Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pleae Answer A,B,C, D counts Pi $90,000 Land S0) On February 22, ABC acquired 200 shares of its $5 par value common stock for $25

pleae Answer A,B,C,D

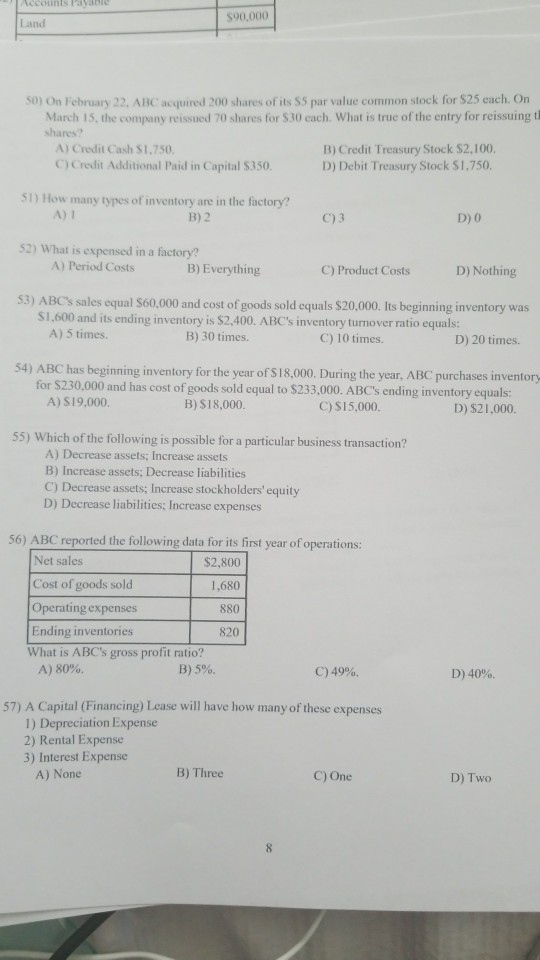

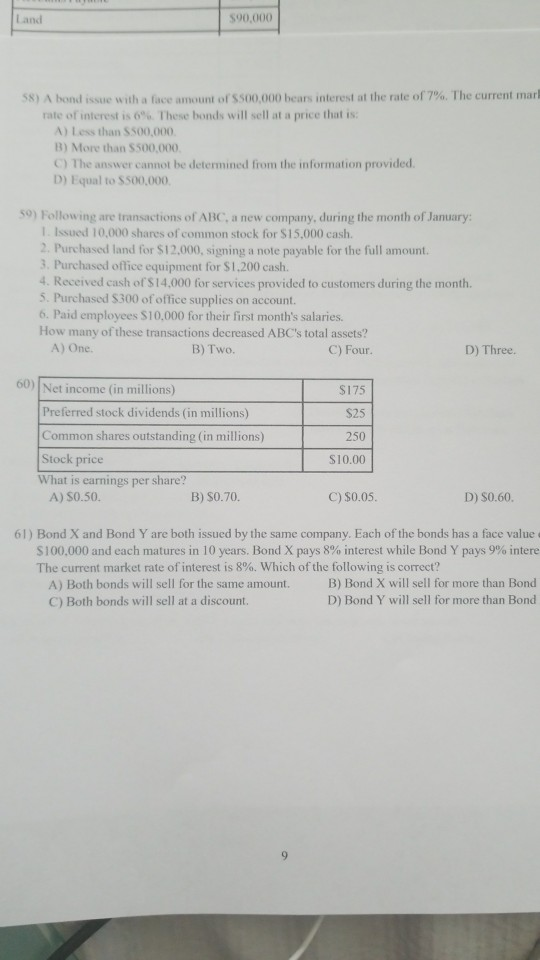

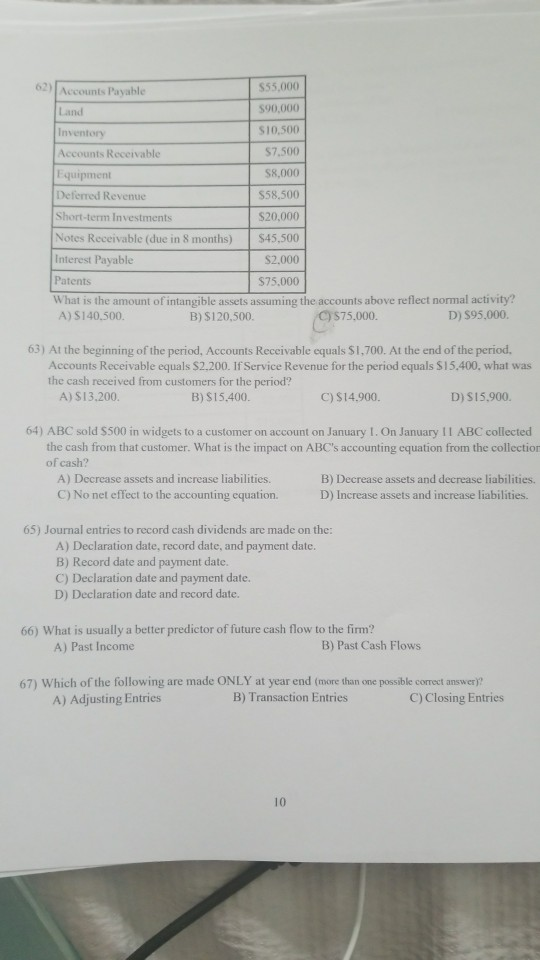

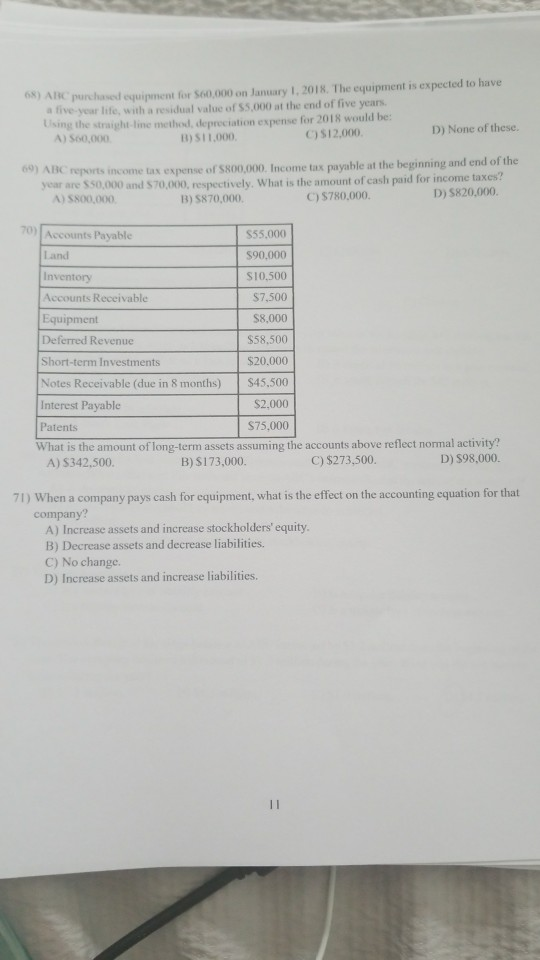

counts Pi $90,000 Land S0) On February 22, ABC acquired 200 shares of its $5 par value common stock for $25 each. On March 15, the company reissued 70 shares for $30 cach. What is true of the entry for reissuing t shares? A) Credit Cash $1,750 C) Credit Additional Paid in Capital $350 B) Credit Treasury Stock $2,100. D) Debit Treasury Stock $1.750. S1) How many types of inventory are in the factory? A) 1 B) 2 D) 0 C)3 2 What is expensed in a factory? A) Period Costs B) Everything C) Product Costs D) Nothing 53) ABC's sales equal 560,000 and cost of goods sold equals $20,000. Its beginning inventory was S1,600 and its ending inventory is $2,400. ABC's inventory turnover ratio equals: A) 5 times B) 30 times. C) I 0 times. D) 20 times. 54) ABC has beginning inventory for the year of $18,000. During the year, ABC purchases inventory for $230.000 and has cost of goods sold equal to $233,000. ABC's ending inventory equals: A) S19,000 B) S18,000. C) S15,000. D) $21,000 55) Which of the following is possible for a particular business transaction A) Decrease assets; Increase assets B) Increase ssets; Decrease liabilities C) Decrease assets; Increase stockholders' equity D) Decrease liabilities; Increase expenses 56) ABC reported the following data for its first year of operations Net sales $2,800 Cost of goods sold Operating expenses 880 Ending inventories 820 What is ABC's gross profit ratio? A) 80%. B) 5%. C) 49%. D) 40% 57) A Capital (Financing) Lease will have how many of these expenses 1) Depreciation Expense 2) Rental Expense 3) Interest Expense A) None B) Three C) One D) Two $90,000 Land 58) A bond issue