pleae pleae pleae help me with these pls ASAP! promise i will vote for you

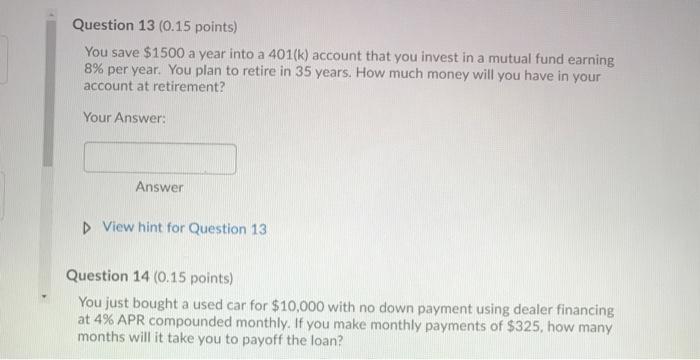

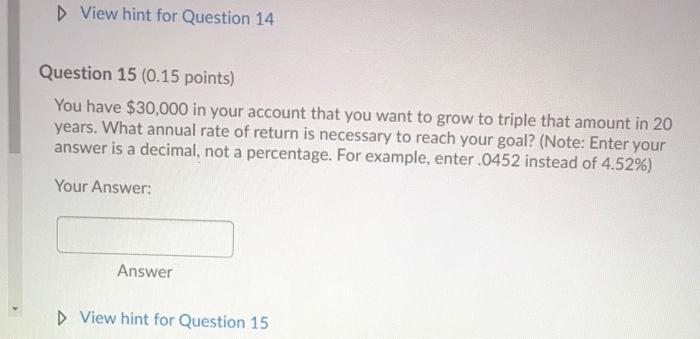

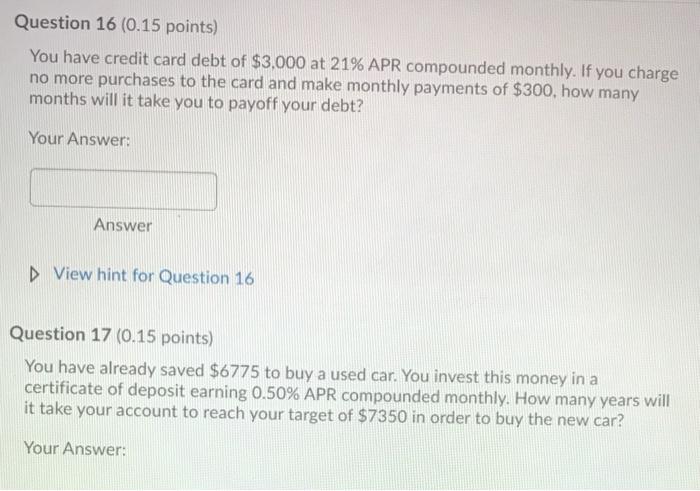

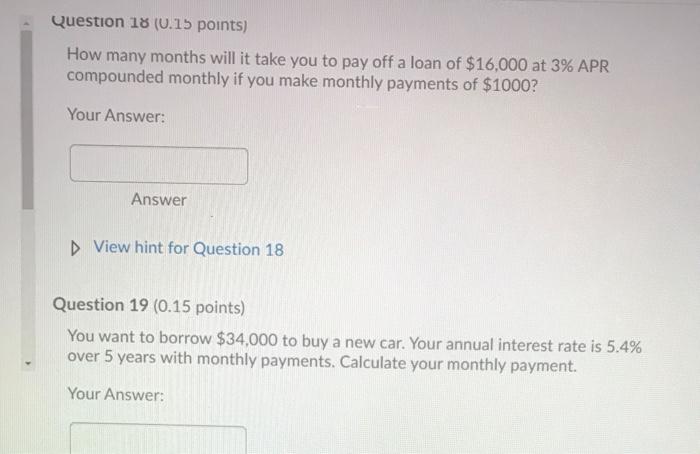

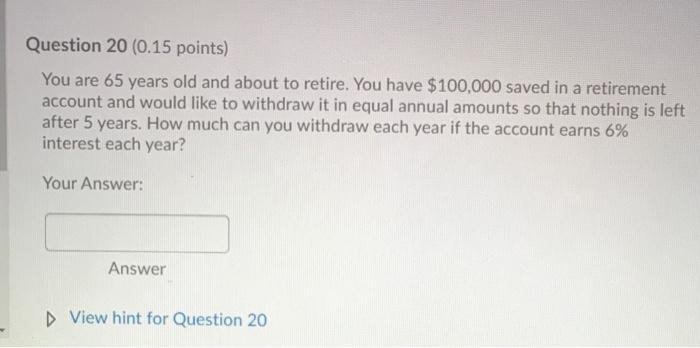

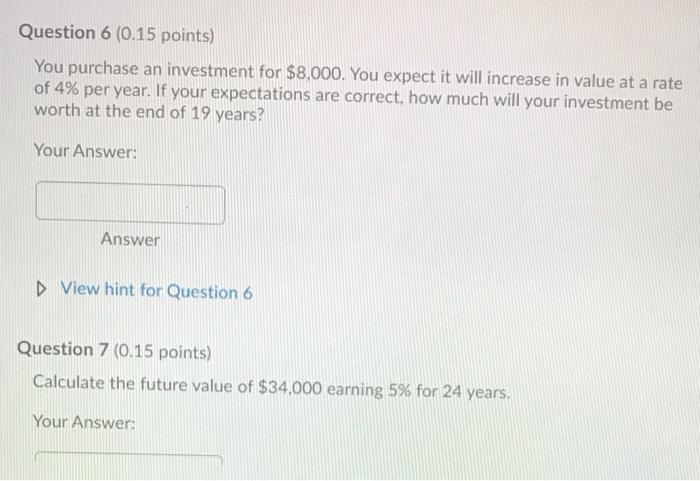

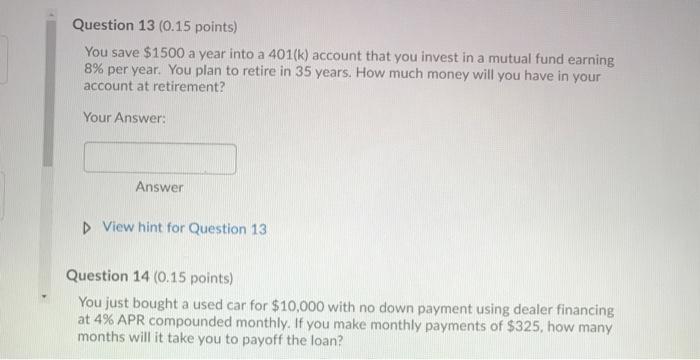

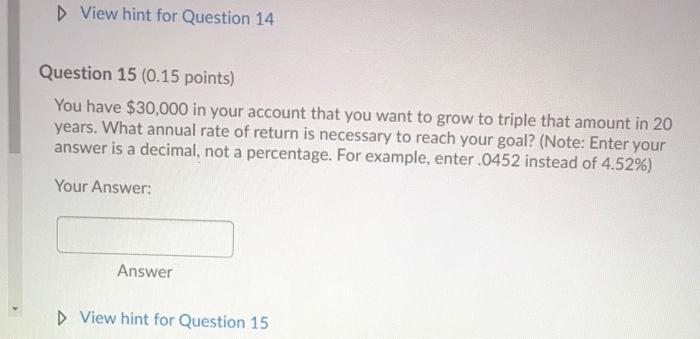

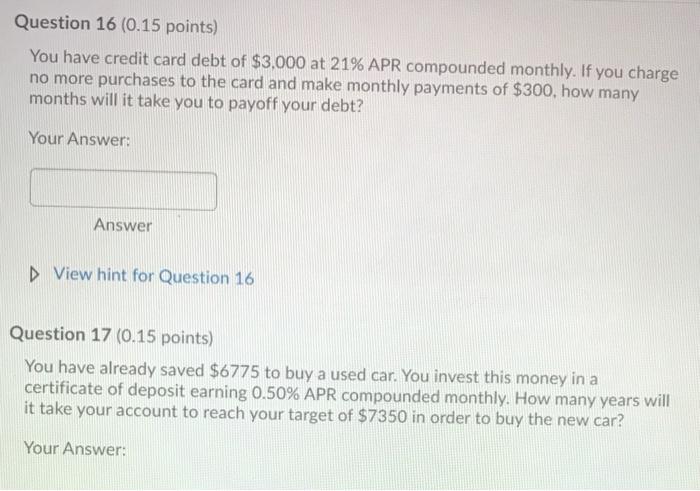

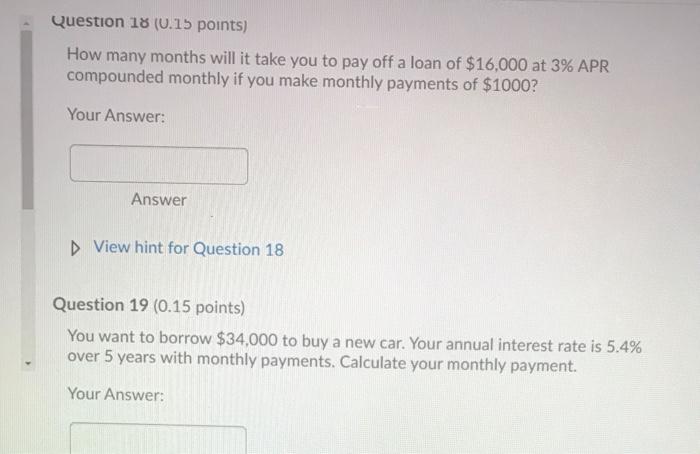

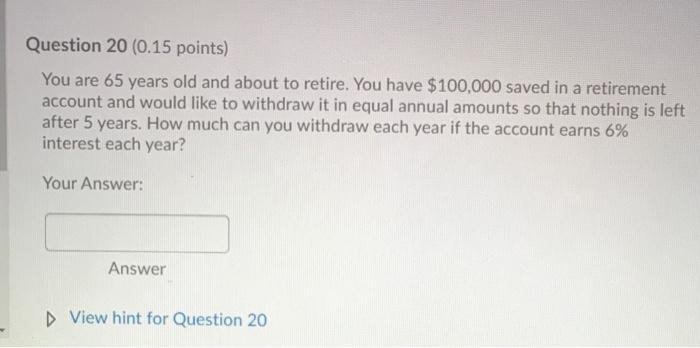

Question 6 (0.15 points) You purchase an investment for $8,000. You expect it will increase in value at a rate of 4% per year. If your expectations are correct, how much will your investment be worth at the end of 19 years? Your Answer: Answer DView hint for Question 6 Question 7 (0.15 points) Calculate the future value of $34,000 earning 5% for 24 years. Your Answer: Question 8 (0.15 points) How much money must you invest today in order to grow to a value of $30,000 in 10 years if your money grows at 6%? Your Answer: Answer Question 9 (0.15 points) You just graduated from college and landed your first "real" job, which pays $32,000 a year. In 8 years how much will you need to earn per year to