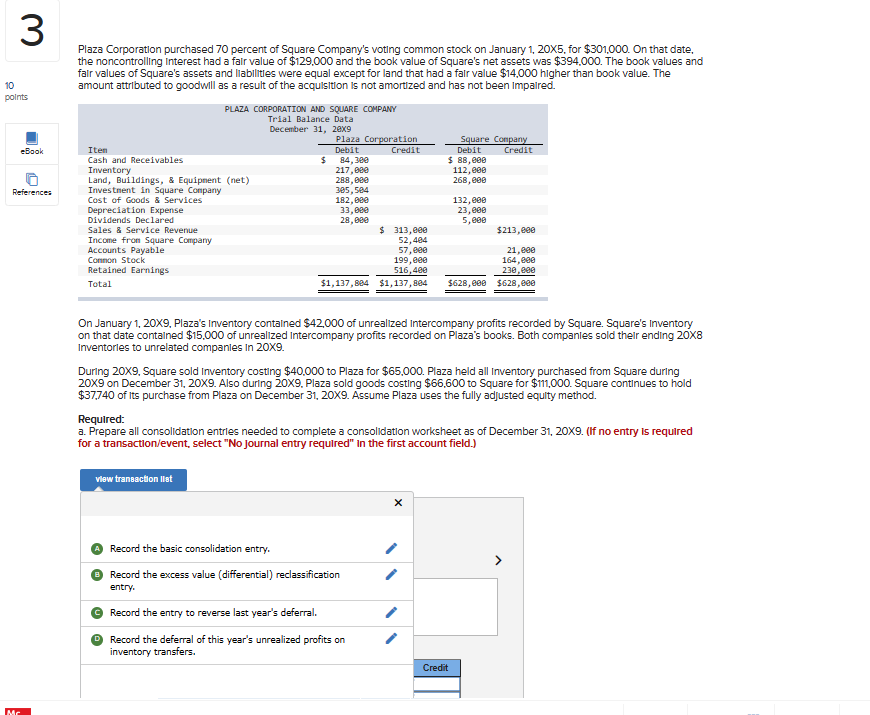

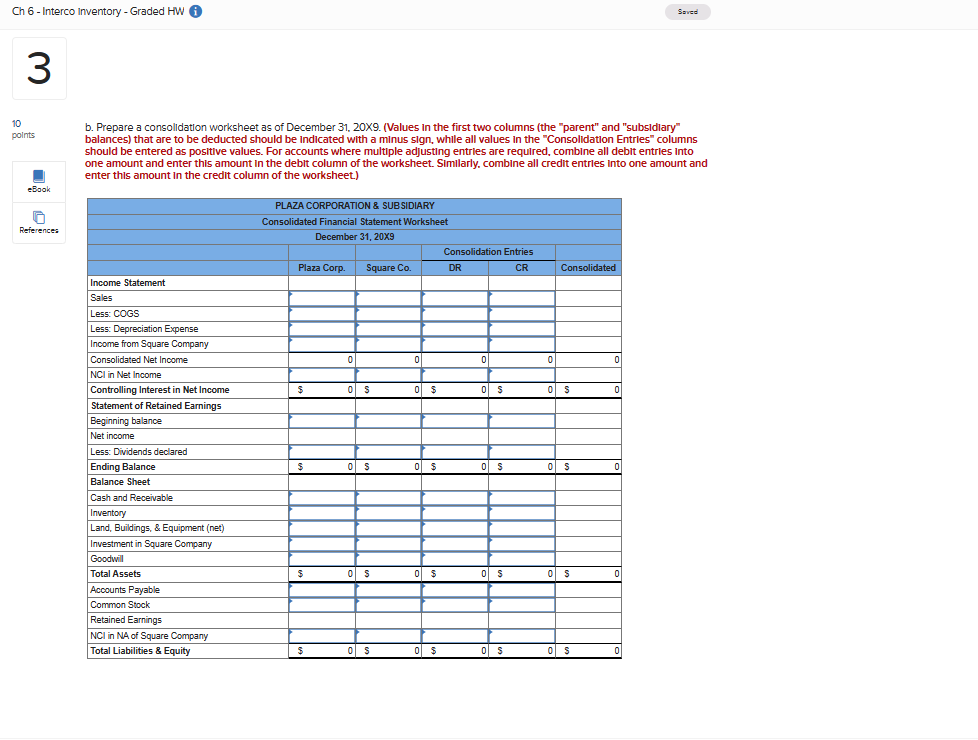

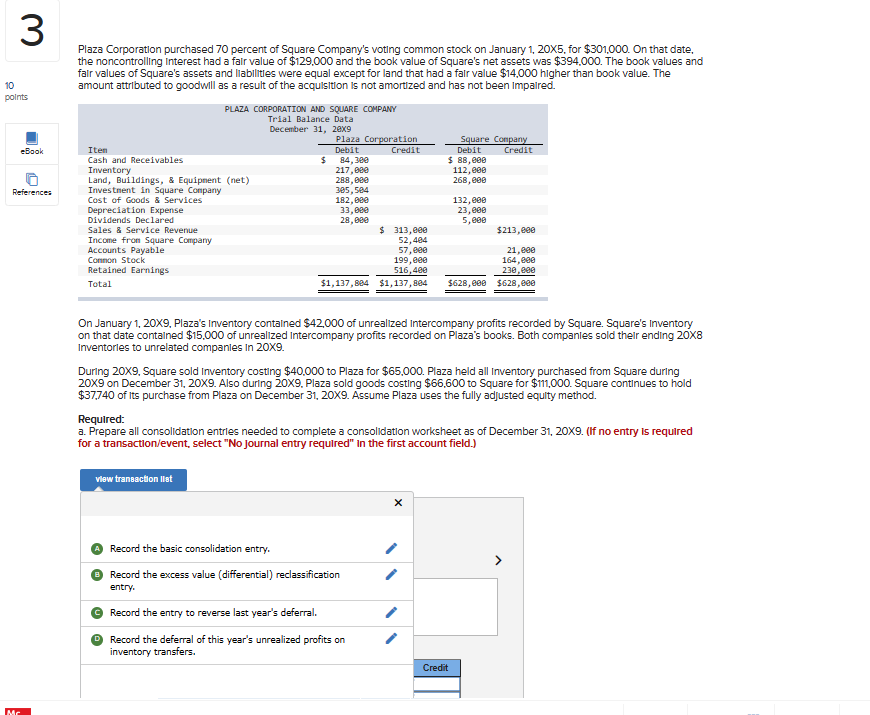

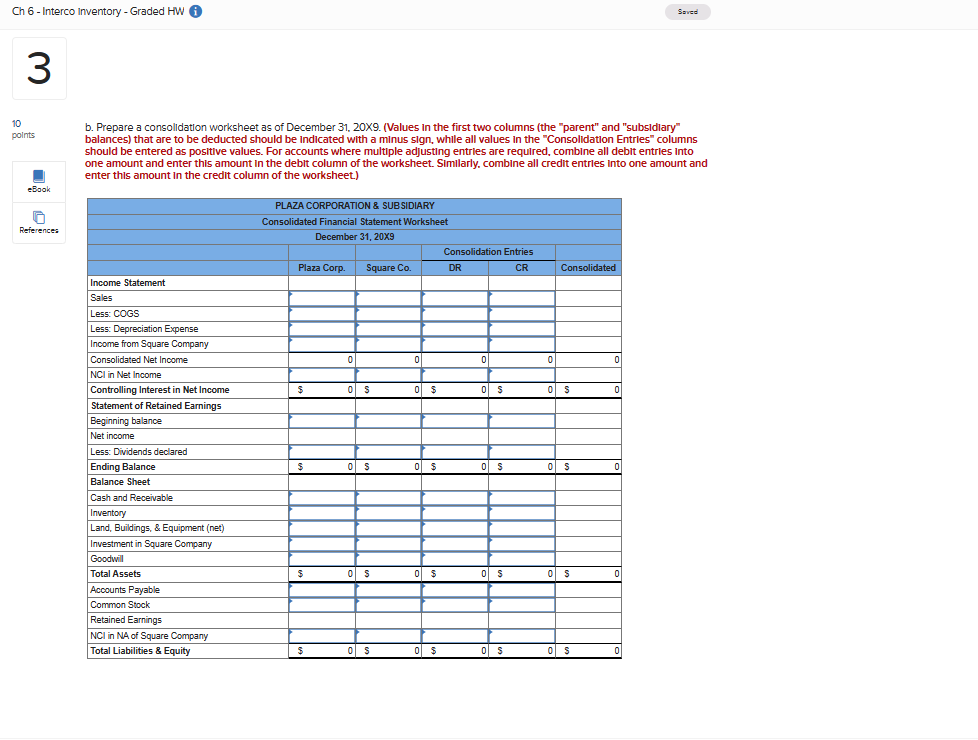

Plaza Corporation purchased 70 percent of Square Company's voting common stock on January 1, 20X5, for $301,000. On that date, the noncontrolling Interest had a fair value of $129,000 and the book value of Square's net assets was $394,000. The book values and falr values of Square's assets and llabilitles were equal except for land that had a fair value $14,000 higher than book value. The amount attributed to goodwill as a result of the acquisition is not amortized and has not been impalred. On January 1, 20X9. Plaza's Inventory contained $42,000 of unrealized intercompany profits recorded by Square. Square's Inventory on that date contained $15,000 of unrealized Intercompany profits recorded on Plaza's books. Both companles sold their ending 208 inventorles to unrelated companles in 209. During 20X9, Square sold Inventory costing $40,000 to Plaza for $65,000. Plaza held all Inventory purchased from Square during 209 on December 31, 20X9. Also during 209. Plaza sold goods costing $66,600 to Square for $111,000. Square continues to hold $37,740 of its purchase from Plaza on December 31, 20X9. Assume Plaza uses the fully adjusted equlty method. Required: a. Prepare all consolidation entrles needed to complete a consolidation worksheet as of December 31,209. