Answered step by step

Verified Expert Solution

Question

1 Approved Answer

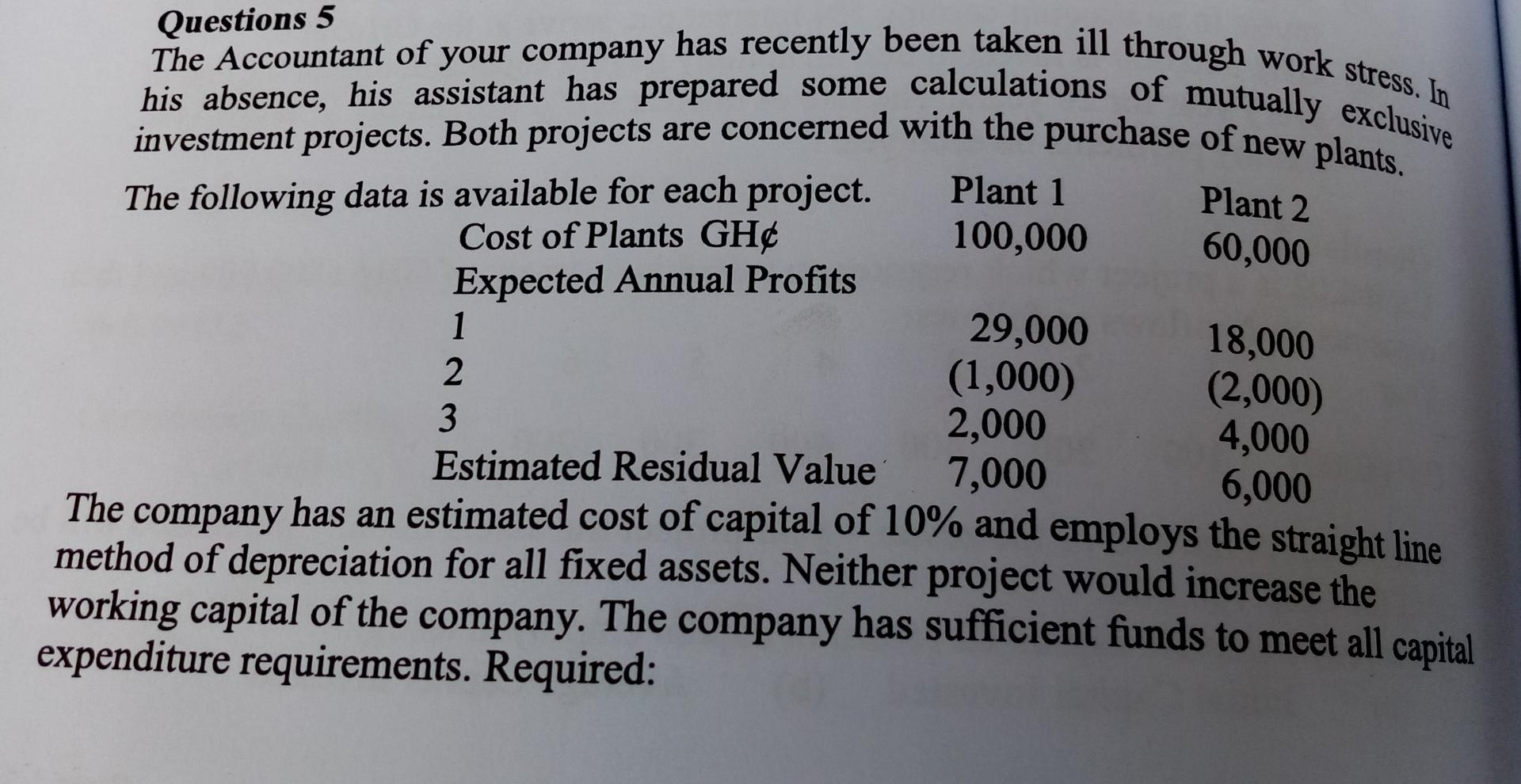

Plant 2 60,000 Questions 5 The Accountant of your company has recently been taken ill through work stress. In investment projects. Both projects are concerned