with a face anount of $500,000 bears interest at the rate of 7%. The current marl rate of interest is 6% These bonds will sell at a price that is A) Less than $500,000 B) More than $500,000 C) The answer cannot be determined from the information provided. D) Equal to S500,000 59) Following are transactions of ABC, a new company, during the month of January: I Issued 10,000 shares of common stock for $15,000 cash 2. Purchased land for $12.000, signing a note payable for the full amount. 3. Purchased office equipment for $1,200 cash. 4. Received cash of $14,000 for services provided to customers during the month 5. Purchased $300 of office supplies on account. 6. Paid employees $10,000 for their first month's salaries. How many of these transactions decreased ABC's total assets? A) One. B) Two. C) Four D) Three. 60) Net income (in millions) $175 Preferred stock dividends (in millions) S25 Common shares outstanding (in millions) 250 Stock price S10.00 What is earnings per share? B) S0.70. C) $0.05 D) S0.60 A) SO.50. 61) Bond X and Bond Y are both issued by the same company. Each of the bonds has a face value SI 00.000 and each matures in 10 years. Bond X pays 8% interest while Bond Y pays 9% intere The current market rate of interest is 8%. Which of the following is correct? A) Both bonds will sell for the same amount. B) Bond X will sell for more than Bond D) Bond Y will sell for more than Bond C) Both bonds will sell at a discount 62) Accounts Payable 55,000 $90,000 Land S10,500 Inventory $7.500 Accounts Receivable $8,000 Equipment Deferred Revenue S58,500 Short-term Investments S20,000 Notes Receivable (due in 8 months) $45,500 Interest Payable S2.000 Patents S75,000 What is the amount of intangible assets assuming the accounts above reflect normal activity? A) S140.500. $75,000. D) S95.000. B) $120.500. 