Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pla help For all the following cases, assume that taxable income does not include any dividend income or capital gain. Required: a. Compute AMT (if

pla help

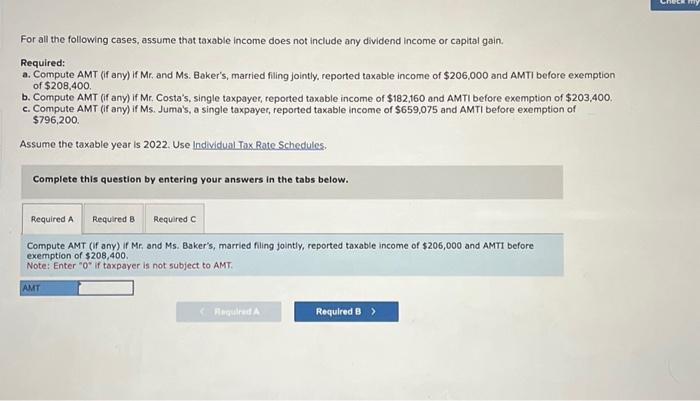

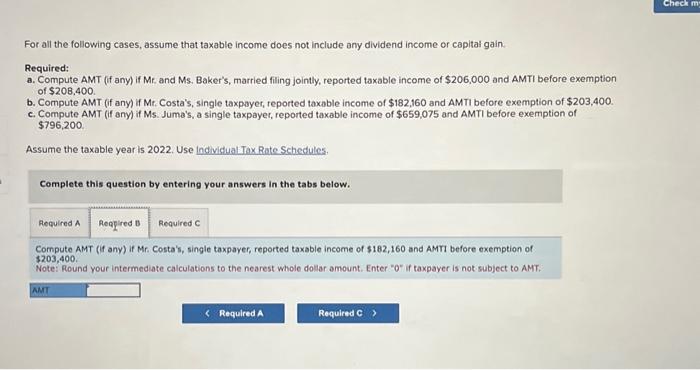

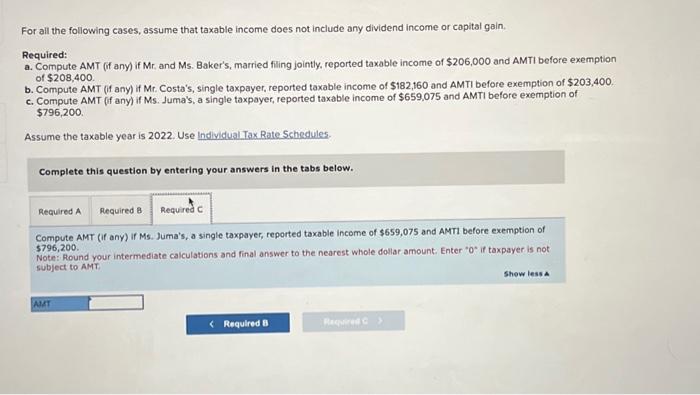

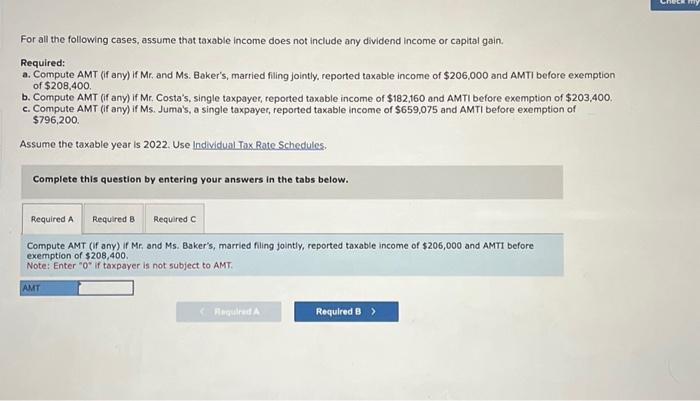

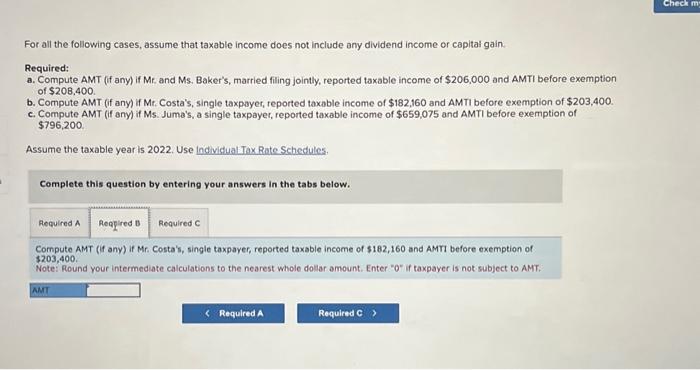

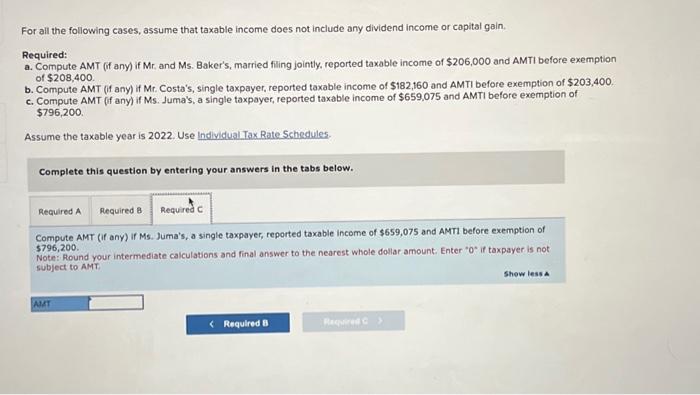

For all the following cases, assume that taxable income does not include any dividend income or capital gain. Required: a. Compute AMT (if any) if Mr, and Ms. Baker's, married filing jointly, reported taxable income of $206,000 and AMTI before exemption of $208,400. b. Compute AMT (if any) if Mr. Costa's, single taxpayer, reported taxable income of $182,160 and AMTI before exemption of $203,400. c. Compute AMT (if any) if Ms. Juma's, a single taxpayer, reported taxable income of \$659,075 and AMTI before exemption of $796,200. Assume the taxable year is 2022. Use Individual Tax Rate Schedules. Complete this question by entering your answers in the tabs below. Compute AMT (if any) if Mr, and Ms. Baker's, married fing jointly, reported taxable income of $206,000 and AMTI before exemption of $208,400. Note: Enter " 0 " If toxpayer is not subject to AMT. For all the following cases, assume that taxable income does not include any dividend income or capital gain. Required: a. Compute AMT (if any) if Mt and Ms. Baker's, married filing jointly, reported taxable income of $206,000 and AMTI before exemption of $208,400. b. Compute AMT (if any) if