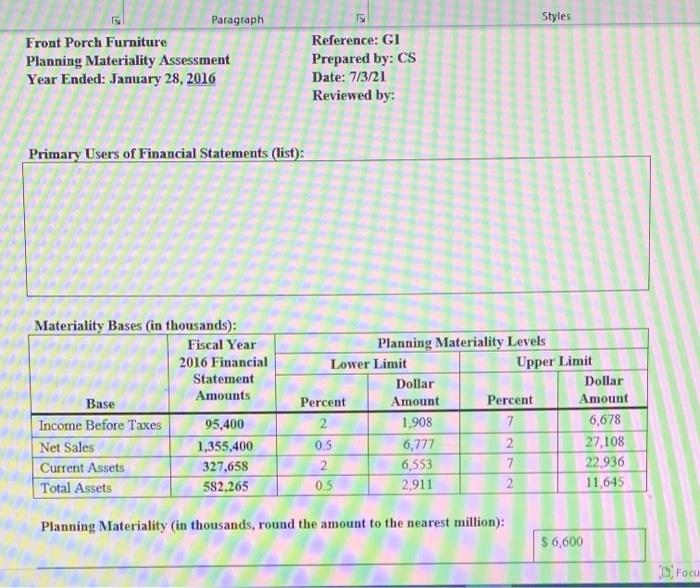

Planning Materiality & Tolerable Misstatement Hands-on Case BACKGROUND Your firm Smith and Jones, is in the initial planning phase for the fiscal 2016 audit of Front Porch Furniture (1.e., the audit for the year that will end on January 28, 2016). As the audit manager, you have been assigned responsibility for determining planning materiality and tolerable misstatement for key financial statement accounts. Your firm's materiality and tolerable misstatement guidelines have been provided to assist you with this assignment (see Exhibit 1). Donna Bennett, the audit partner, has performed a preliminary analysis of the company and its performance and believes the likelihood of management fraud is low. Donna's initial analysis of the company's performance is documented in the memo referenced as 04 (top right hand corner of the document). Additionally, Donna has documented current events/issues noted while performing the preliminary analysis in a separate memo G-5. You have recorded the audited fiscal 2015 and projected fiscal 2016 financial statement numbers on audit schedule G-3. D w 994 41% comer of the document). Additionally, Donna has documented current events/issues noted while performing the preliminary analysis in a separate memo, G-5. You have recorded the audited fiscal 2015 and projected fiscal 2016 financial statement numbers on audit schedule G-3. Assume no material misstatements were discovered during the fiscal 2015 audit. REQUIRED Based on your review of Exhibit 1 and the audit memos (G-4 and G-5), determine: 1) Planning materiality for the engagement (G-I) I 2) Tolerable misstatement for each class of account balance (G-2) 3) Which accounts are material for testing purposes either based on the tolerable misstatement level or other quantitative factors (G-3) Styles Paragraph Front Porch Furniture Planning Materiality Assessment Year Ended: January 28, 2016 Reference: GI Prepared by: CS Date: 7/3/21 Reviewed by: Primary Users of Financial Statements (list): Materiality Bases (in thousands): Fiscal Year 2016 Financial Statement Amounts Base Income Before Taxes 95,400 Net Sales 1,355,400 Current Assets 327,658 Total Assets 582,265 Planning Materiality Levels Lower Limit Upper Limit Dollar Dollar Percent Amount Percent Amount 2 1.908 7 6,678 0.5 6,777 2 27.108 2 6,553 7 22,936 0.5 2,911 2 11,645 Planning Materiality (in thousands, round the amount to the nearest million): $6,600 Focu