Ple Please answer question 4 based on the information above.

Please answer question 4 based on the information above.

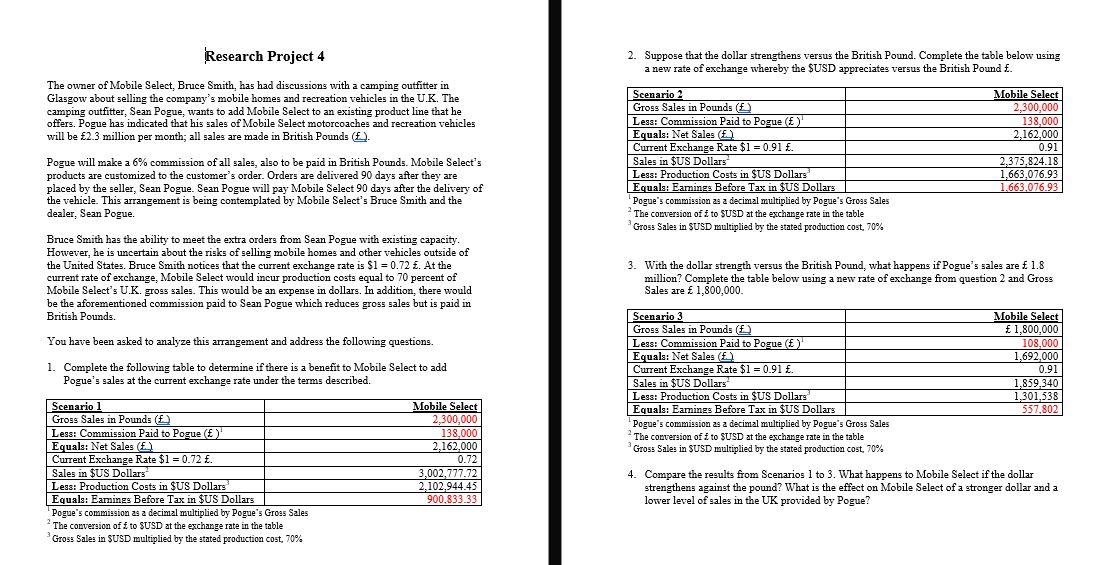

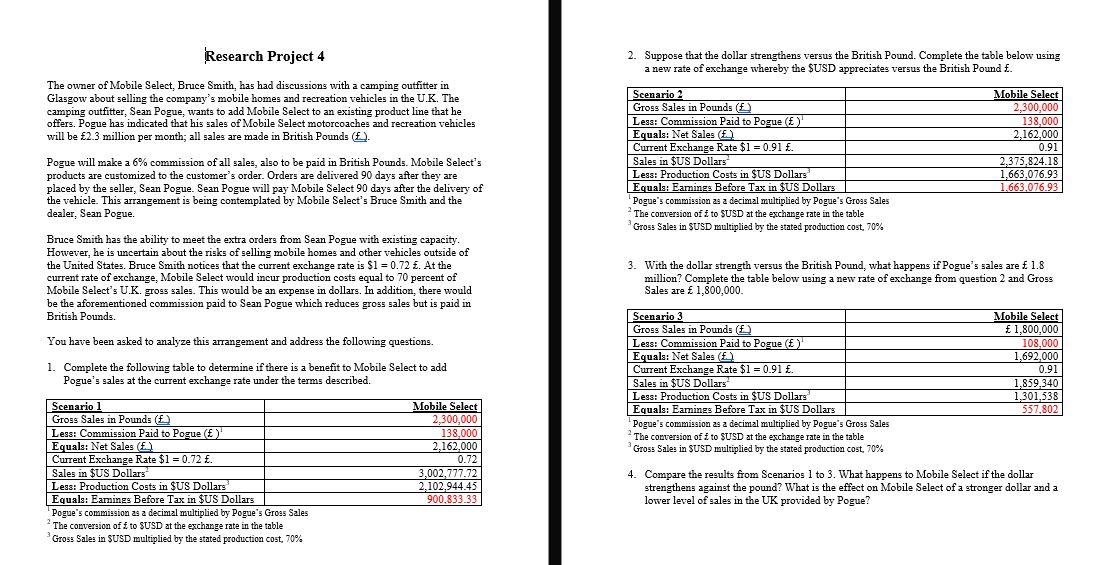

Research Project 4 2. Suppose that the dollar strengthens versus the British Pound. Complete the table below using a new rate of exchange whereby the $USD appreciates versus the British Pound f. The owner of Mobile Select, Bruce Smith, has had discussions with a camping outfitter in Glasgow about selling the company's mobile homes and recreation vehicles in the U.K. The camping outfitter, Sean Pogue, wants to add Mobile Select to an existing product line that he offers. Pogue has indicated that his sales of Mobile Select motorcoaches and recreation vehicles will be 2.3 million per month; all sales are made in British Pounds (. Pogue will make a 6% commission of all sales, also to be paid in British Pounds. Mobile Select's products are customized to the customer's order. Orders are delivered 90 days after they are placed by the seller, Sean Pogue. Sean Pogue will pay Mobile Select 90 days after the delivery of the vehicle. This arrangement is being contemplated by Mobile Select's Bruce Smith and the dealer, Sean Pogue. Bruce Smith has the ability to meet the extra orders from Sean Pogue with existing capacity, However, he is uncertain about the risks of selling mobile homes and other vehicles outside of the United States. Bruce Smith notices that the current exchange rate is $1 = 0.72 . At the current rate of exchange, Mobile Select would incur production costs equal to 70 percent of Mobile Select's U.K. gross sales. This would be an expense in dollars. In addition, there would be the aforementioned commission paid to Sean Pogue which reduces gross sales but is paid in British Pounds. Scenario 2 Gross Sales in Pounds ( Less: Commission Paid to Pogue ()' Equals: Net Sales () Current Exchange Rate $1 = 0.91 . Sales in $US Dollars Less: Production Costs in $US Dollars Equals: Eamings Before Tax in $US Dollars Pogue's commission as a decimal multiplied by Pogue's Gross Sales The conversion off to SUSD at the exchange rate in the table Gross Sales in SUSD multiplied by the stated production cost, 70% Mobile Select 2,300,000 138,000 2.162,000 0.91 2.375.824.18 1,663,076.93 1.663.076.93 3. With the dollar strength versus the British Pound, what happens if Pogue's sales are 1.8 million? Complete the table below using a new rate of exchange from question 2 and Gross Sales are 1,800,000 You have been asked to analyze this arrangement and address the following questions. 