Mr. Costa's, single taxpayer, teported taxable income of $182,160 and AMT is before exemption of $203,400. c. Compute AMT (f any) if Ms. Juma's, a single taxpayer, reported taxable income of $659,075 and AMTI before exemption of $796,200. Assume the taxable year is 2022. Use Individual Tax Rate Schedules. Complete this question by entering your answers in the tabs below. Compute AMT (If any) if Mr. Costa's, single taxpayer, reported taxable income of $182,160 and AMTI before exemption of 3203,400 . Note: Round your intermediate calculations to the nearest whole dollar amount. Enter " 0 " if taxpayer is not subject to AMT. For all the following cases, assume that taxable income does not include any dividend income or capital gain. Required: a. Compute AMT (f any) if Mr. and Ms. Baker's, married filing jointly, reported taxable income of $206,000 and AMTI before exemption of $208,400 b. Compute AMT (if any) if Mr. Costa's, single taxpayer, reported taxable income of $182,160 and AMTI before exemption of $203,400 c. Compute AMT (f any) if Ms. Juma's, a single taxpayer, reported taxable income of $659.075 and AMTI before exemption of $796,200. Assume the taxable year is 2022. Use Individual Tax Rate Schedules. Complete this question by entering your answers in the tabs below. Compute AMT (f any) if Ms. Juma's, a single taxpayer, reported taxable income of $659,075 and AMT1 before exemption of $796,200. \$796,200. Noter your intermediate calculations and final answer to the nearest whole dollar amount. Enter " 0 * if taxpayer is not subject to AMT

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started