Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pleas i need solve PART 1 - CREATION OF ACCOUNTING STATEMENTS. Anita Clodhopper been trading as a retailer of foot care products for many years.

pleas i need solve

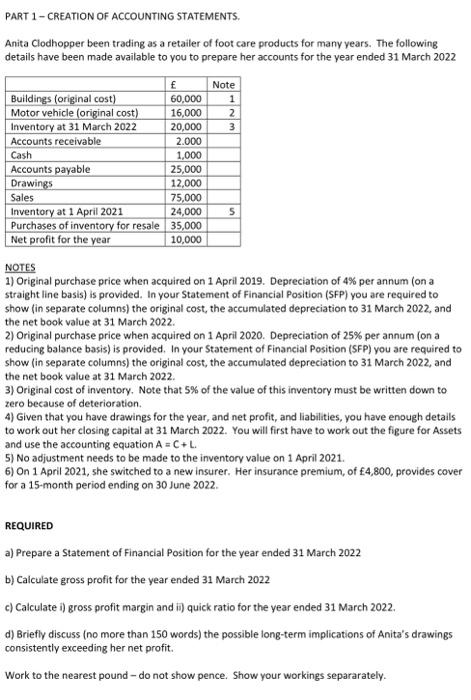

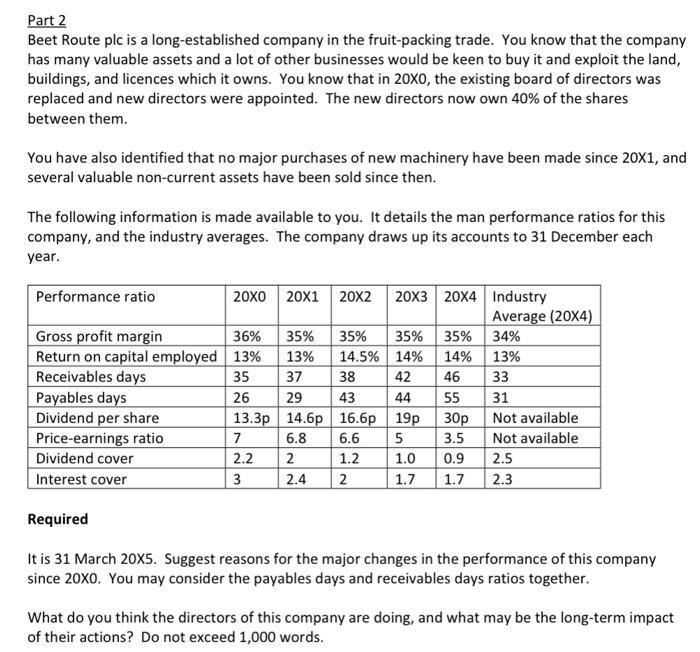

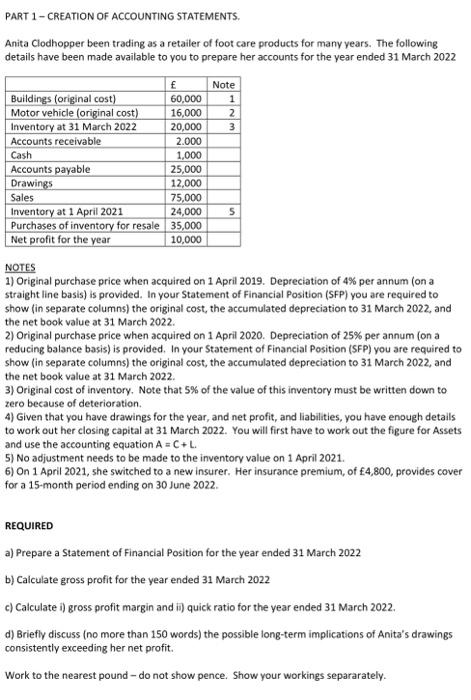

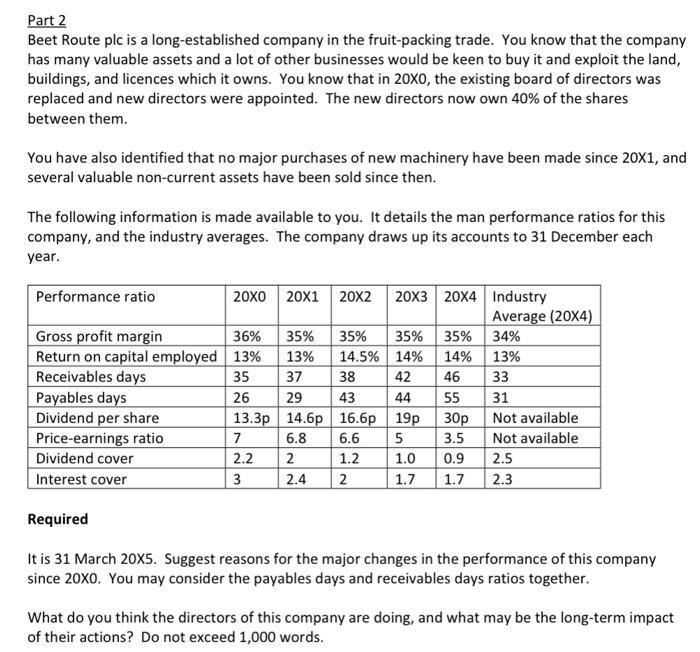

PART 1 - CREATION OF ACCOUNTING STATEMENTS. Anita Clodhopper been trading as a retailer of foot care products for many years. The following details have been made available to you to prepare her accounts for the year ended 31 March 2022 NOTES 1) Original purchase price when acquired on 1 April 2019. Depreciation of 4% per annum (on a straight line basis) is provided. In your Statement of Financial Position (SFP) you are required to show (in separate columns) the original cost, the accumulated depreciation to 31 March 2022, and the net book value at 31March2022. 2) Original purchase price when acquired on 1 April 2020. Depreciation of 25% per annum (on a reducing balance basis) is provided. In your Statement of Financial Position (SFP) you are required to show (in separate columns) the original cost, the accumulated depreciation to 31 March 2022, and the net book value at 31March2022. 3) Original cost of inventory. Note that 5% of the value of this inventory must be written down to zero because of deterioration. 4) Given that you have drawings for the year, and net profit, and liabilities, you have enough details to work out her closing capital at 31March2022. You will first have to work out the figure for Assets and use the accounting equation A=C+L. 5) No adjustment needs to be made to the inventory value on 1 April 2021. 