Places answer all question. Thanks

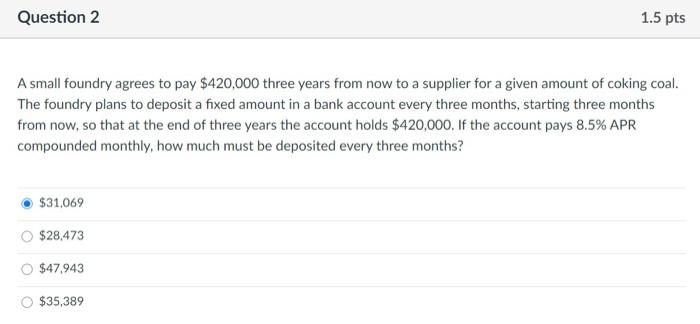

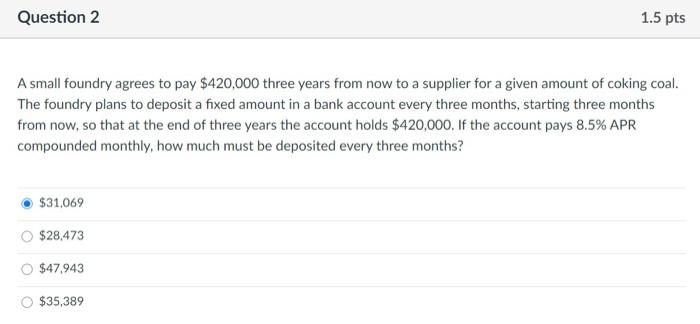

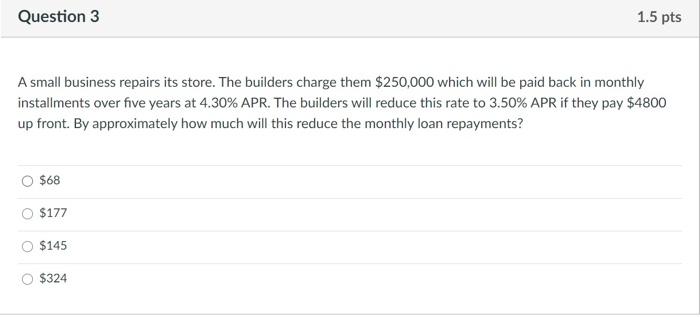

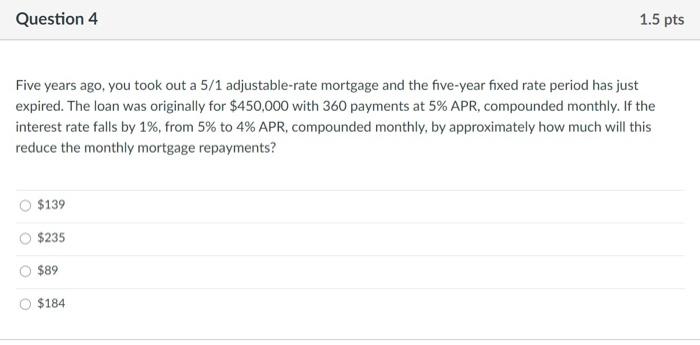

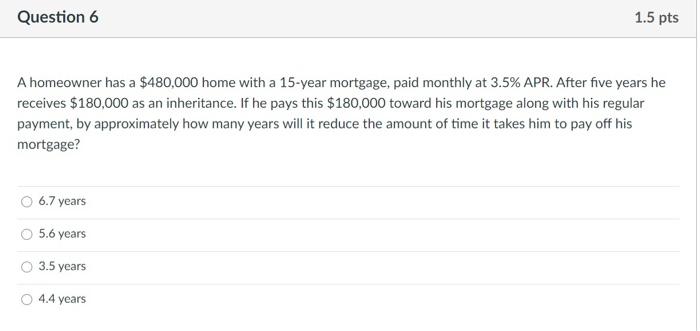

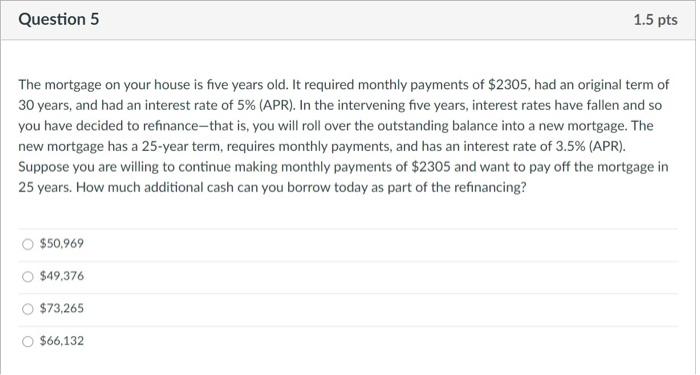

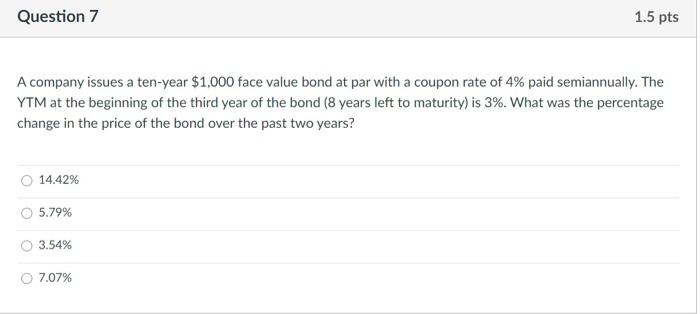

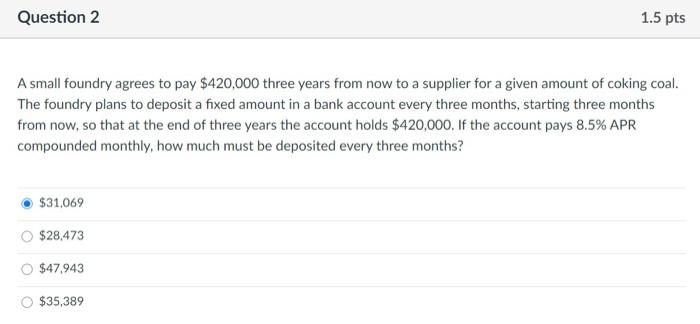

Question 2 1.5 pts A small foundry agrees to pay $420,000 three years from now to a supplier for a given amount of coking coal. The foundry plans to deposit a fixed amount in a bank account every three months, starting three months from now, so that at the end of three years the account holds $420,000. If the account pays 8.5% APR compounded monthly, how much must be deposited every three months? $31,069 $28,473 $47,943 $35,389 Question 3 1.5 pts A small business repairs its store. The builders charge them $250,000 which will be paid back in monthly installments over five years at 4.30% APR. The builders will reduce this rate to 3.50% APR if they pay $4800 up front. By approximately how much will this reduce the monthly loan repayments? $68 $177 $145 $324 Question 4 1.5 pts Five years ago, you took out a 5/1 adjustable-rate mortgage and the five-year fixed rate period has just expired. The loan was originally for $450,000 with 360 payments at 5% APR, compounded monthly. If the interest rate falls by 1%, from 5% to 4% APR, compounded monthly, by approximately