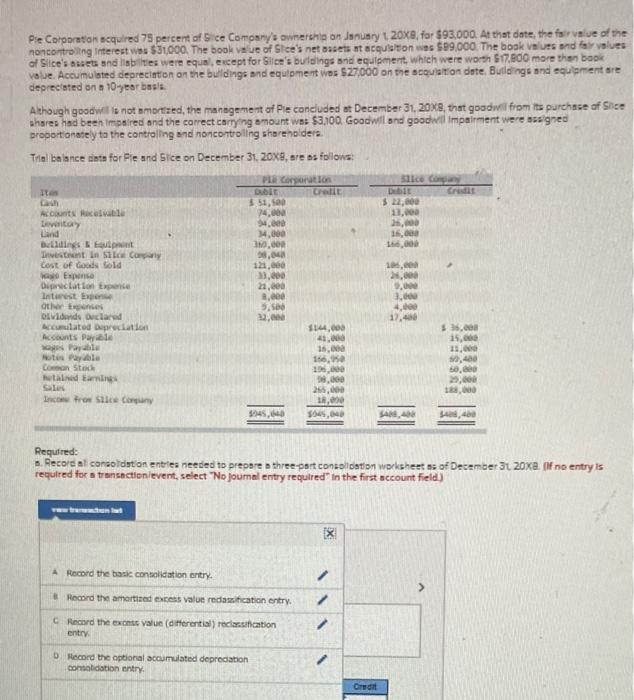

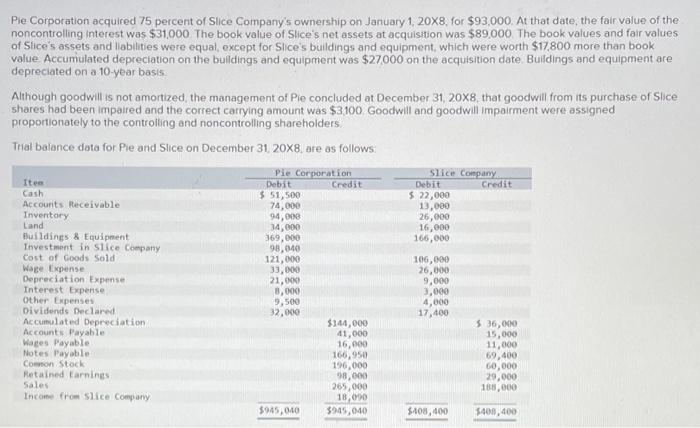

Ple Corporation acquired 75 percent of ce Company's owners on January 1 20X, for $93.000. At that date, the fair value of the noncontrong interest was $31000. The book value of Sice's net assets nt acquiston was $99.000. The book values and values of Slice's uses and liabilities were equal, except for Slice's buildings and equipment, which were worth $17,000 more than book value. Accumulated depreciation on the buildings and equipment was $27.000 on the Souton date Buildings and equipment are deprecated on 10 year basis. Although goodwill not amortized, the management of Ple concluded at December 31, 20x8, that goodwil from its purchase of Sice shares had been impaired and the correct carrying amount was $3,200. Goodwill and goodwill impairment were assigned proportionately to the controlling and noncontrolling shareholders Trial balance data for Ple and Sice on December 31, 20x8, are as follows: co Dubit Credit $ 22,000 11,000 PL Corporation Bubit CE $ 51, 74,00 . 14.000 11.COM 2,048 16.00 . 106,00 Cash Account celle Levy Land Dubing Et het in Sic Company Cost of Goods Gold Expense Deprecation to Interest other te Vidas clared Accumulated Depreciation Accounts Paya Payable Hotele Coron Stock Nad Earning Sale cofron Se Conny 33,00 22,ce B. 5. 22.00 5.000 3. 4.000 17,400 $144,000 15, 16, 1, 38.000 255.000 1, 1945, $35.00 15. 11. 40 50, 2. 1,000 1945.5 SAN, 5408,400 Required: Record al consoldation entries needed to prepare three-part consolidation worksheets of December at 20xa. Of no entry is required for a transaction event, select "No journal entry required in the first account field x X > A Record the basic consolidation entry Record the amortie excess value redasification entry. Record the exam Valur (differenti reclasification entry Record the optional accumulated depredation contabidation entry Credit Pie Corporation acquired 75 percent of Slice Company's ownership on January 1 20x8, for $93,000. At that date, the fair value of the noncontrolling Interest was $31.000 The book value of Slice's net assets at acquisition was $89,000 The book values and fair values of Slice's assets and liabilities were equal, except for Slice's buildings and equipment, which were worth $17.800 more than book value Accurriulated depreciation on the buildings and equipment was $27000 on the acquisition date Buildings and equipment are depreciated on a 10-year basis Although goodwill is not amortized the management of Pie concluded at December 31, 20x8, that goodwill from its purchase of Slice shares had been impaired and the correct carrying amount was $3,800 Goodwill and goodwill impairment were assigned proportionately to the controlling and noncontrolling shareholders Trial balance data for Pie and Slice on December 31 20X8. are as follows: Pie Corporation Slice Company Item Debit Credit Debit Credit Cash $ 51,500 $ 22,000 Accounts Receivable 74,000 13,000 Inventory 94,000 26,000 14,000 16,000 Buildings & Equipment 369,000 166,000 Investment in slice Company 98,040 Cost of Goods Sold 121,000 106,000 Wake Expense 33,000 26,000 Depreciation Expense 21,000 9,000 Interest Expense 8,000 3,000 Other Expenses 4,000 Dividends Declared 32,000 17,400 Accumulated Depreciation $144,000 $ 36,000 Accounts Payable 41,000 15,000 Wages Payable 16,000 11,000 Notes Payable 166,950 69,400 Common Stock 196,000 60,000 Retained tarnings 98,000 29,000 265,000 188,000 Income from Slice Company 18,000 $945, 040 $945,040 $108,400 $408,400 Land 9,500 Sales ...... Record the basic consolidation entry. B Record the amortized excess value reclassification entry. C Record the excess value (differential) reclassification entry. Record the optional accumulated depreciation consolidation entry