Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pleace add excel fild I don't have more details, just only information give me. Because this question very hard, you I need your help that

pleace add excel fild

I don't have more details, just only information give me. Because this question very hard, you I need your help that why I purshes on your website.

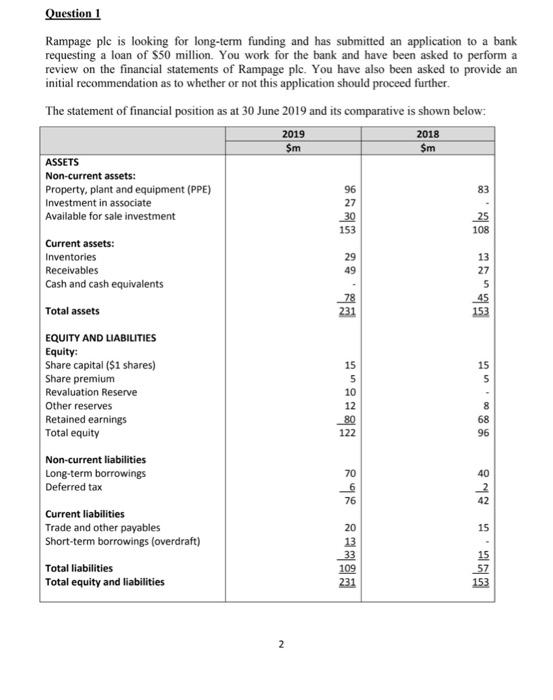

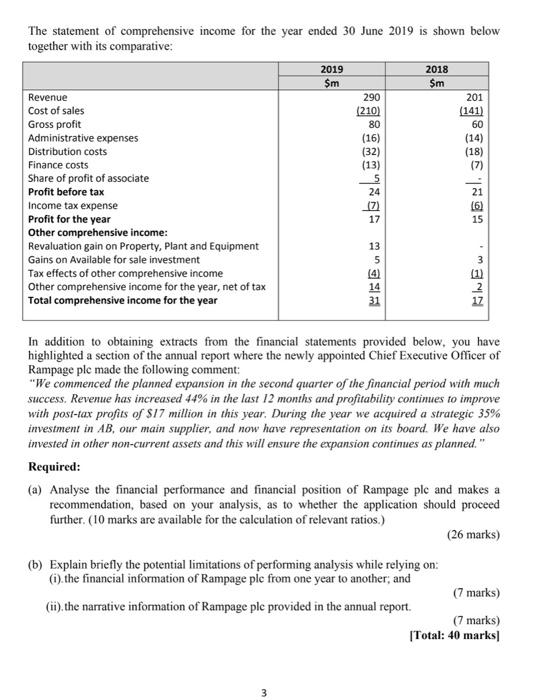

Question 1 Rampage ple is looking for long-term funding and has submitted an application to a bank requesting a loan of $50 million. You work for the bank and have been asked to perform a review on the financial statements of Rampage ple. You have also been asked to provide an initial recommendation as to whether or not this application should proceed further. The statement of financial position as at 30 June 2019 and its comparative is shown below: 2019 2018 $m Sm ASSETS Non-current assets: Property, plant and equipment (PPE) Investment in associate Available for sale investment 83 96 27 30 153 25 108 29 49 13 27 5 45 153 231 15 5 Current assets: Inventories Receivables Cash and cash equivalents Total assets EQUITY AND LIABILITIES Equity Share capital ($1 shares) Share premium Revaluation Reserve Other reserves Retained earnings Total equity Non-current liabilities Long-term borrowings Deferred tax Current liabilities Trade and other payables Short-term borrowings (overdraft) Total liabilities Total equity and liabilities 15 5 10 12 80 122 8 68 96 70 40 2 42 76 15 20 13 33 109 231 153 N The statement of comprehensive income for the year ended 30 June 2019 is shown below together with its comparative: 2019 2018 $m Sm Revenue 290 201 Cost of sales (210) (141) Gross profit 80 60 Administrative expenses (16) (14) Distribution costs (32) (18) Finance costs (13) (7) Share of profit of associate Profit before tax 24 Income tax expense (6) Profit for the year 17 15 Other comprehensive income: Revaluation gain on Property, Plant and Equipment 13 Gains on Available for sale investment 5 Tax effects of other comprehensive income 4) (1) Other comprehensive income for the year, net of tax 14 Total comprehensive income for the year 31 In addition to obtaining extracts from the financial statements provided below, you have highlighted a section of the annual report where the newly appointed Chief Executive Officer of Rampage ple made the following comment: "We commenced the planned expansion in the second quarter of the financial period with much success. Revenue has increased 44% in the last 12 months and profitability continues to improve with post-tax profits of $17 million in this year. During the year we acquired a strategic 35% investment in AB, our main supplier, and now have representation on its board. We have also invested in other non-current assets and this will ensure the expansion continues as planned." Required: (a) Analyse the financial performance and financial position of Rampage ple and makes a recommendation, based on your analysis, as to whether the application should proceed further. (10 marks are available for the calculation of relevant ratios.) (26 marks) (b) Explain briefly the potential limitations of performing analysis while relying