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Record the basic consolidation entry. Record the excess value (differential) reclassification entry. Record the entry to reverse last year's deferral. Record the deferral of this year's unrealized profits on inventory transfers. b. Prepare a consolidation worksheet as of December 31, 20X. (Values in the first two columns (the "parent" and "subsidlary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly. combine all credit entrles into one amount and enter this amount in the credit column of the worksheet.) Plaza Corporation purchased 70 percent of Square Company's voting common stock on January 1, 20X5, for $301,000. On that date, the noncontrolling Interest had a fair value of $129,000 and the book value of Square's net assets was $394,000. The book values and falr values of Square's assets and llabilitles were equal except for land that had a fair value $14,000 higher than book value. The amount attributed to goodwill as a result of the acquisition is not amortized and has not been impalred. On January 1, 20X9. Plaza's Inventory contained $42,000 of unrealized intercompany profits recorded by Square. Square's Inventory on that date contained $15,000 of unrealized Intercompany profits recorded on Plaza's books. Both companles sold their ending 208 inventorles to unrelated companles in 209. During 20X9, Square sold Inventory costing $40,000 to Plaza for $65,000. Plaza held all Inventory purchased from Square during 209 on December 31, 20X9. Also during 209. Plaza sold goods costing $66,600 to Square for $111,000. Square continues to hold $37,740 of its purchase from Plaza on December 31, 20X9. Assume Plaza uses the fully adjusted equlty method. Required: a. Prepare all consolidation entrles needed to complete a consolidation worksheet as of December 31,209. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Record the basic consolidation entry. Record the excess value (differential) reclassification entry. Record the entry to reverse last year's deferral. Record the deferral of this year's unrealized profits on inventory transfers. b. Prepare a consolidation worksheet as of December 31, 20X. (Values in the first two columns (the "parent" and "subsidlary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly. combine all credit entrles into one amount and enter this amount in the credit column of the worksheet.)