Answered step by step

Verified Expert Solution

Question

1 Approved Answer

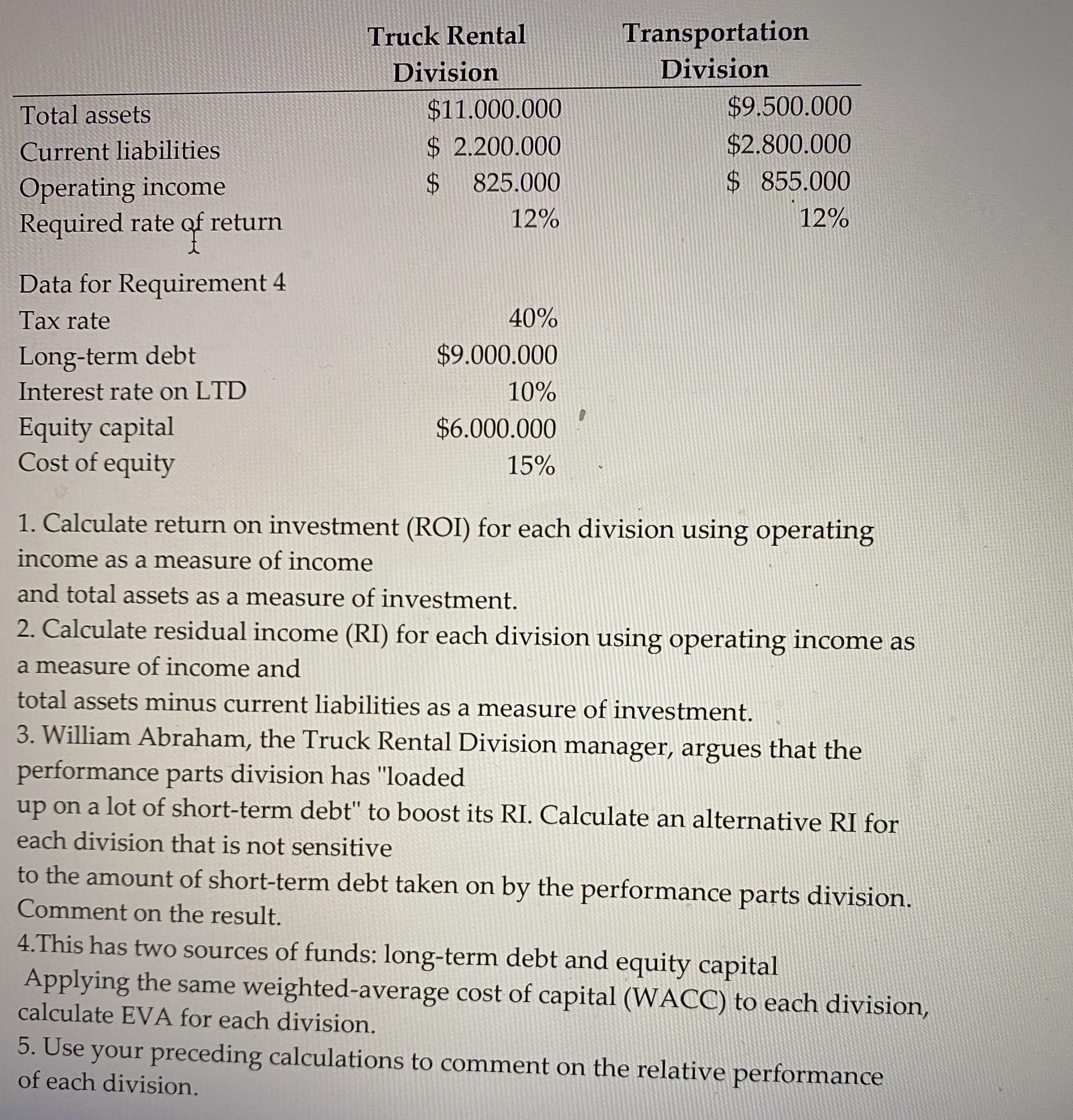

Total assets Current liabilities Operating income Truck Rental Division $11.000.000 $ 2.200.000 959 $ 825.000 Transportation Division $9.500.000 $2.800.000 $ 855.000 12% 12% Required

Total assets Current liabilities Operating income Truck Rental Division $11.000.000 $ 2.200.000 959 $ 825.000 Transportation Division $9.500.000 $2.800.000 $ 855.000 12% 12% Required rate of return Data for Requirement 4 Tax rate Long-term debt Interest rate on LTD Equity capital Cost of equity 40% $9.000.000 10% $6.000.000 15% 1. Calculate return on investment (ROI) for each division using operating income as a measure of income and total assets as a measure of investment. 2. Calculate residual income (RI) for each division using operating income as a measure of income and total assets minus current liabilities as a measure of investment. 3. William Abraham, the Truck Rental Division manager, argues that the performance parts division has "loaded up on a lot of short-term debt" to boost its RI. Calculate an alternative RI for each division that is not sensitive to the amount of short-term debt taken on by the performance parts division. Comment on the result. 4.This has two sources of funds: long-term debt and equity capital Applying the same weighted-average cost of capital (WACC) to each division, calculate EVA for each division. 5. Use your preceding calculations to comment on the relative performance of each division.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Return on Investment ROI for each division using operating income as a measure of income and total assets as a measure of investment can be calculat...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started