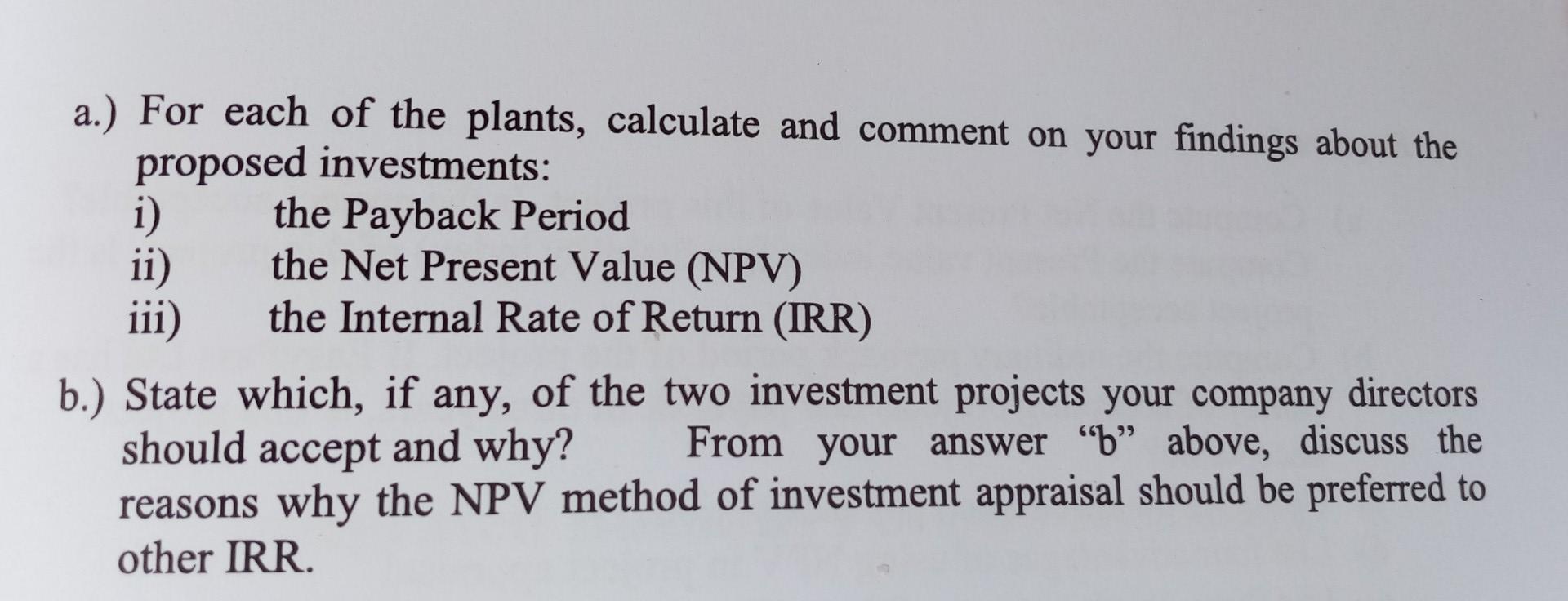

Plant 2 60,000 Questions 5 The Accountant of your company has recently been taken ill through work stress. In investment projects. Both projects are concerned with the purchase of new plants. his absence, his assistant has prepared some calculations of mutually exclusive Plant 1 The following data is available for each project. Cost of Plants GH 100,000 Expected Annual Profits 1 29,000 18,000 2 (1,000) (2,000) 3 2,000 4,000 Estimated Residual Value 7,000 6,000 The company has an estimated cost of capital of 10% and employs the straight line method of depreciation for all fixed assets. Neither project would increase the working capital of the company. The company has sufficient funds to meet all capital expenditure requirements. Required: a.) For each of the plants, calculate and comment on your findings about the proposed investments: i) the Payback Period ii) the Net Present Value (NPV) iii) the Internal Rate of Return (IRR) b.) State which, if any, of the two investment projects your company directors should accept and why? From your answer b above, discuss the reasons why the NPV method of investment appraisal should be preferred to other IRR

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started