plase provide in excel

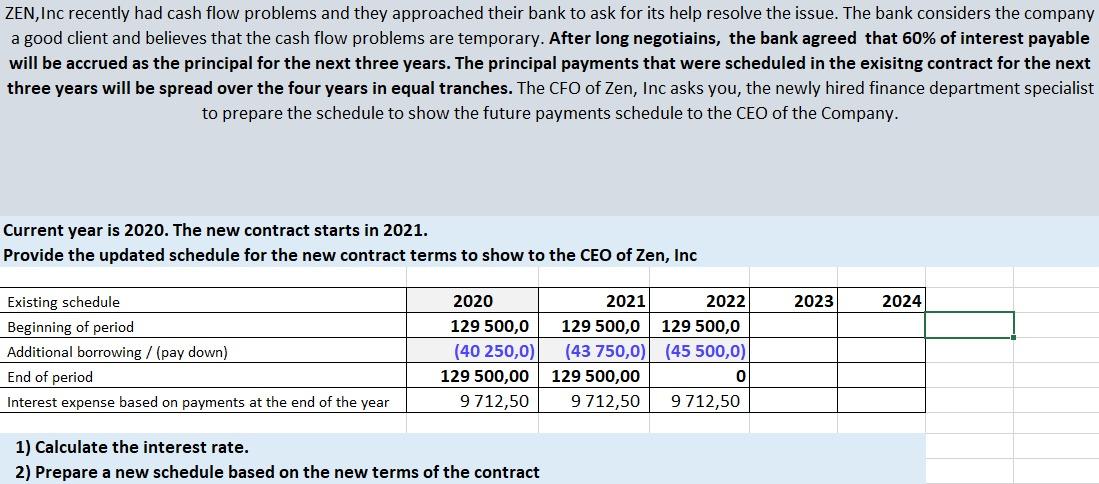

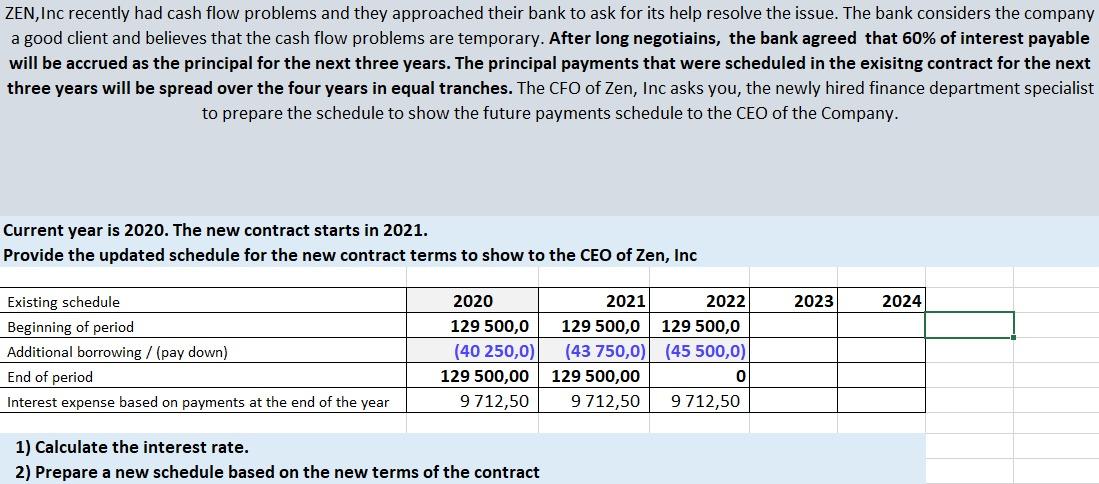

ZEN, Inc recently had cash flow problems and they approached their bank to ask for its help resolve the issue. The bank considers the company a good client and believes that the cash flow problems are temporary. After long negotiains, the bank agreed that 60% of interest payable will be accrued as the principal for the next three years. The principal payments that were scheduled in the exisitng contract for the next three years will be spread over the four years in equal tranches. The CFO of Zen, Inc asks you, the newly hired finance department specialist to prepare the schedule to show the future payments schedule to the CEO of the Company. Current year is 2020. The new contract starts in 2021. Provide the updated schedule for the new contract terms to show to the CEO of Zen, Inc 2023 2024 Existing schedule Beginning of period Additional borrowing / (pay down) End of period Interest expense based on payments at the end of the year 2020 129 500,0 (40 250,0) 129 500,00 9712,50 2021 2022 129 500,0 129 500,0 (43 750,0) (45 500,0) 129 500,00 0 9712,50 9 712,50 1) Calculate the interest rate. 2) Prepare a new schedule based on the new terms of the contract ZEN, Inc recently had cash flow problems and they approached their bank to ask for its help resolve the issue. The bank considers the company a good client and believes that the cash flow problems are temporary. After long negotiains, the bank agreed that 60% of interest payable will be accrued as the principal for the next three years. The principal payments that were scheduled in the exisitng contract for the next three years will be spread over the four years in equal tranches. The CFO of Zen, Inc asks you, the newly hired finance department specialist to prepare the schedule to show the future payments schedule to the CEO of the Company. Current year is 2020. The new contract starts in 2021. Provide the updated schedule for the new contract terms to show to the CEO of Zen, Inc 2023 2024 Existing schedule Beginning of period Additional borrowing / (pay down) End of period Interest expense based on payments at the end of the year 2020 129 500,0 (40 250,0) 129 500,00 9712,50 2021 2022 129 500,0 129 500,0 (43 750,0) (45 500,0) 129 500,00 0 9712,50 9 712,50 1) Calculate the interest rate. 2) Prepare a new schedule based on the new terms of the contract