1. Complete the following table to determine if there is a benefit to Mobile Select to add Pogue's sales at the current exchange rate under the terms described. Scenario 1 Gross Sales in Pounds ( Less: Commission Paid to Pogue (8) Equals: Net Sales (F) Current Exchange Rate $1 = 0.72 . Sales in $US Dollars Less: Production Costs in $US Dollars Equals: Earnings Before Tax in $US Dollars Pogue's commission as a decimal multiplied by Pogue's Gross Sales The conversion off to SUSD at the exchange rate in the table Gross Sales in $USD multiplied by the stated production cost. 70% Mobile Select 2,300,000 138,000 2,162,000 0.72 3.002.777.72 2,102,944.45 900.833.33 Scenario 3 Mobile Select Gross Sales in Pounds ( 1,800,000 Less: Commission Paid to Pogue ()' 108,000 Equals: Net Sales ( 1.692,000 Current Exchange Rate $1 = 0.91 . 0.91 Sales in $US Dollars 1,859,340 Less: Production Costs in SUS Dollars 1.301,538 Equals: Earings Before Tax in $US Dollars 557.802 Pogue's commission as a decimal multiplied by Pogue's Gross Sales The conversion of to SUSD at the exchange rate in the table Gross Sales in SUSD multiplied by the stated production cost, 70% 4. Compare the results from Scenarios 1 to 3. What happens to Mobile Select if the dollar strengthens against the pound? What is the effect on Mobile Select of a stronger dollar and a lower level of sales in the UK provided by Pogue? Research Project 4 2. Suppose that the dollar strengthens versus the British Pound. Complete the table below using a new rate of exchange whereby the $USD appreciates versus the British Pound f. The owner of Mobile Select, Bruce Smith, has had discussions with a camping outfitter in Glasgow about selling the company's mobile homes and recreation vehicles in the U.K. The camping outfitter, Sean Pogue, wants to add Mobile Select to an existing product line that he offers. Pogue has indicated that his sales of Mobile Select motorcoaches and recreation vehicles will be 2.3 million per month; all sales are made in British Pounds (. Pogue will make a 6% commission of all sales, also to be paid in British Pounds. Mobile Select's products are customized to the customer's order. Orders are delivered 90 days after they are placed by the seller, Sean Pogue. Sean Pogue will pay Mobile Select 90 days after the delivery of the vehicle. This arrangement is being contemplated by Mobile Select's Bruce Smith and the dealer, Sean Pogue. Bruce Smith has the ability to meet the extra orders from Sean Pogue with existing capacity, However, he is uncertain about the risks of selling mobile homes and other vehicles outside of the United States. Bruce Smith notices that the