Question

Planner Corporation owns 60 percent of Schedule Companys voting shares. During 20X3, Planner produced 33,000 computer desks at a cost of $88 each and sold

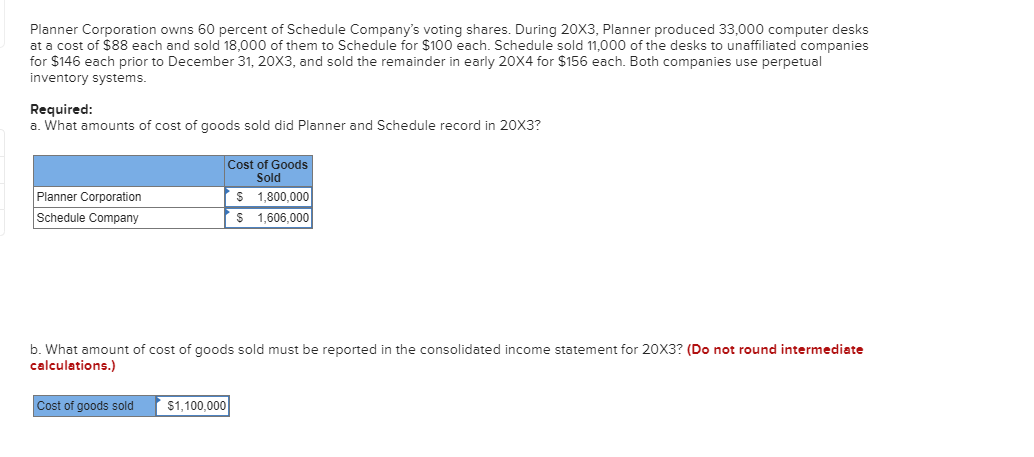

Planner Corporation owns 60 percent of Schedule Companys voting shares. During 20X3, Planner produced 33,000 computer desks at a cost of $88 each and sold 18,000 of them to Schedule for $100 each. Schedule sold 11,000 of the desks to unaffiliated companies for $146 each prior to December 31, 20X3, and sold the remainder in early 20X4 for $156 each. Both companies use perpetual inventory systems. Required: a. What amounts of cost of goods sold did Planner and Schedule record in 20X3? b. What amount of cost of goods sold must be reported in the consolidated income statement for 20X3? (Do not round intermediate calculations.) c. Prepare the worksheet consolidation entry or entries needed in preparing consolidated financial statements at December 31, 20X3, relating to the intercorporate sale of inventory. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.) d. Prepare the worksheet consolidation entry or entries needed in preparing consolidated financial statements at December 31, 20X4, relating to the intercorporate sale of inventory. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.) e. Prepare the worksheet consolidation entry or entries needed in preparing consolidated financial statements at December 31, 20X4, relating to the intercorporate sale of inventory if the sales were upstream. Assume that Schedule produced the computer desks at a cost of $88 each and sold 18,000 desks to Planner for $100 each in 20X3, with Planner selling 11,000 desks to unaffiliated companies in 20X3 and the remaining 7,000 in 20X4. Planner Corporation owns 60 percent of Schedule Companys voting shares. During 20X3, Planner produced 33,000 computer desks at a cost of $88 each and sold 18,000 of them to Schedule for $100 each. Schedule sold 11,000 of the desks to unaffiliated companies for $146 each prior to December 31, 20X3, and sold the remainder in early 20X4 for $156 each. Both companies use perpetual inventory systems. Required: a. What amounts of cost of goods sold did Planner and Schedule record in 20X3?

b. What amount of cost of goods sold must be reported in the consolidated income statement for 20X3? (Do not round intermediate calculations.)

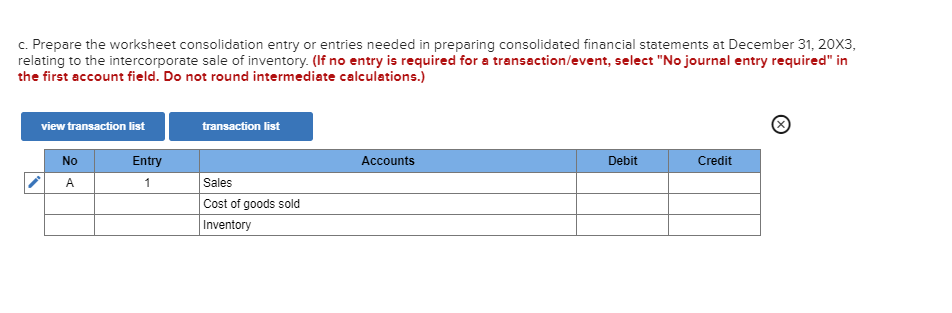

c. Prepare the worksheet consolidation entry or entries needed in preparing consolidated financial statements at December 31, 20X3, relating to the intercorporate sale of inventory. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.)

d. Prepare the worksheet consolidation entry or entries needed in preparing consolidated financial statements at December 31, 20X4, relating to the intercorporate sale of inventory. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations.)

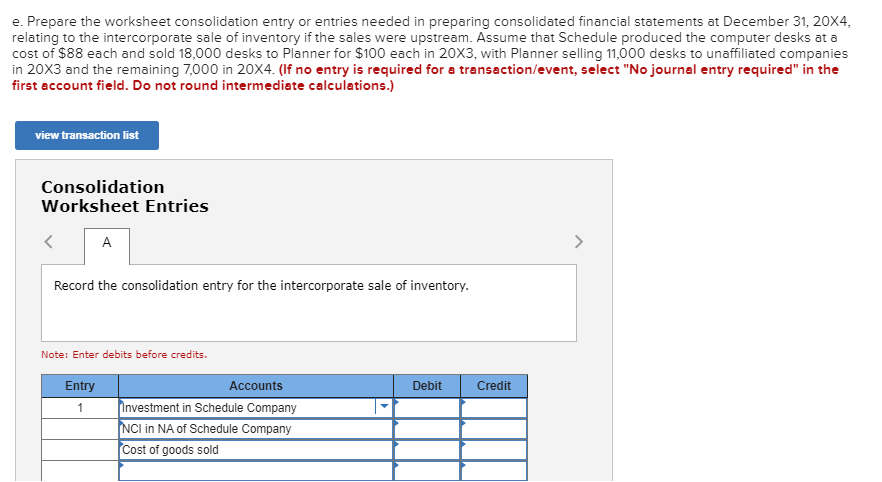

e. Prepare the worksheet consolidation entry or entries needed in preparing consolidated financial statements at December 31, 20X4, relating to the intercorporate sale of inventory if the sales were upstream. Assume that Schedule produced the computer desks at a cost of $88 each and sold 18,000 desks to Planner for $100 each in 20X3, with Planner selling 11,000 desks to unaffiliated companies in 20X3 and the remaining 7,000 in 20X4.

Answer Parts A-E the answers i have filled in are most likely incorrect but this is due tonight so i left them in case no one responds in time

Answer Parts A-E the answers i have filled in are most likely incorrect but this is due tonight so i left them in case no one responds in time

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started