pleaee help with these questions

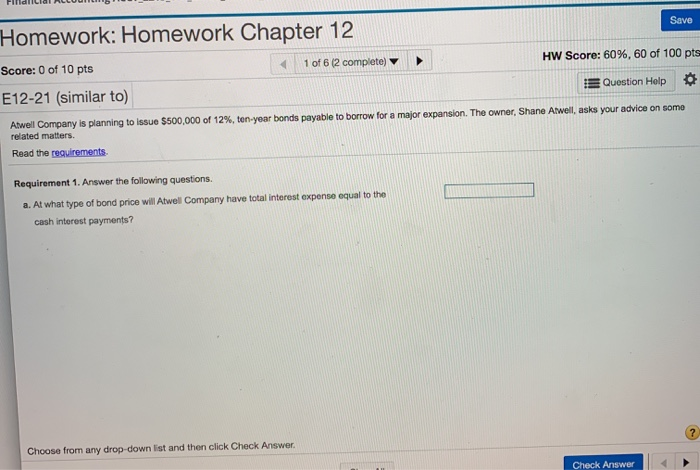

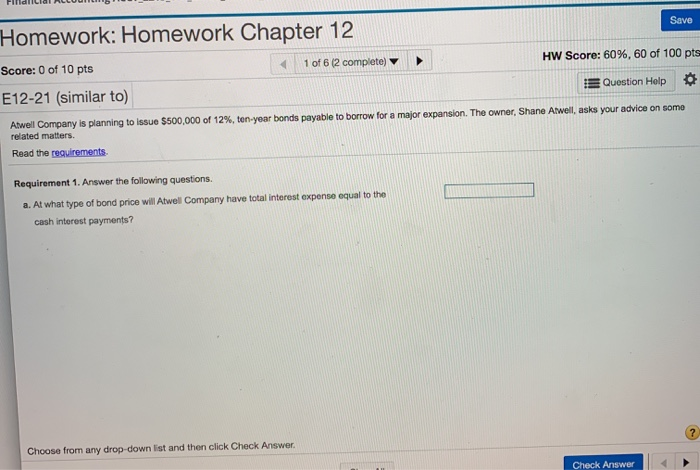

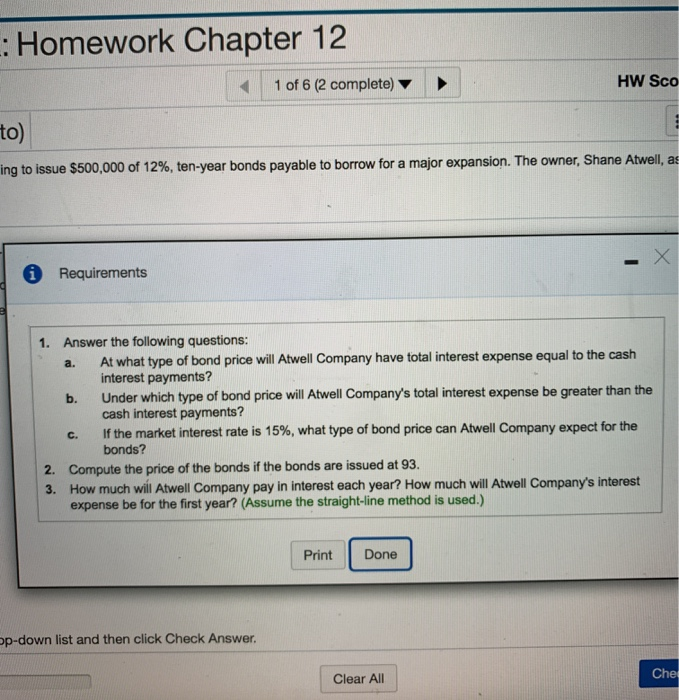

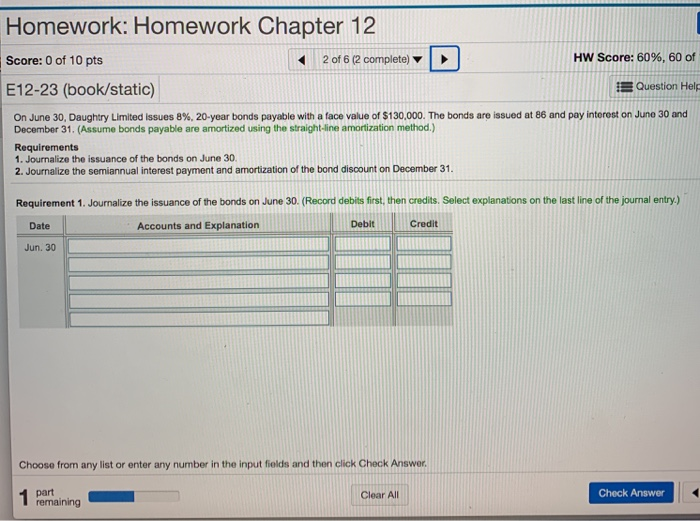

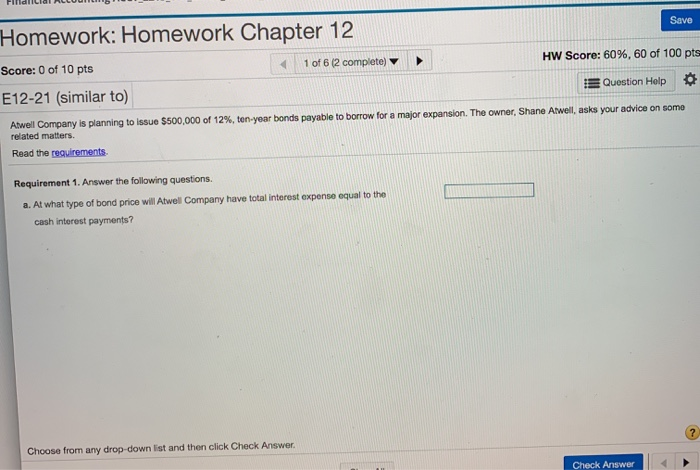

Homework: Homework Chapter 12 Save Score: 0 of 10 pts 1 of 6 (2 complete) HW Score: 60%, 60 of 100 pt E12-21 (similar to) E Question Help Atwell Company is planning to issue $500,000 of 12%, ten-year bonds payable to borrow for a major expansion. The owner, Shane Alwell, asks your advice on some related matters. Read the requirements Requirement 1. Answer the following questions. a. At what type of bond price will Atwell Company have total interest expenso equal to the cash interest payments ? Choose from any drop down list and then click Check Answer. : Homework Chapter 12 1 of 6 (2 complete) HW Scd ing to issue $500,000 of 12%, ten-year bonds payable to borrow for a major expansion. The owner, Shane Atwell, a i Requirements 1. Answer the following questions: a. At what type of bond price will Atwell Company have total interest expense equal to the cash interest payments? b. Under which type of bond price will Atwell Company's total interest expense be greater than the cash interest payments? C. If the market interest rate is 15%, what type of bond price can Atwell Company expect for the bonds? 2. Compute the price of the bonds if the bonds are issued at 93. 3. How much will Atwell Company pay in interest each year? How much will Atwell Company's interest expense be for the first year? (Assume the straight-line method is used.) Print Done p-down list and then click Check Answer. Clear All Che Homework: Homework Chapter 12 Score: 0 of 10 pts 2 of 6 (2 complete) E12-23 (book/static) HW Score: 60%, 60 of Question Help On June 30, Daughtry Limited issues 8%. 20-year bonds payable with a face value of $130,000. The bonds are issued at 86 and pay interest on June 30 and December 31. (Assume bonds payable are amortized using the straight-line amortization method.) Requirements 1. Journalize the issuance of the bonds on June 30 2. Journalize the semiannual interest payment and amortization of the bond discount on December 31 Requirement 1. Journalize the issuance of the bonds on June 30. (Record debits first, then credits. Select explanations on the last line of the journal entry) Date Accounts and Explanation Debit Credit Jun. 30 Choose from any list or enter any number in the input fields and then click Check Answer 1 part Check Answer Clear All remaining