63) At the beginning of the period, Accounts Receivable equals S1,700. At the end of the period. Accounts Receivable equals $2.200. If Service Revenue for the period equals $15.400, what was the cash received from customers for the period? A) $13.200 B) S15.400. C) $14.900. D) S15,900 64) ABC sold $500 in widgets to a customer on account on January I. On January I1 ABC collected the cash from that customer. What is the impact on ABC's accounting equation from the collection of cash? A) Decrease assets and increase liabilities. B) Decrease assets and decrease liabilities. C) No net effect to the accounting equation. D) Increase assets and increase liabilities. 65) Journal entries to record cash dividends are made on the: A) Declaration date, record date, and payment date B) Record date and payment date. C) Declaration date and payment date D) Declaration date and record date 66) What is usually a better predictor of future cash flow to the firm? B) Past Cash Flows A) Past Income 67) Which of the following are made ONLY at year end (more than one possible correct answer)? B) Transaction Entries C) Closing Entries A) Adjusting Entries 10 )Alic purchased equipment for $60,000 on lanuary 1, 2018. The equipment is expected to have a five year life, with a residual value of $5,000 at the end of five years. Using the straight-line metheod, depreciation expense for 2018 would be: A) So0,000 68) ARC D) None of these C)512,000 11) 511.000 69) ABC reports income tax expense of $800,000. Income tax payable at the beginning and end of the and $70,000, respectively. What is the amount of cash paid for income taxes? D) 5820,000 000. C) 5780,000. B) 5870, S55,000 Land $90,000 S10,500 Inventory Accounts Receivable S7,500 Equipment S8,000 Deferred Revenue $58,500 Short-term Investments $20.000 Notes Receivable (due in 8 months) S45,500 $2.000 Interest Payable S75,000 What is the amount of long-term assets assuming the accounts above reflect normal activity? A) S342,500 D) S98,000. C) $273,500 B) S173,000 71) When a company pays cash for equipment, what is the effect on the accounting cquation for that company? A) Increase assets and increase