Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pleaae answer asap! Use the information and table below to answer questions 35 to 40 Two chemical companies Walter and Jesse are a major source

pleaae answer asap!

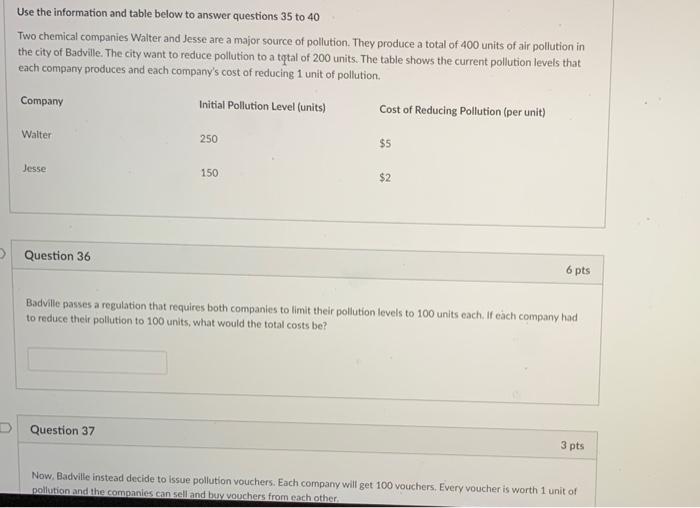

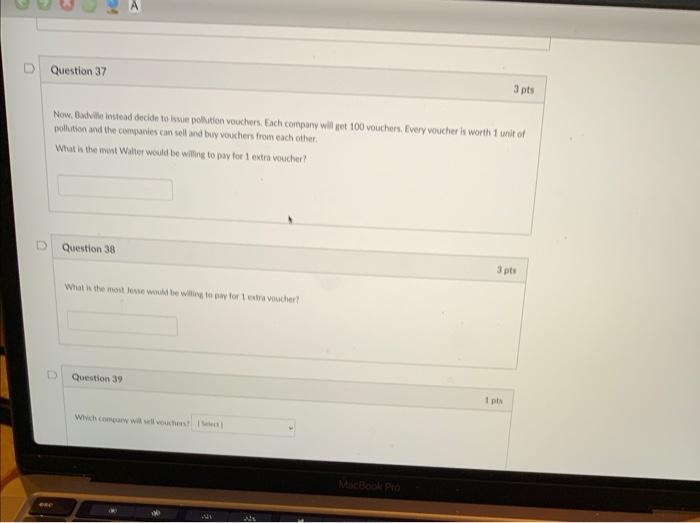

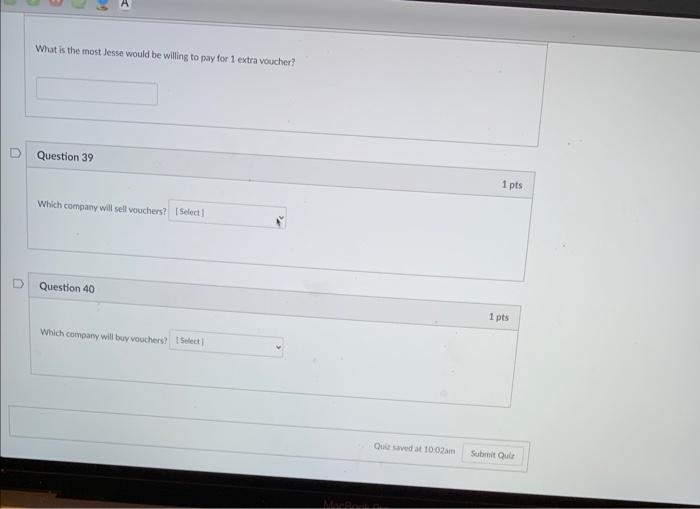

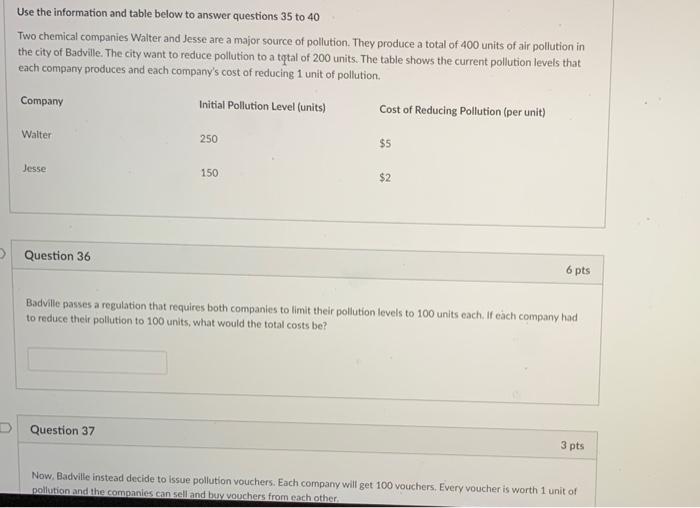

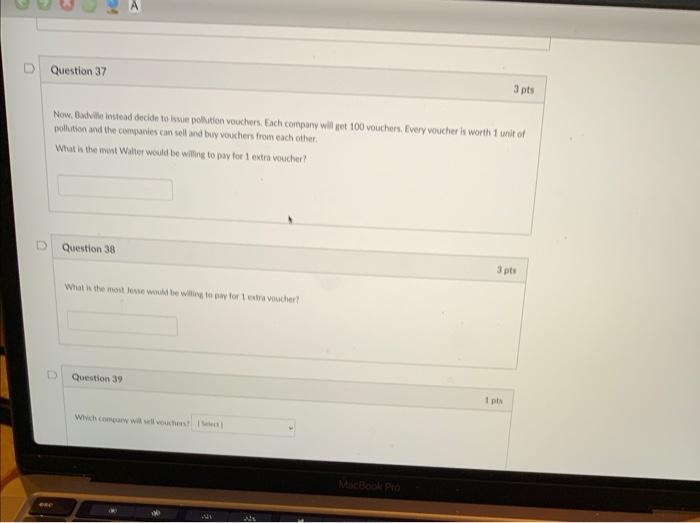

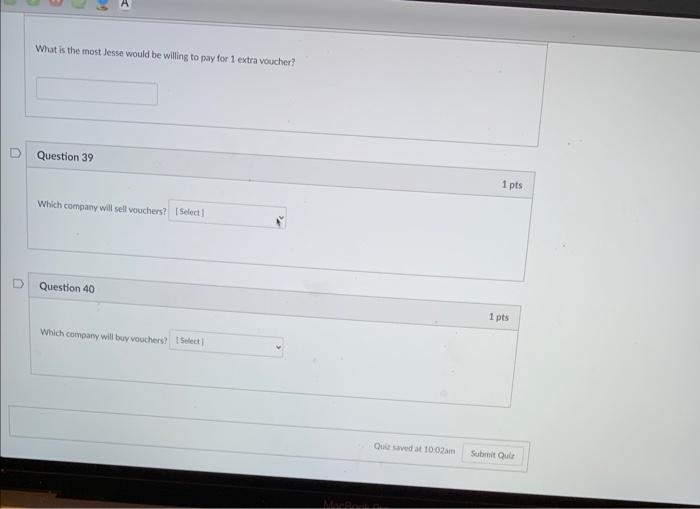

Use the information and table below to answer questions 35 to 40 Two chemical companies Walter and Jesse are a major source of pollution. They produce a total of 400 units of air pollution in the city of Badville. The city want to reduce pollution to a total of 200 units. The table shows the current pollution levels that each company produces and each company's cost of reducing 1 unit of pollution Company Initial Pollution Level (units) Cost of Reducing Pollution (per unit) Walter 250 $5 Jesse 150 $2 Question 36 6 pts Badville passes a regulation that requires both companies to limit their pollution levels to 100 units each. If each company had to reduce their pollution to 100 units, what would the total costs be? D Question 37 3 pts Now, Badville instead decide to Issue pollution vouchers. Each company will get 100 vouchers. Every voucher is worth 1 unit of pollution and the companies can sell and buy vouchers from each other D Question 37 3 pts Now. Badivile instead decide to sue pollution vouchers. Each company will get 100 vouchers. Every voucher is worth 1 unit of pollution and the companies can sell and buy vouchers from each other What is the most Walter would be willing to pay for 1 extra voucher Question 38 3 pts What the most bewing to pay for extra voucher Question 39 1 pts Which one will then I M Pro A What is the most Jesse would be willing to pay for 1 extra voucher? Question 39 1 pts Which company will sell vouchers? Select Question 40 1 pts Which company will buy vouchers? Select Qusaved at 10:02 Submit Quit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started