how much will this reduce the monthly mortgage repayments? $139 $235 $89 $184 Question 6 1.5 pts A homeowner has a $480,000 home with a 15-year mortgage, paid monthly at 3.5% APR. After five years he receives $180,000 as an inheritance. If he pays this $180,000 toward his mortgage along with his regular payment, by approximately how many years will it reduce the amount of time it takes him to pay off his mortgage? 6.7 years 5.6 years 3.5 years 4.4 years Question 5 1.5 pts The mortgage on your house is five years old. It required monthly payments of $2305, had an original term of 30 years, and had an interest rate of 5% (APR). In the intervening five years, interest rates have fallen and so you have decided to refinance-that is, you will roll over the outstanding balance into a new mortgage. The new mortgage has a 25-year term, requires monthly payments, and has an interest rate of 3.5% (APR). Suppose you are willing to continue making monthly payments of $2305 and want to pay off the mortgage in 25 years. How much additional cash can you borrow today as part of the refinancing? $50,969 $49,376 $73,265 O $66,132 Question 7 1.5 pts A company issues a ten-year $1,000 face value bond at par with a coupon rate of 4% paid semiannually. The YTM at the beginning of the third year of the bond (8 years left to maturity) is 3%. What was the percentage change in the price of the bond over the past two years? 14.42% 5.79% 3.54% 7.07%