current exchange rate is $1 = 0.72 . At the current rate of exchange, Mobile Select would incur production costs equal to 70 percent of Mobile Select's U.K. gross sales. This would be an expense in dollars. In addition, there would be the aforementioned commission paid to Sean Pogue which reduces gross sales but is paid in British Pounds. Scenario 2 Gross Sales in Pounds ( Less: Commission Paid to Pogue ()' Equals: Net Sales () Current Exchange Rate $1 = 0.91 . Sales in $US Dollars Less: Production Costs in $US Dollars Equals: Eamings Before Tax in $US Dollars Pogue's commission as a decimal multiplied by Pogue's Gross Sales The conversion off to SUSD at the exchange rate in the table Gross Sales in SUSD multiplied by the stated production cost, 70% Mobile Select 2,300,000 138,000 2.162,000 0.91 2.375.824.18 1,663,076.93 1.663.076.93 3. With the dollar strength versus the British Pound, what happens if Pogue's sales are 1.8 million? Complete the table below using a new rate of exchange from question 2 and Gross Sales are 1,800,000 You have been asked to analyze this arrangement and address the following questions. 1. Complete the following table to determine if there is a benefit to Mobile Select to add Pogue's sales at the current exchange rate under the terms described. Scenario 1 Gross Sales in Pounds ( Less: Commission Paid to Pogue (8) Equals: Net Sales (F) Current Exchange Rate $1 = 0.72 . Sales in $US Dollars Less: Production Costs in $US Dollars Equals: Earnings Before Tax in $US Dollars Pogue's commission as a decimal multiplied by Pogue's Gross Sales The conversion off to SUSD at the exchange rate in the table Gross Sales in $USD multiplied by the stated production cost. 70% Mobile Select 2,300,000 138,000 2,162,000 0.72 3.002.777.72 2,102,944.45 900.833.33 Scenario 3 Mobile Select Gross Sales in Pounds ( 1,800,000 Less: Commission Paid to Pogue ()' 108,000 Equals: Net Sales ( 1.692,000 Current Exchange Rate $1 = 0.91 . 0.91 Sales in $US Dollars 1,859,340 Less: Production Costs in SUS Dollars 1.301,538 Equals: Earings Before Tax in $US Dollars 557.802 Pogue's commission as a decimal multiplied by Pogue's Gross Sales The conversion of to SUSD at the exchange rate in the table Gross Sales in SUSD multiplied by the stated production cost, 70% 4. Compare the results from Scenarios 1 to 3. What happens to Mobile Select if the dollar strengthens against the pound? What is the effect on Mobile Select of a stronger dollar and a lower level of sales in the UK provided by Pogue

Please answer question 4 based on the information above.

Please answer question 4 based on the information above.