Answered step by step

Verified Expert Solution

Question

1 Approved Answer

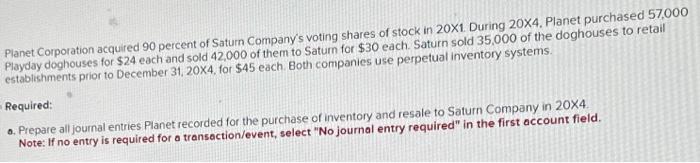

Planet Corporation acquired 90 percent of Saturn Company's voting shares of stock in 20X1. During 20X4, Planet purchased 57,000 Playday doghouses for $24 each and

Planet Corporation acquired 90 percent of Saturn Company's voting shares of stock in 20X1. During 20X4, Planet purchased 57,000 Playday doghouses for $24 each and sold 42,000 of them to Saturn for $30 each. Saturn sold 35,000 of the doghouses to retail establishments prior to December 31, 20X4, for $45 each. Both companies use perpetual inventory systems. Required: a. Prepare all journal entries Planet recorded for the purchase of inventory and resale to Saturn Company in 20X4. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started