Answered step by step

Verified Expert Solution

Question

1 Approved Answer

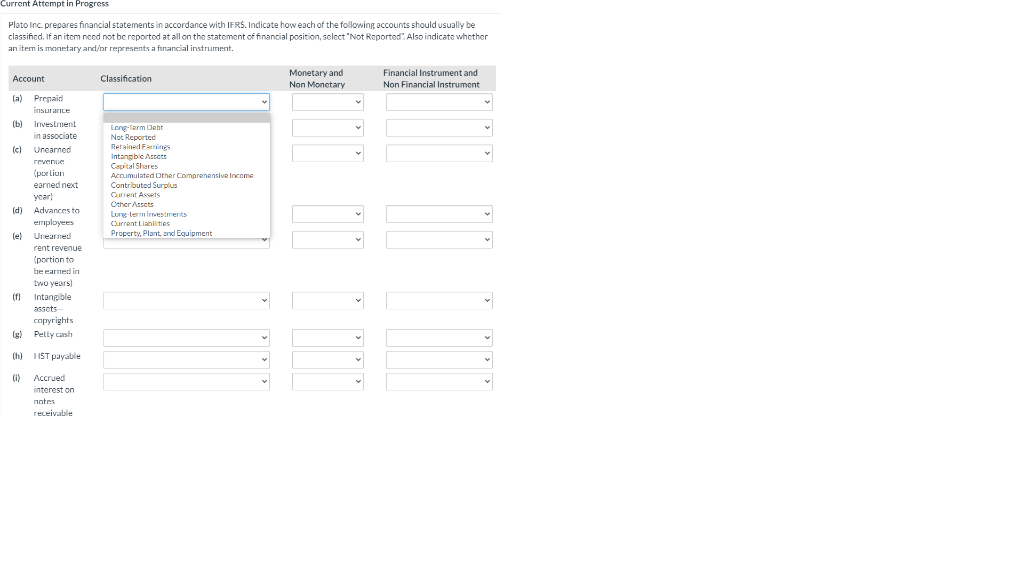

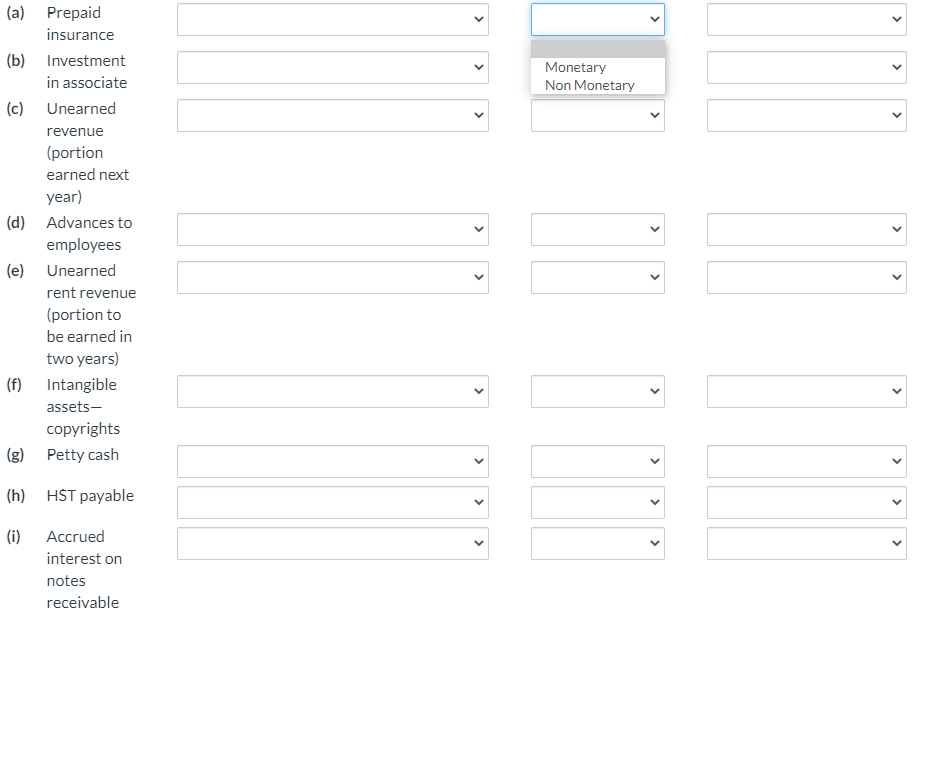

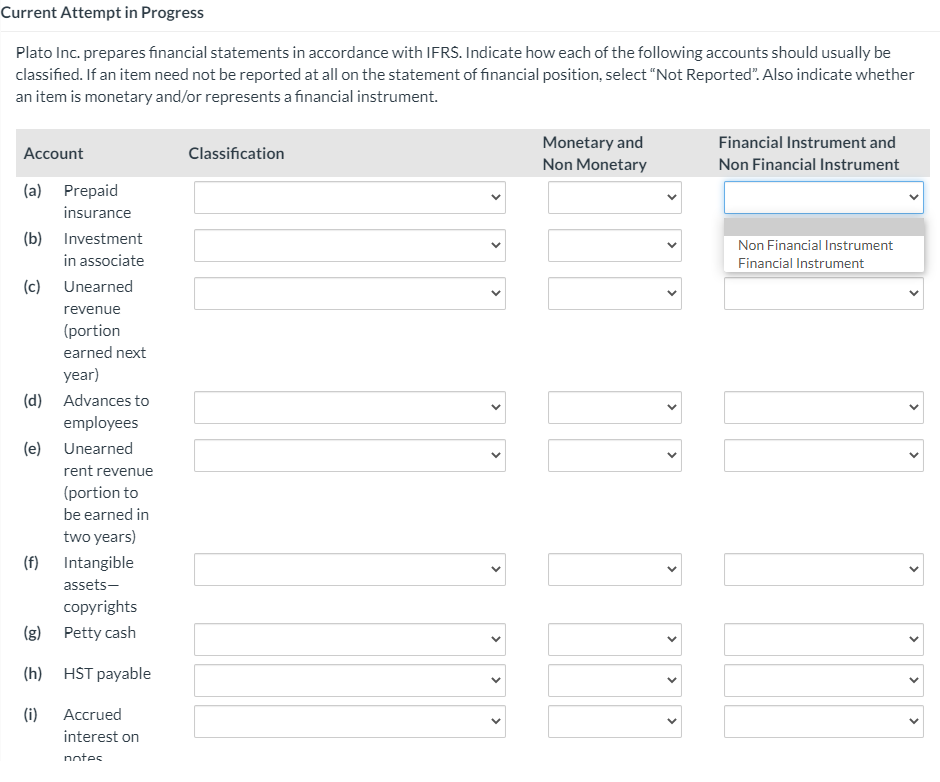

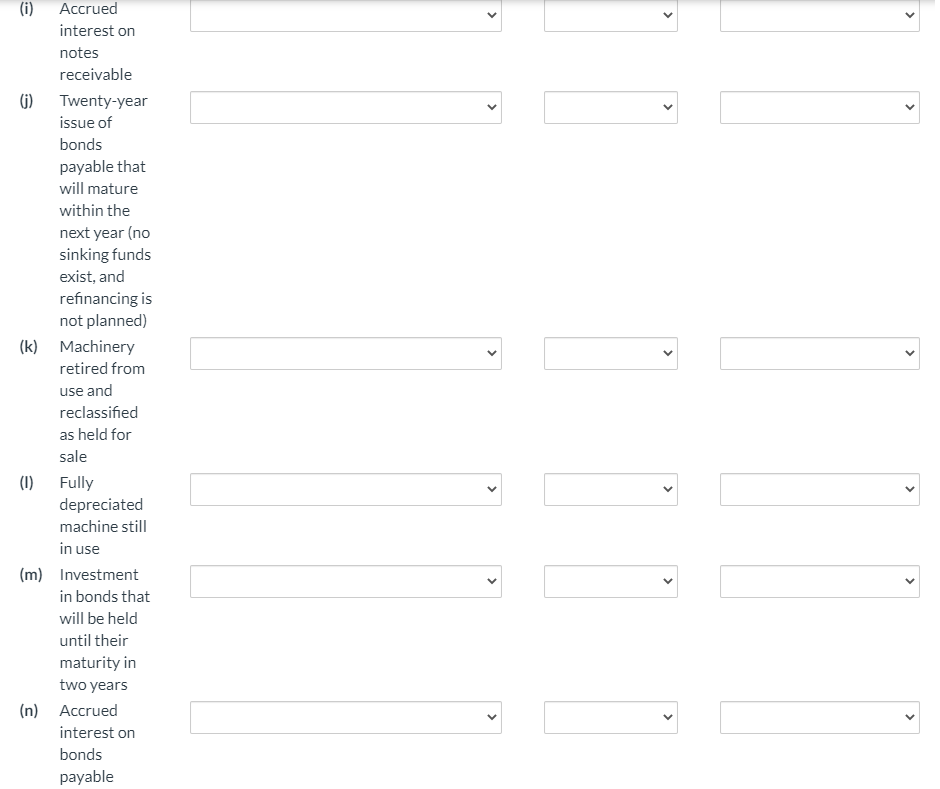