stockholders' equity. B) Decrease assets and decrease liabilities. C) No change. D) Increase assets and increase liabilities 72)Sales revenue $440,000 60,000 Advertising expense 10,000 Interest expense Salaries expense 55,000 Utilities expense 25,000 Income tax expense 45,000 Cost of goods sold 180,000 What is the gross profit? A) S180,000. D) $220,000 C) $260,000 B) S120,000. 73) Window Dressing causes which kind of entry A) Transaction C) Closing B) Adjusting 74) ABC retires a $40 million bond issue when the carrying value of the bonds is $42 million, but the market value of the bonds is $36 million. The entry to record the retirement will include: A) A debit of S6 million to a loss account. C) No gain or loss on retirement. B) A credit of $6 million to a gain account. D) A credit to cash for $42 million. 75) Which is easier to calculate A) A firm's Cash Flow B) A firm's Net Income 76) ABC accounts for bad debts using the allowance method. On 6/1, ABC wrote off DE's $2,500 account. What effect will this write-off have on ABC's balance sheet at the time of the write-off? A) A decrease to assets and a decrease to stockholders' equity B) An increase to stockholders' equity and a decrease to liabilities. C) No effect. D) An increase to assets and an increase to stockholders' equity. 77) Unearned revenue A) Is a unique type of liability account C) Is a regular income account B) Is a regular liability account D) Is a unique type of income account 78) The ending Retained Earnings balance of ABC increased by $3.2 milion from the beginning of the year. The company earned during the year? A) S3.2 million. declared a dividend of S1.3 million during the year. What was the net income D) $4.5 million. C) S1.9 million. B) $1.3 million. 