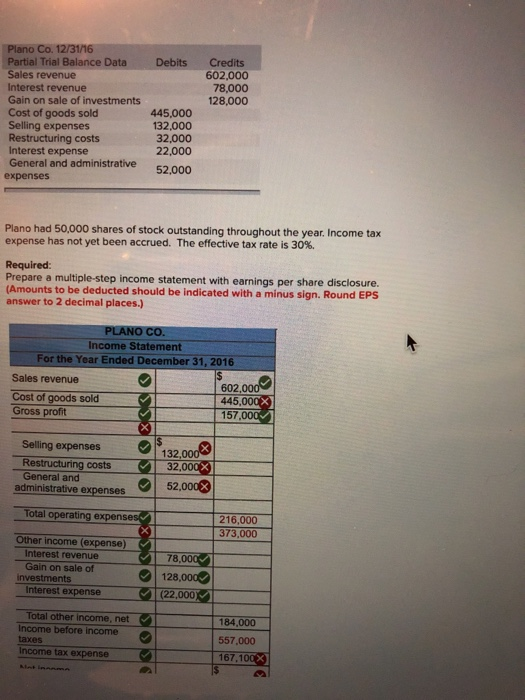

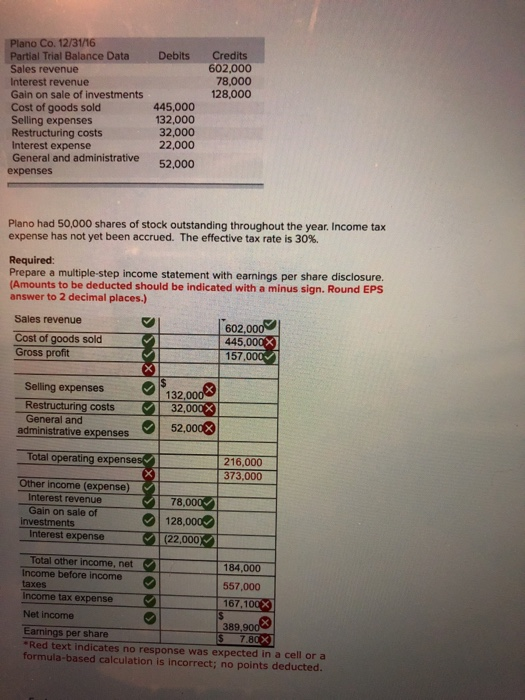

Plano Co. 12/31/16 Partial Trial Balance Data Sales revenue Interest revenue Gain on sale of investments Cost of goods sold Selling expenses Restructuring costs Interest expense General and administrative Credits 602,000 78,000 128,000 Debits 445.000 132,000 32,000 22,000 52,000 expenses Plano had 50,000 shares of stock outstanding throughout the year. Income tax expense has not yet been accrued. The effective tax rate is 30% Required: Prepare a multiple-step income statement with earnings per share disclosure. (Amounts to be deducted should be indicated with a minus sign. Round EPS answer to 2 decimal places.) PLANO CO. Income Statement For the Year Ended December 31, 2016 Sales revenue 602.000 445,000X 157,000 Cost of goods sold Gross profit Selling expenses 132,000 32,000X Restructuring costs General and administrative expenses 52,000x Total operating expenses 216,000 373,000 Other income (expense) Interest revenue Gain on sale of investments Interest expense 78,000 128,000 (22,000) Total other income, net 184,000 Income before income taxes Income tax expense 557,000 167.100x) Met inenme Plano Co. 12/31/16 Partial Trial Balance Data Sales revenue Interest revenue Gain on sale of investments Credits 602,000 78,000 128,000 Debits 445,000 132,000 32,000 22,000 Cost of goods sold Selling expenses Restructuring costs Interest expense General and administrative 52,000 expenses Plano had 50,000 shares of stock outstanding throughout the year. Income tax expense has not yet been accrued. The effective tax rate is 30 %. Required: Prepare a multiple-step income statement with earnings per share disclosure. (Amounts to be deducted should be indicated with a minus sign. Round EPS answer to 2 decimal places.) Sales revenue 602,000 445,000X) 157,000 Cost of goods sold Gross profit X IS 132,000 32,000X) Selling expenses Restructuring costs General and administrative expenses 52,000 Total operating expenses 216,000 373,000 Other income (expense) Interest revenue Gain on sale of investments Interest expense 78,000 128,000 (22,000) Total other income, net Income before income 184,000 557,000 taxes Income taX expense 167,100X) S 389,900 7.80X Net income Earnings per share Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted