Answered step by step

Verified Expert Solution

Question

1 Approved Answer

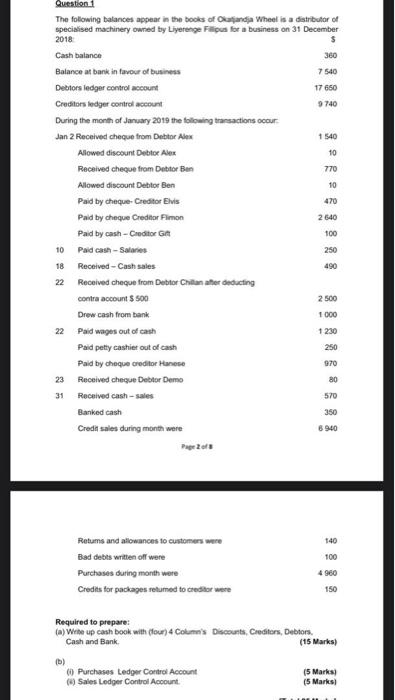

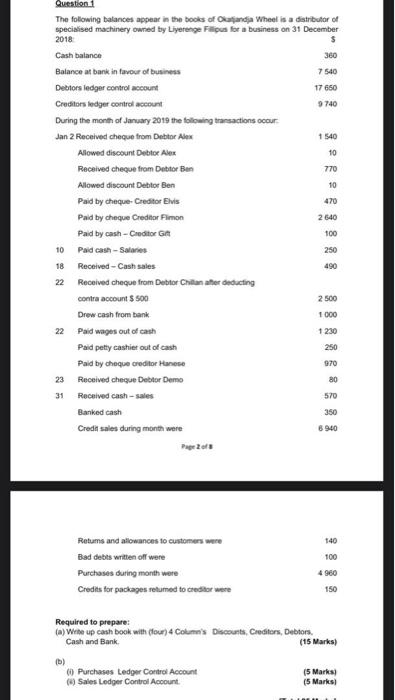

pleas answer and show calculations 2016 Question 1 The following balances appear in the books of Oljanja Wheel is a distributor of specialised machinery owned

pleas answer and show calculations

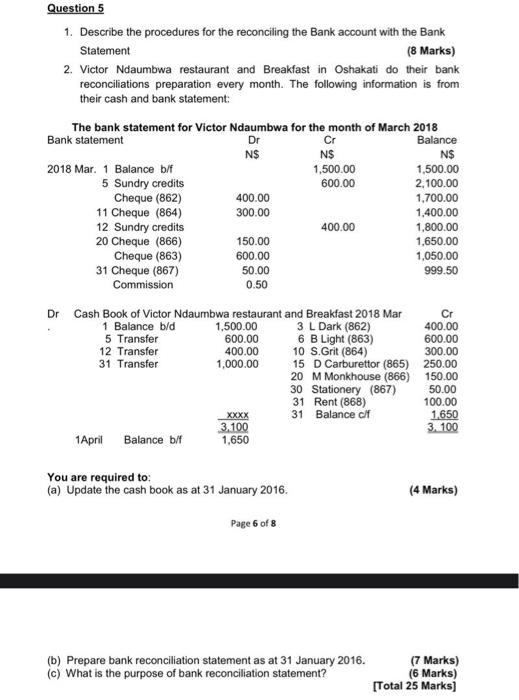

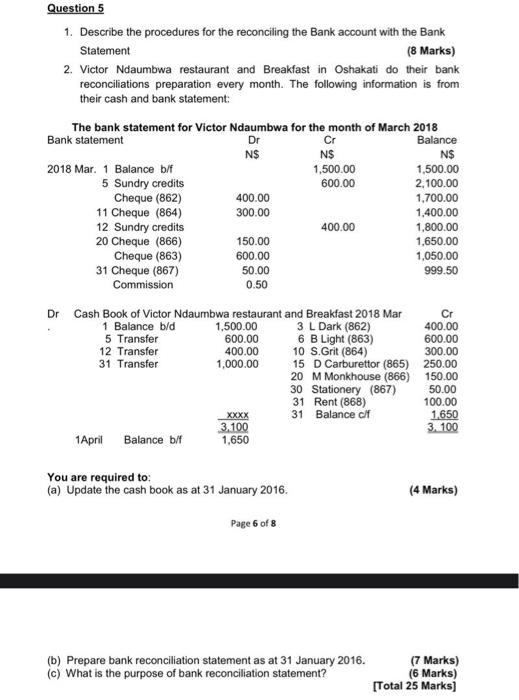

2016 Question 1 The following balances appear in the books of Oljanja Wheel is a distributor of specialised machinery owned by Liyerenge Filius for a business on 31 December $ Cash balance 360 Balance at bank in favour of business 7540 Debtors ledger control account 17 660 Creditors ledger control account 9 740 During the month of January 2019 the following transactions occur Jan 2 Received cheque from Debtor Alex 1540 Allowed discount Debte Alex 10 Received cheque from Debtor Ben 770 Allowed discount Debtor Ben 10 Paid by cheque-Creditor Elvis 470 Paid by choque Creditor Pimon 2 640 Paid by cash-Creditor 100 10 Paid cash-Salaries 250 18 Received - Cash sales 490 22 Received cheque from Debtor Chitanate detecting contra account $ 500 2500 Drew cash from bank 22 Paid wages out of cash 1 230 Paid petty cashier out of cash 250 Paid by chaque creditor Hanese 970 23 Received cheque Debtor Demo 80 31 Received cash-sales 570 Banked cash 350 Credit sales during month were 6940 Page 2 1 000 140 100 Retums and allowances to customers were Bad debts written off were Purchases during month were Credits for packages retumed to creditor were 4960 150 Required to prepare: Wirhe up cash book with (low) 4 Column's Discounts, Creditors, Debtors Cash and Bank (15 Marks) Purchases Ledger Control Account Sales Lodger Control Account (5 Marks) (5 Marks Question 5 1. Describe the procedures for the reconciling the Bank account with the Bank Statement (8 Marks) 2. Victor Ndaumbwa restaurant and Breakfast in Oshakati do their bank reconciliations preparation every month. The following information is from their cash and bank statement: The bank statement for Victor Ndaumbwa for the month of March 2018 Bank statement Dr Cr Balance N$ N$ N$ 2018 Mar. 1 Balance bif 1,500.00 1,500.00 5 Sundry credits 600.00 2,100.00 Cheque (862) 400.00 1,700.00 11 Cheque (864) 300.00 1,400.00 12 Sundry credits 400.00 1.800.00 20 Cheque (866) 150.00 1,650.00 Cheque (863) 600.00 1,050.00 31 Cheque (867) 50.00 999.50 Commission 0.50 Dr Cash Book of Victor Ndaumbwa restaurant and Breakfast 2018 Mar Cr 1 Balance b/d 1,500.00 3 L Dark (862) 400.00 5 Transfer 600.00 6 B Light (863) 600.00 12 Transfer 400.00 10 S. Grit (864) 300.00 31 Transfer 1,000.00 15 D Carburettor (865) 250.00 20 M Monkhouse (866) 150.00 30 Stationery (867) 50.00 31 Rent (868) 100.00 XXXX 31 Balance of 1.650 3.100 3.100 1 April Balance b/f 1,650 You are required to (a) Update the cash book as at 31 January 2016 (4 Marks) Page 6 of 8 (b) Prepare bank reconciliation statement as at 31 January 2016. (c) What is the purpose of bank reconciliation statement? (7 Marks) (6 Marks) [Total 25 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started