Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plant & Company plans to convert to IFRSs with a date of transition to IFRSs of 1 January 2X22. Under previous GAAP certain non-derivative

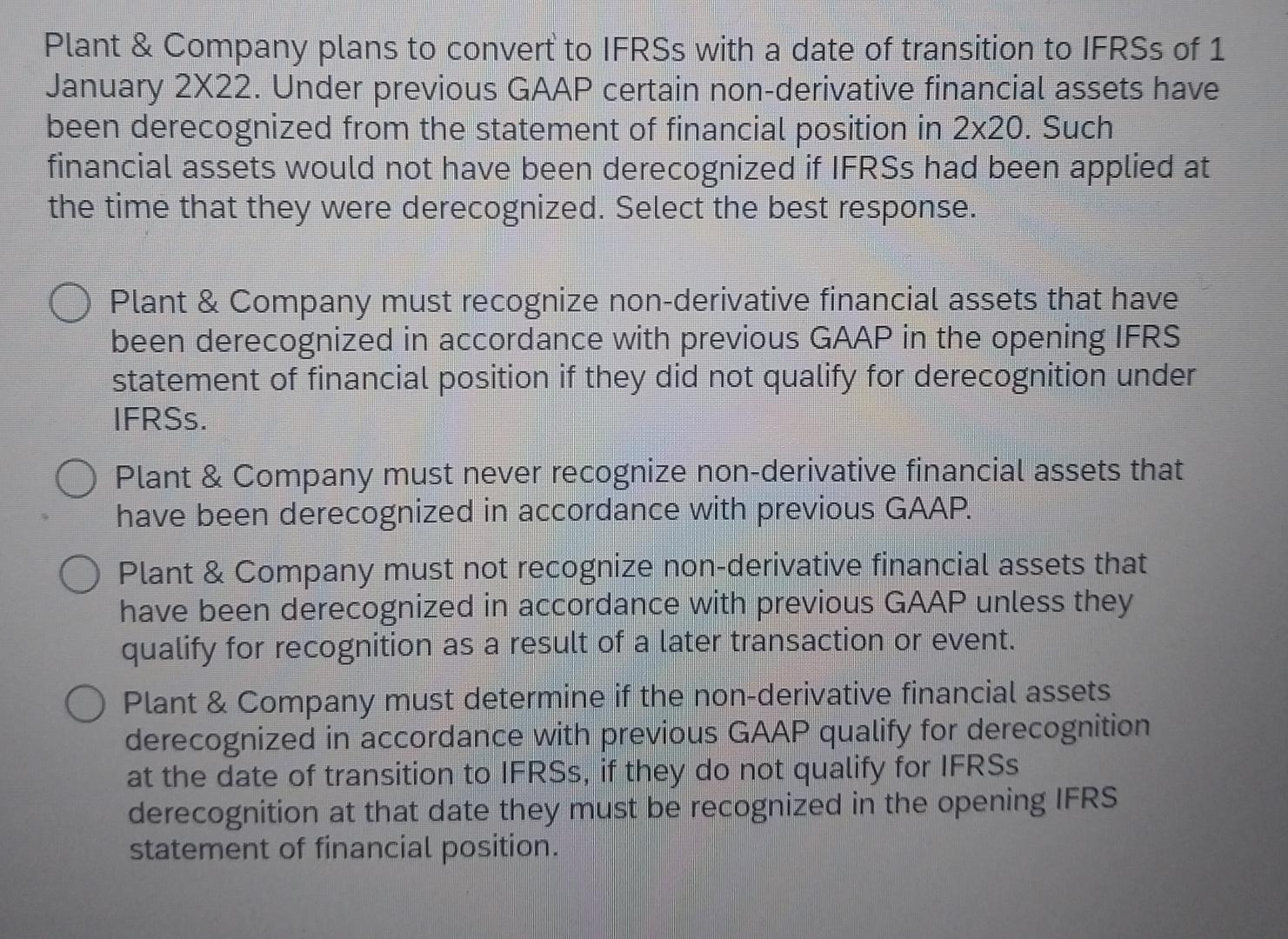

Plant & Company plans to convert to IFRSs with a date of transition to IFRSs of 1 January 2X22. Under previous GAAP certain non-derivative financial assets have been derecognized from the statement of financial position in 2x20. Such financial assets would not have been derecognized if IFRSs had been applied at the time that they were derecognized. Select the best response. Plant & Company must recognize non-derivative financial assets that have been derecognized in accordance with previous GAAP in the opening IFRS statement of financial position if they did not qualify for derecognition under IFRSs. Plant & Company must never recognize non-derivative financial assets that have been derecognized in accordance with previous GAAP. Plant & Company must not recognize non-derivative financial assets that have been derecognized in accordance with previous GAAP unless they qualify for recognition as a result of a later transaction or event. Plant & Company must determine if the non-derivative financial assets derecognized in accordance with previous GAAP qualify for derecognition at the date of transition to IFRSs, if they do not qualify for IFRSs derecognition at that date they must be recognized in the opening IFRS statement of financial position.

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

The image shows a question regarding the accounting treatment for nonderivative financial assets that were previously derecognized under GAAP Generall...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started