12 Which of the following statements regarding liquidity ratios is true? A ) A high work ing capital generally indicates the ability to, pay current liabilities on a timely basis b) A low acid test ratio generally indicates the ability to pay current liabilities on a timely basis. C) All current assets are due within one year and therefore have essentially equal liquidity D) A low current ratio generally indicates the ability to pay current liabilities on a timely basis. The year end adjusting entry for warranties Credits A) an asset C) an expense B) an income account D) a liability ) Choose one A) Periodic Inventory Accounting is less expensive to maintain than Perpetual Inventory Accounting B) Periodic Inventory Accounting is more expensive to maintain than Perpetual inventory Accounting C) There is no difference between the expense of using Periodic Inventory Accounting versus Perpetual Inventory Accounting 2) ABC's beginning inventory is $2,000 and its ending inventory is $1,000. The inventory turnover is 6 times. Cost of goods sold for the year must equal A) 56,000 B) S12,000 C) 518,000 D) $9,000. 3) In January, 2018, ABC sells a gift card for $50 and receives cash. In February, 2018, the customer comes back and spends $20 of their gift card on a water bottle. What would be the appropriate journal entry for the purchase of the water bottle? A) Debit Deferred Revenue, S20, credit Sales Revenue, $20. B) Debit Deferred Revenue, $50, credit Sales Revenue, $50 C) Debit Sales Revenue, $20; credit Deferred Revenue, $20 D) No journal entry is necessary nt assets: cash, $102 million; receivables, $94 million; inventory si 82 mullion, and other current assets, S I 8 million. ABC also has the following chilites accounts payable, 598 million; current portion of long-term debt, $35 million; and long-term debt, $23 million. Based on these amounts, what is the acid-test ratio? A) 3.86 D) 2.00 B) 1.47 C)2.84 85) ABC issued a ten-year, s20 million bond with a 10% interest rate for SI ,sooooo. The entry to record the bond isuance would have what effect on the financial statements? A) Inerease only assets C) Increase only stockholders' equity B) Increase assets and liabilities. D) Increase only liabilities. 