Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Platinum Inc. has outstanding cumulative preferred stock with a par value of $ 8 5 . 0 0 . The shares pay a 5 %

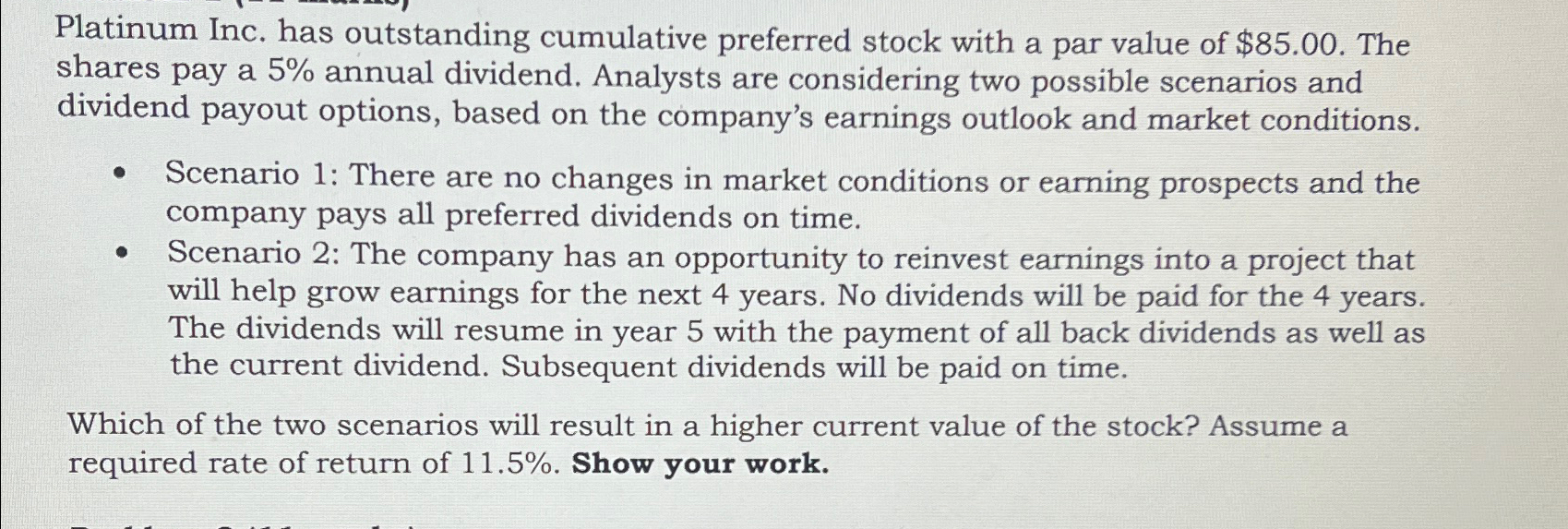

Platinum Inc. has outstanding cumulative preferred stock with a par value of $ The shares pay a annual dividend. Analysts are considering two possible scenarios and dividend payout options, based on the company's earnings outlook and market conditions.

Scenario : There are no changes in market conditions or earning prospects and the company pays all preferred dividends on time.

Scenario : The company has an opportunity to reinvest earnings into a project that will help grow earnings for the next years. No dividends will be paid for the years. The dividends will resume in year with the payment of all back dividends as well as the current dividend. Subsequent dividends will be paid on time.

Which of the two scenarios will result in a higher current value of the stock? Assume a required rate of return of Show your work.

Please provide a written calculation answer. Thank you.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started