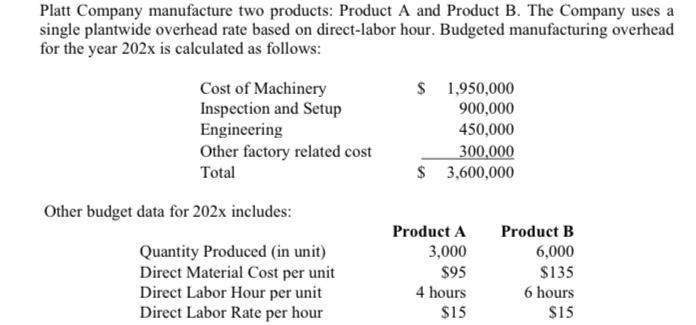

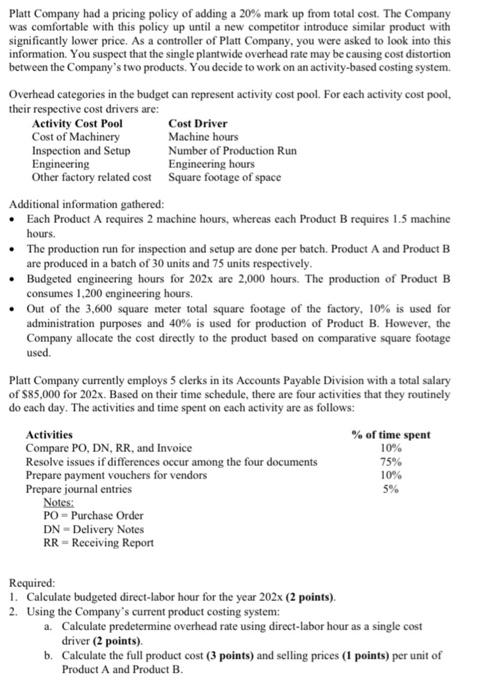

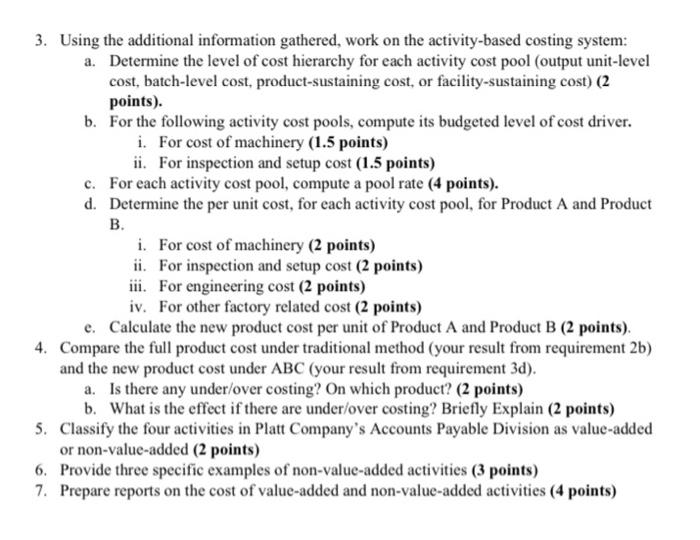

Platt Company manufacture two products: Product A and Product B. The Company uses a single plantwide overhead rate based on direct-labor hour. Budgeted manufacturing overhead for the year 202x is calculated as follows: Cost of Machinery Inspection and Setup Engineering Other factory related cost Total $ 1,950,000 900,000 450,000 300,000 $ 3,600,000 Other budget data for 202x includes: Quantity Produced (in unit) Direct Material Cost per unit Direct Labor Hour per unit Direct Labor Rate per hour Product A 3,000 $95 4 hours $15 Product B 6,000 $135 6 hours $15 Platt Company had a pricing policy of adding a 20% mark up from total cost. The Company was comfortable with this policy up until a new competitor introduce similar product with significantly lower price. As a controller of Platt Company, you were asked to look into this information. You suspect that the single plantwide overhead rate may be causing cost distortion between the Company's two products. You decide to work on an activity-based costing system. Overhead categories in the budget can represent activity cost pool. For each activity cost pool. their respective cost drivers are: Activity Cost Pool Cost Driver Cost of Machinery Machine hours Inspection and Setup Number of Production Run Engineering Engineering hours Other factory related cost Square footage of space Additional information gathered: Each Product A requires 2 machine hours, whereas cach Product B requires 1.5 machine hours. The production run for inspection and setup are done per batch. Product A and Product B are produced in a batch of 30 units and 75 units respectively. Budgeted engineering hours for 202x are 2,000 hours. The production of Product B consumes 1,200 engineering hours. Out of the 3,600 square meter total square footage of the factory, 10% is used for administration purposes and 40% is used for production of Product B. However, the Company allocate the cost directly to the product based on comparative square footage used. Platt Company currently employs 5 clerks in its Accounts Payable Division with a total salary of $85,000 for 202x. Based on their time schedule, there are four activities that they routinely do each day. The activities and time spent on each activity are as follows: Activities % of time spent Compare PO, DN, RR, and Invoice 10% Resolve issues if differences occur among the four documents 75% Prepare payment vouchers for vendors 10% Prepare journal entries 5% Notes: PO - Purchase Order DN - Delivery Notes RR - Receiving Report Required: 1. Calculate budgeted direct-labor hour for the year 202X (2 points) 2. Using the Company's current product costing system: a. Calculate predetermine overhead rate using direct-labor hour as a single cost driver (2 points) b. Calculate the full product cost (3 points) and selling prices (1 points) per unit of Product A and Product B. 3. Using the additional information gathered, work on the activity-based costing system: a. Determine the level of cost hierarchy for each activity cost pool (output unit-level cost, batch-level cost, product-sustaining cost, or facility-sustaining cost) (2 points). b. For the following activity cost pools, compute its budgeted level of cost driver. i. For cost of machinery (1.5 points) ii. For inspection and setup cost (1.5 points) c. For each activity cost pool, compute a pool rate (4 points). d. Determine the per unit cost, for each activity cost pool, for Product A and Product B. i. For cost of machinery (2 points) ii. For inspection and setup cost (2 points) iii. For engineering cost (2 points) iv. For other factory related cost (2 points) e. Calculate the new product cost per unit of Product A and Product B (2 points) 4. Compare the full product cost under traditional method (your result from requirement 2b) and the new product cost under ABC (your result from requirement 3d). a. Is there any under/over costing? On which product? (2 points) b. What is the effect if there are under/over costing? Briefly Explain (2 points) 5. Classify the four activities in Platt Company's Accounts Payable Division as value-added or non-value-added (2 points) 6. Provide three specific examples of non-value-added activities (3 points) 7. Prepare reports on the cost of value-added and non-value-added activities (4 points)