maintain the same purchasing power if inflation is 0.50% per year? Your Answer: Question 10 (0.15 points) You want to invest an amount today that will last for 6 years and allow you to withdraw $425 at the end of each 6-month period. You earn 4% APR compounded semiannually on your investment. How much do you need to invest today to achieve your goal? Your Answer: Answer Question 13 (0.15 points) You save $1500 a year into a 401(k) account that you invest in a mutual fund earning 8% per year. You plan to retire in 35 years. How much money will you have in your account at retirement? Your Answer: Answer D View hint for Question 13 Question 14 (0.15 points) You just bought a used car for $10,000 with no down payment using dealer financing at 4% APR compounded monthly. If you make monthly payments of $325, how many months will it take you to payoff the loan? View hint for Question 14 Question 15 (0.15 points) You have $30,000 in your account that you want to grow to triple that amount in 20 years. What annual rate of return is necessary to reach your goal? (Note: Enter your answer is a decimal, not a percentage. For example, enter .0452 instead of 4.52%) Your Answer: Answer View hint for Question 15 Question 16 (0.15 points) You have credit card debt of $3,000 at 21% APR compounded monthly. If you charge no more purchases to the card and make monthly payments of $300, how many months will it take you to payoff your debt? Your Answer: Answer View hint for Question 16 Question 17 (0.15 points) You have already saved $6775 to buy a used car. You invest this money in a certificate of deposit earning 0.50% APR compounded monthly. How many years will it take your account to reach your target of $7350 in order to buy the new car? Your Answer: Question 18 (0.15 points) How many months will it take you to pay off a loan of $16,000 at 3% APR compounded monthly if you make monthly payments of $1000? Your Answer: Answer View hint for Question 18 Question 19 (0.15 points) You want to borrow $34,000 to buy a new car. Your annual interest rate is 5.4% over 5 years with monthly payments. Calculate your monthly payment. Your Answer: Question 20 (0.15 points) You are 65 years old and about to retire. You have $100,000 saved in a retirement account and would like to withdraw it in equal annual amounts so that nothing is left after 5 years. How much can you withdraw each year if the account earns 6% interest each year? Your Answer: Answer View hint for Question 20