13 86) Days in the Operating Cycle equals A) Days in Inventory- Days in Receivables + Days in Payables B) Days in Inventory + Days in Receivables- Days in Payables C) Days in Inventory+ Days in Receivables+ Days in Payables D) Days in Inventory- Days in Receivables- Days in Payables 87) The ending Retained Earnings balance of ABC increased by $1.5 million from the beginning of the year. The company's net income earned during the year is $3.5 million. What is the amount of dividends ABC declared and paid? A) S3.5 million. B) $2.0 million. C) S1.5 million. D) S5.0 million. 88) Which of the following is NOT an example of aggressive accounting practices? A) Recording contingent losses that are probable. B) Increasing the useful life used in calculating depreciation. C) Recording research and development costs as assets. D) Using a lower estimate of bad debts 89) ABC issued callable bonds on January 1, 2018. ABC's accountant has projected the following amortization schedule from issuance until maturity Cash Paid Date Interest Increase in Carrying ExpenseCarrying Value Value S194,758 1/1/2018 $7,000 $7,790 $790 6/30/2018 195,548 7,822 12/31/2018 7,000 822 196,370 7.855 7.000 197.225 6/30/2019 7.889 889 198,114 12/31/2019 7,000 7.925 925 199,039 7,000 6/30/2020 7.961 961 200,000 7,000 12/31/2020 What is the annual stated interest rate on the bonds? (Hint: Be sure to provide the annual rate rather than the six month rate.) A) 6%. B)3.5%. C)7%. D) 3% 90) Par value of shares is A) an important number for common stock but a garbage number for preferred shares B) an important number for both common and preferred shares C) a garbage number for common stock but an important number for preferred shares D) a garbage number for both common and preferred shares 14 1) ABC buys widgets for $5 cash and sells them on account for $8. What is the sacrifice value of a widget on the books of ABC? A) SS B) S8 C) S3 D) Impossible to determine from the given information 02) State and city politicians generally prefer giving their