Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Planet Corporation acquired 90 percent of Saturn Company's voting shares of stock in 20X1. During 20X4, Planet purchased 40,000 Playday doghouses for $24 each and

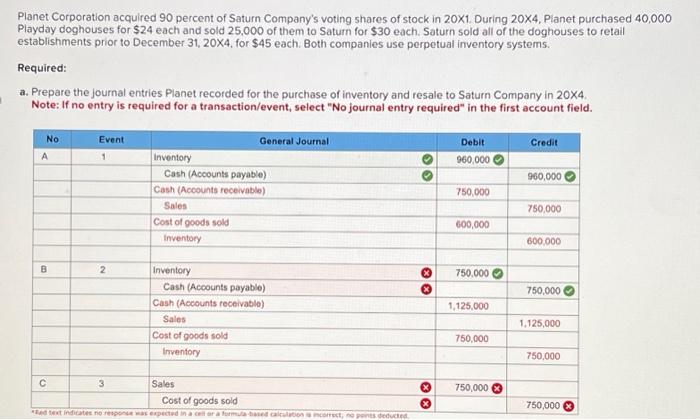

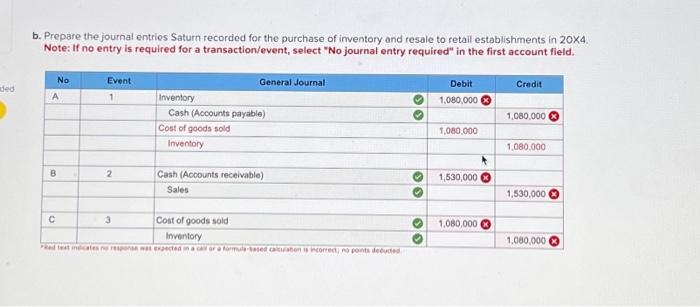

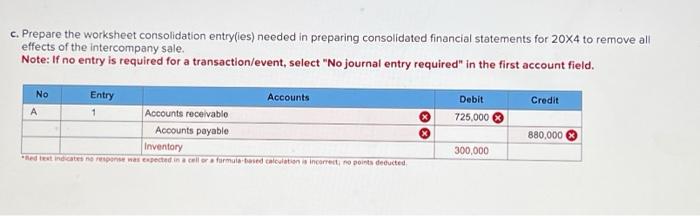

Planet Corporation acquired 90 percent of Saturn Company's voting shares of stock in 20X1. During 20X4, Planet purchased 40,000 Playday doghouses for $24 each and sold 25,000 of them to Saturn for $30 each. Saturn sold all of the doghouses to retail establishments prior to December 31, 20X4, for $45 each. Both companies use perpetual inventory systems. Required: a. Prepare the journal entries Planet recorded for the purchase of inventory and resale to Saturn Company in 20X4. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. No A B C Event 1 2 3 Inventory Cash (Accounts payable) Cash (Accounts receivable) Sales Cost of goods sold Inventory Inventory General Journal Cash (Accounts payable) Cash (Accounts receivable) Sales Cost of goods sold Inventory Sales Cost of goods sold *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. XX Debit 960,000 750,000 600,000 750,000 1,125,000 750,000 750,000 Credit 960,000 750,000 600,000 750,000 1,125,000 750,000 750,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started