6) On 1 April 2021, she switched to a new insurer. Her insurance premium, of 4,800, provides cover for a 15-month period ending on 30 June 2022 . REQUIRED a) Prepare a Statement of Financial Position for the year ended 31 March 2022 b) Calculate gross profit for the year ended 31 March 2022 c) Calculate i) gross profit margin and ii) quick ratio for the year ended 31 March 2022. d) Briefly discuss (no more than 150 words) the possible long-term implications of Anita's drawings consistently exceeding her net profit. Work to the nearest pound - do not show pence. Show your workings separarately. Part 2 Beet Route plc is a long-established company in the fruit-packing trade. You know that the company has many valuable assets and a lot of other businesses would be keen to buy it and exploit the land, buildings, and licences which it owns. You know that in 20X0, the existing board of directors was replaced and new directors were appointed. The new directors now own 40% of the shares between them. You have also identified that no major purchases of new machinery have been made since 20X1, and several valuable non-current assets have been sold since then. The following information is made available to you. It details the man performance ratios for this company, and the industry averages. The company draws up its accounts to 31 December each year. Required It is 31 March 20X5. Suggest reasons for the major changes in the performance of this company since 20X0. You may consider the payables days and receivables days ratios together. What do you think the directors of this company are doing, and what may be the long-term impact of their actions? Do not exceed 1,000 words

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started