workers B) Defined Benefit Plans A) Defined Contribution Plans C) Social Security D) Either plan 93) Periodic vs.Perpetual Inventory Accounting A) Periodic Inventory Accounting results in a higher Cost of Goods Sold than Perpetual Inventory Accounting B) Periodic Inventory Accounting results in a lower Cost of Goods Sold than Perpetual Inventory Accounting C) Sometimes Periodic Inventory Accounting results in a lower Cost of Goods Sold than Perpetual Inventory Accounting and sometimes Periodic Inventory Accounting results in a higher Cost of Goods Sold than Perpetual Inventory Accounting D) Periodic and Perpetual Inventory Accounting result in the same Cost of Goods Sold 94) In the Allowance Method when we do the year end adjusting entry for Bad Debts A) Assets increase, Net Income increases. B) Assets stay the same, Net Income stays the same. C) It depends on the balance in the Allowance account before we make the entry. D) Assets decrease, Net Income decreases 95) ABC issues l ,000 shares of 6%, S 1 00 par value preferred stock at the beginning of20 17. All remaining shares are common stock. The company was not able to pay dividends in 2017, but plan to pay dividends of S18,000 in 2018. Assuming the preferred stock is cumulative, how much of the $18,000 dividend will be paid to preferred stockholders and how much will be paid to common stockholders in 2018? A) S18,000 to preferred stockholders and S0 to common stockholders. B) S6,000 to preferred stockholders and S12,000 to common stockholders C) $9,000 to preferred stockholders and $9,000 to common stockholders D) $12.000 to preferred stockholders and S6,000 to common stockholders. 96) When we collect Sales tax we DR Cash and Credit A) A Liability D) An Asset B) An Expense C) Revenue 15Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

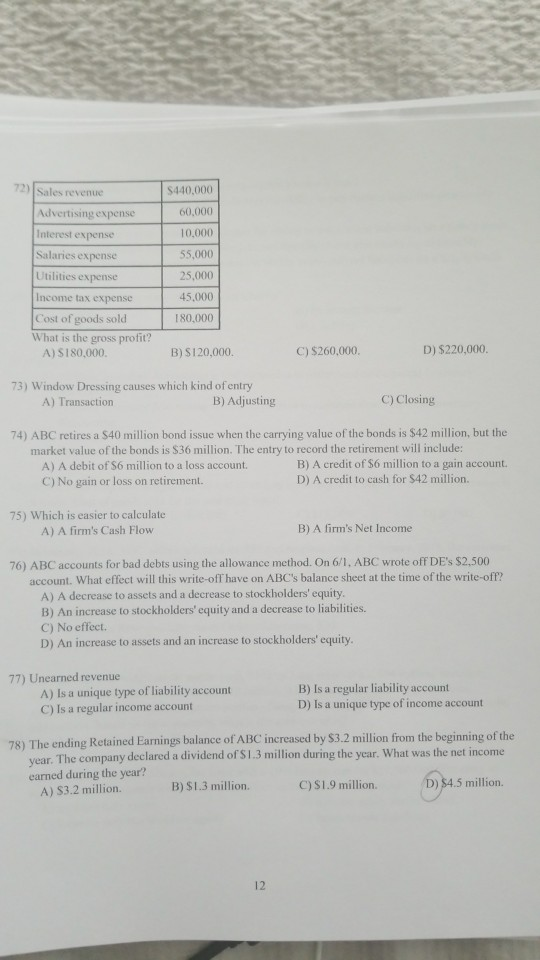

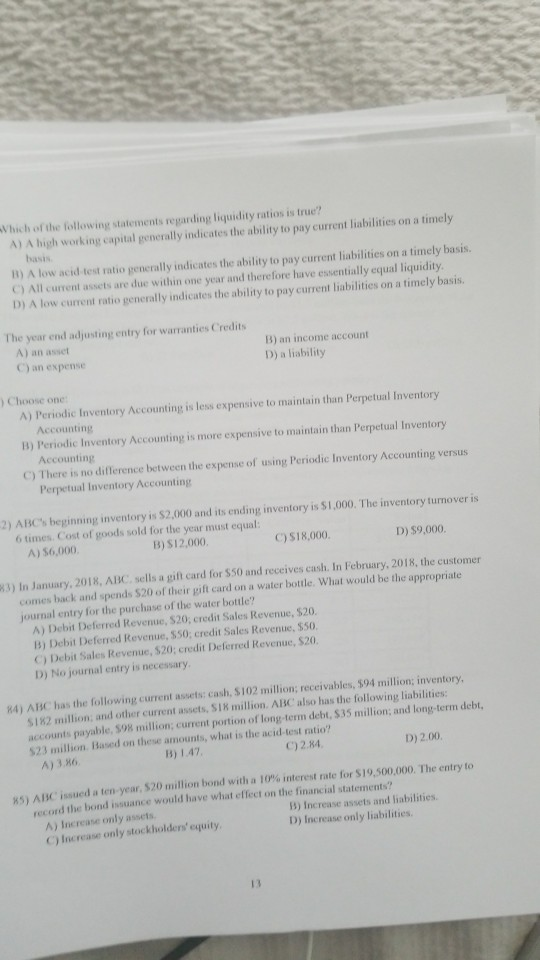

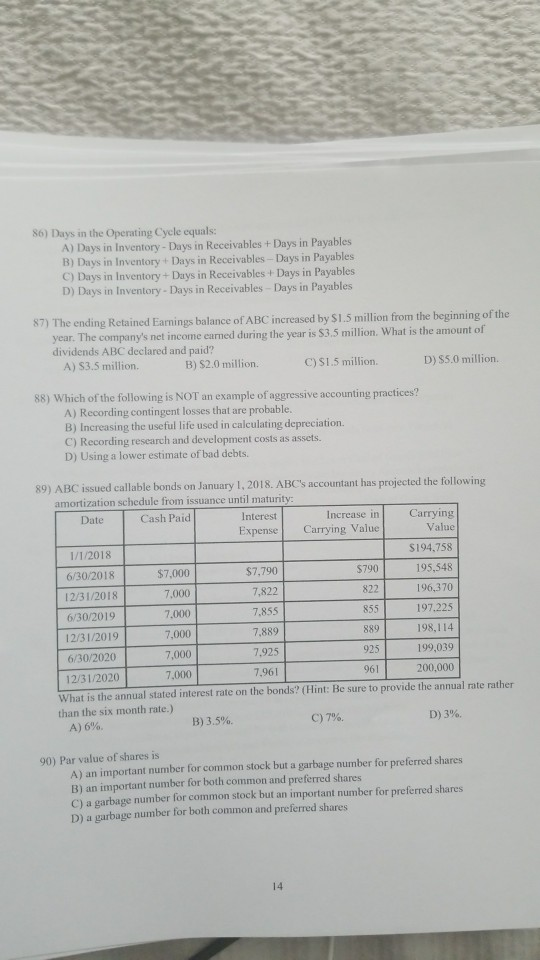

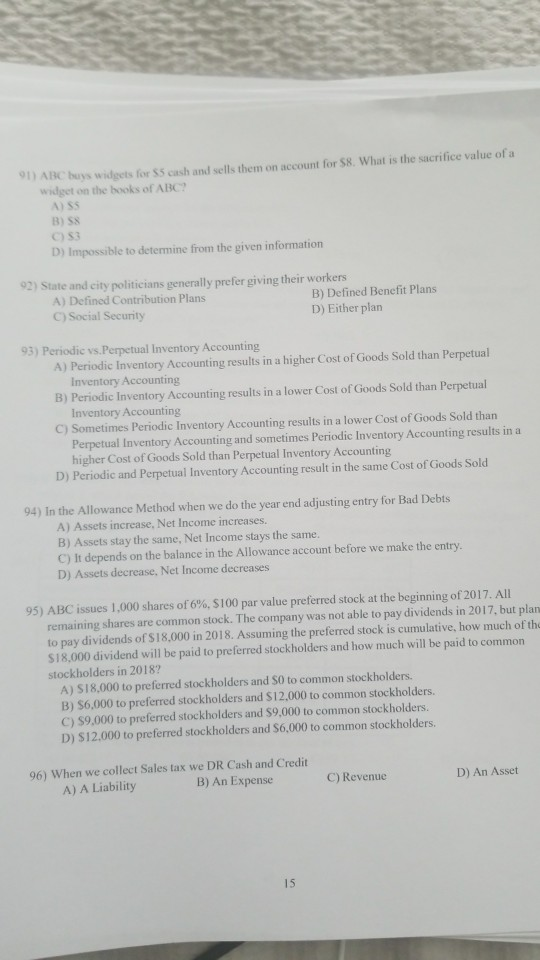

Get Started