated to be $35.000 You require a 15% rate of return on investment interest factors for discrete compounding when = 15% per year we given below What should be the maximum amount you spend to purchase the equipment? A. $122.961 OB. $351 316 C. $175.658 D. $210.750 E. $245 921 Present Wouth Facto PAN Capital Recovery Fact APAM 0.00 Equal Sin Find Facto (AFM 1000 0264 0.2000 0.2003 4 ore into Compound Around Factor (FAN 10000 1500 34723 4.5934 3.75 Single Payment Compound Present Amount Worth Factor Facto AP.IN PEL 1.1500 1322 0.7561 1.5209 0.6575 1.7450 2011 N 1142 1 2 0.7637 232 2.3171 Single Payment Compound Present Amount Worth Factor Factor (F/P.I, N) (P/F, 1, N) 1.1500 08696 13225 0.7561 15209 0.6575 1.7490 05718 20114 04972 Compound Amount Factor (F/A, I, N) 1.0000 2 1500 3.4725 6.9934 6.7424 Equal Payment Series Sinking Present Fund Worth Factor Factor (AJF, I, N) (PIA, IN) 1 0000 0.8596 0.4651 16257 0 2800 2 2832 0 2003 28550 1483 33522 Capital Recovery Factor (APN) 1.1500 0.6151 04380 0 3603 02983 N 3.7845 4.1604 46373 47716 50130 01142 0 0904 0 0729 0 0596 0049 8.7537 11 0660 137268 167858 203037 02642 02404 02225 0.2090 0.1590 0.4323 0.3759 3269 0 28443 0 2472 2.3131 2.6600 30590 35179 40456 1911 18.45 8 10 52337 52205 55001 57245 ya 00011 0345 0.0251 0227 00210 1742 01710 24 3493 29 0017 34 3519 10 5047 47.5854 02145 01069 0.1625 0 1413 01229 46524 5.3503 6. 1520 7.0757 8.1371 11 12 13 14 4F Party! 15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started