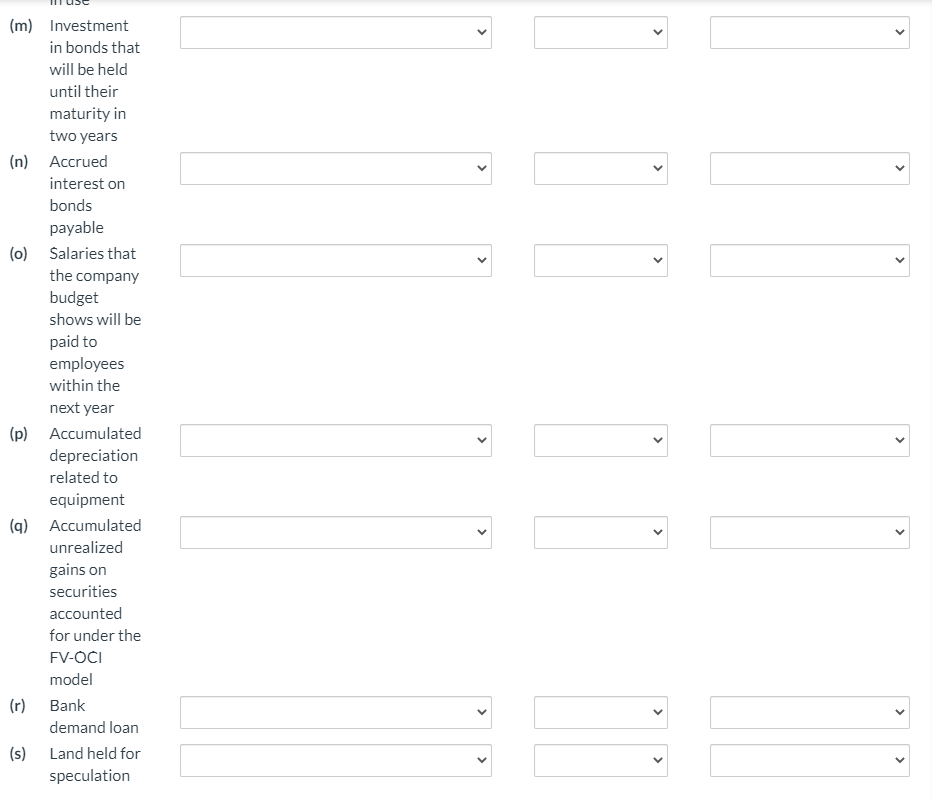

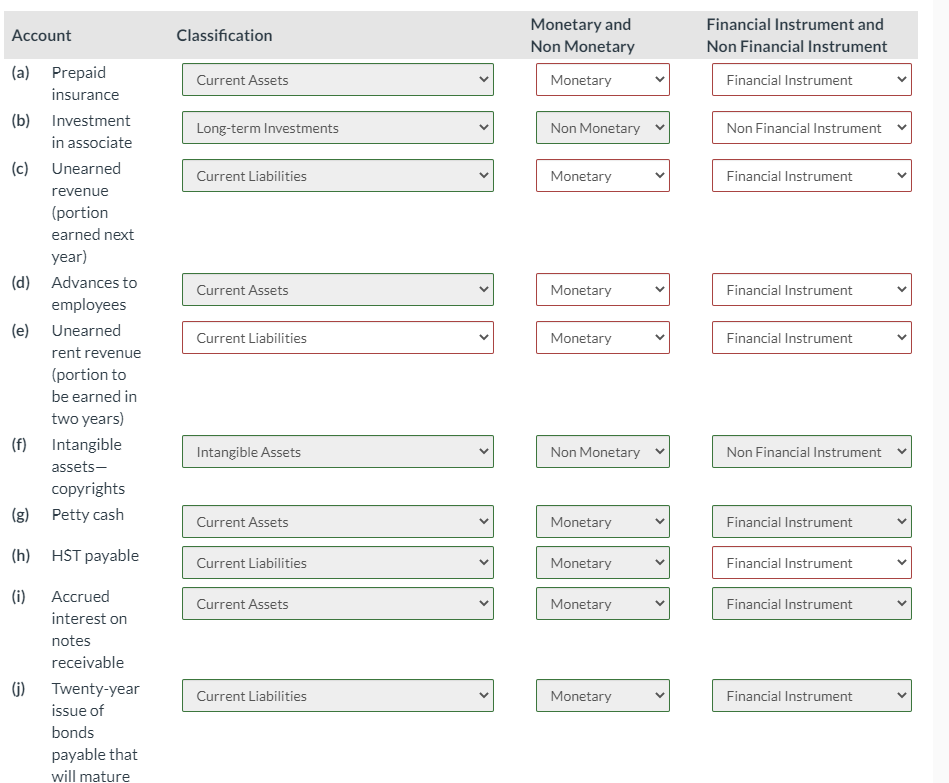

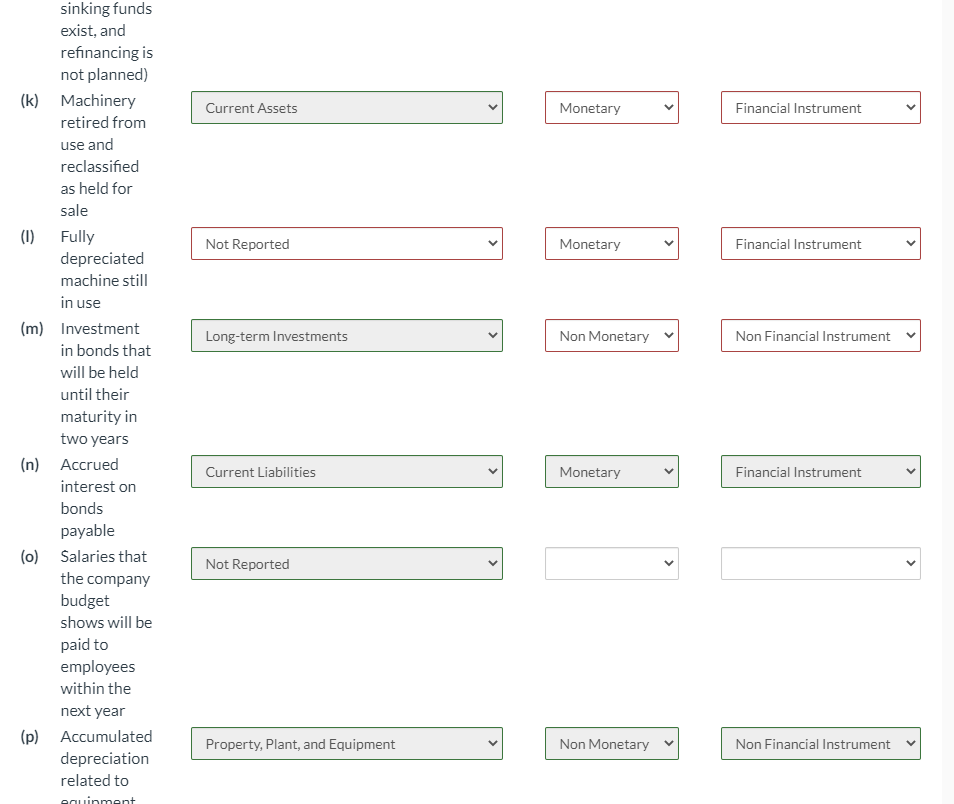

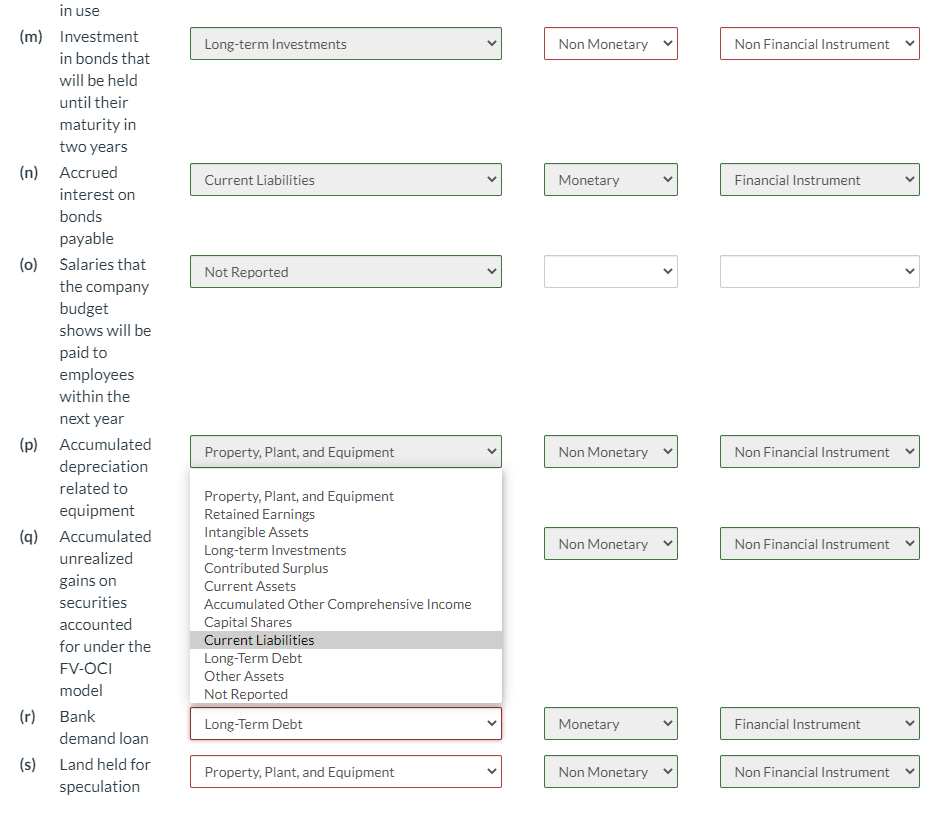

Plato Inc. prepares financial statements in accordance with IFRS. Indicate how each of the following accounts should usually be classified. If an item need not

Plato Inc. prepares financial statements in accordance with IFRS. Indicate how each of the following accounts should usually be classified. If an item need not be reported at all on the statement of financial position, select Not Reported. Also indicate whether an item is monetary and/or represents a financial instrument. Note that each item can be either blank for the monetary or non-monetary and the financial instrument can be either or or none of the above too. Thanks. Please carefully see below. It is out of 10 marks.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started