Answered step by step

Verified Expert Solution

Question

1 Approved Answer

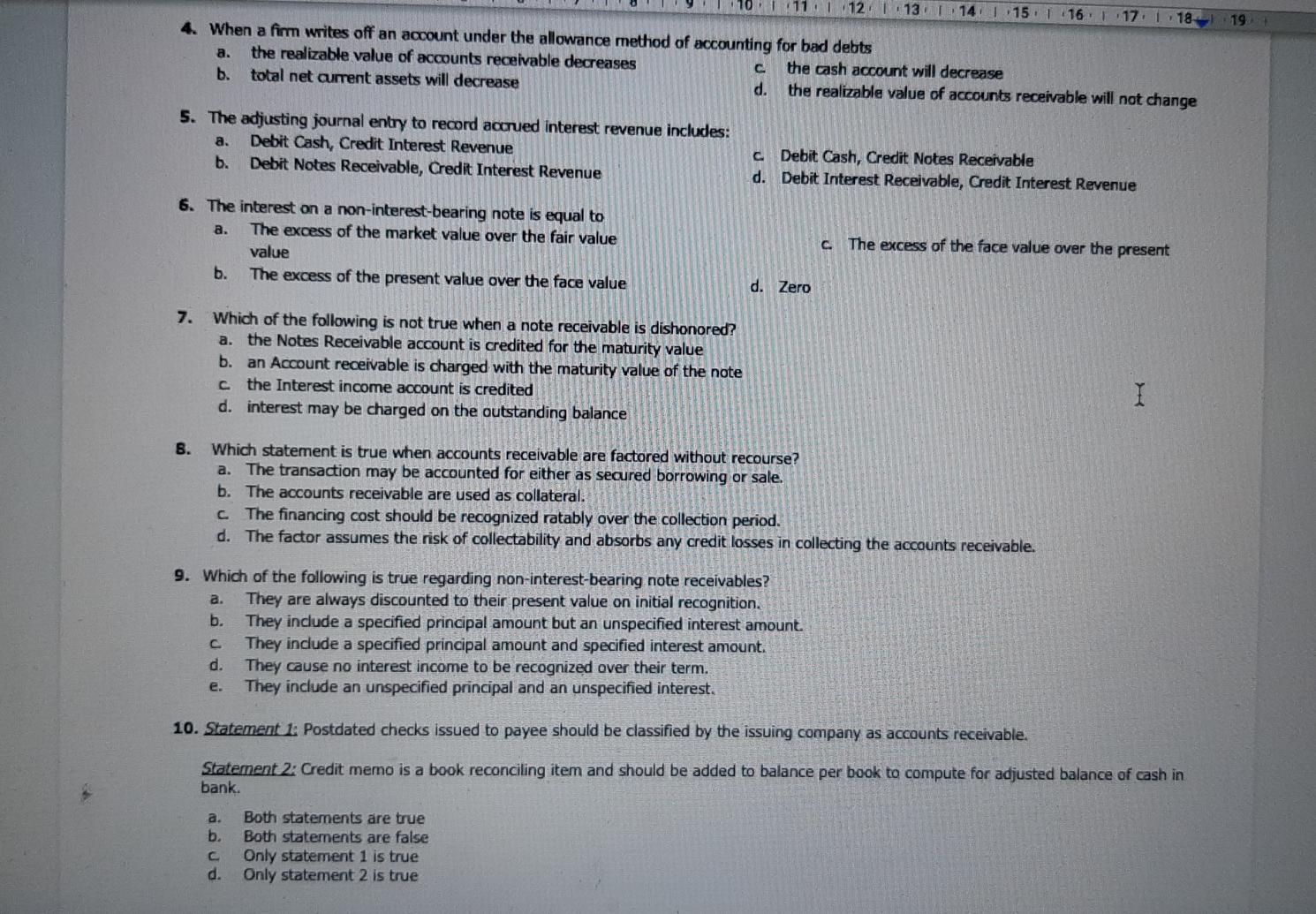

pleaaaase answer 4,5,6,7,8,9,10 11 1 12 1 13 14 115 116 117 118 19 4. When a firm writes off an account under the allowance

pleaaaase answer 4,5,6,7,8,9,10

11 1 12 1 13 14 115 116 117 118 19 4. When a firm writes off an account under the allowance method of accounting for bad debts the realizable value of accounts receivable decreases the cash account will decrease b. total net current assets will decrease d. the realizable value of accounts receivable will not change a. 5. The adjusting journal entry to record aarued interest revenue includes: a. Debit Cash, Credit Interest Revenue b. Debit Notes Receivable, Credit Interest Revenue C Debit Cash, Credit Notes Receivable d. Debit Interest Receivable, Credit Interest Revenue 6. The interest on a non-interest-bearing note is equal to a. The excess of the market value over the fair value value b. The excess of the present value over the face value c. The excess of the face value over the present d. Zero 7. Which of the following is not true when a note receivable is dishonored? a. the Notes Receivable account is credited for the maturity value b. an Account receivable is charged with the maturity value of the note c the Interest income account is credited d. interest may be charged on the outstanding balance I B. Which statement is true when accounts receivable are factored without recourse? a. The transaction may be accounted for either as secured borrowing or sale. b. The accounts receivable are used as collateral. c The financing cost should be recognized ratably over the collection period. d. The factor assumes the risk of collectability and absorbs any credit losses in collecting the accounts receivable. a. 9. Which of the following is true regarding non-interest-bearing note receivables? They are always discounted to their present value on initial recognition. b. They include a specified principal amount but an unspecified interest amount. C They include a specified principal amount and specified interest amount. d. They cause no interest income to be recognized over their term. They include an unspecified principal and an unspecified interest. e. 10. Statement 1: Postdated checks issued to payee should be classified by the issuing company as accounts receivable. Statement 2: Credit memo is a book reconciling item and should be added to balance per book to compute for adjusted balance of cash in bank. a. b. Both statements are true Both statements are false Only statement 1 is true Only statement 2 is true d

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started