on: (i) the financial information of Rampage ple from one year to another; and (7 marks) (ii) the narrative information of Rampage ple provided in the annual report. (7 marks) Total: 40 marks 3 Question 1 Rampage ple is looking for long-term funding and has submitted an application to a bank requesting a loan of $50 million. You work for the bank and have been asked to perform a review on the financial statements of Rampage ple. You have also been asked to provide an initial recommendation as to whether or not this application should proceed further. The statement of financial position as at 30 June 2019 and its comparative is shown below: 2019 2018 $m Sm ASSETS Non-current assets: Property, plant and equipment (PPE) Investment in associate Available for sale investment 83 96 27 30 153 25 108 29 49 13 27 5 45 153 231 15 5 Current assets: Inventories Receivables Cash and cash equivalents Total assets EQUITY AND LIABILITIES Equity Share capital ($1 shares) Share premium Revaluation Reserve Other reserves Retained earnings Total equity Non-current liabilities Long-term borrowings Deferred tax Current liabilities Trade and other payables Short-term borrowings (overdraft) Total liabilities Total equity and liabilities 15 5 10 12 80 122 8 68 96 70 40 2 42 76 15 20 13 33 109 231 153 N The statement of comprehensive income for the year ended 30 June 2019 is shown below together with its comparative: 2019 2018 $m Sm Revenue 290 201 Cost of sales (210) (141) Gross profit 80 60 Administrative expenses (16) (14) Distribution costs (32) (18) Finance costs (13) (7) Share of profit of associate Profit before tax 24 Income tax expense (6) Profit for the year 17 15 Other comprehensive income: Revaluation gain on Property, Plant and Equipment 13 Gains on Available for sale investment 5 Tax effects of other comprehensive income 4) (1) Other comprehensive income for the year, net of tax 14 Total comprehensive income for the year 31 In addition to obtaining extracts from the financial statements provided below, you have highlighted a section of the annual report where the newly appointed Chief Executive Officer of Rampage ple made the following comment: "We commenced the planned expansion in the second quarter of the financial period with much success. Revenue has increased 44% in the last 12 months and profitability continues to improve with post-tax profits of $17 million in this year. During the year we acquired a strategic 35% investment in AB, our main supplier, and now have representation on its board. We have also invested in other non-current assets and this will ensure the expansion continues as planned." Required: (a) Analyse the financial performance and financial position of Rampage ple and makes a recommendation, based on your analysis, as to whether the application should proceed further. (10 marks are available for the calculation of relevant ratios.) (26 marks) (b) Explain briefly the potential limitations of performing analysis while relying on: (i) the financial information of Rampage ple from one year to another; and (7 marks) (ii) the narrative information of Rampage ple provided in the annual report. (7 marks) Total: 40 marks 3 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started